Addressing Elevated Stock Market Valuations: Insights From BofA

Table of Contents

BofA's Assessment of Current Market Conditions

BofA's recent reports consistently highlight the elevated nature of current stock market valuations. Their analysis, often incorporating proprietary models and extensive data sets, provides a comprehensive overview of the market's health. For instance, their analysts frequently reference metrics like price-to-earnings (P/E) ratios, comparing them to historical averages and considering industry-specific variations. They also closely monitor macroeconomic indicators such as interest rates and inflation to gauge their impact on investor sentiment and asset pricing.

- Key Indicators BofA is Monitoring: P/E ratios, Shiller P/E (CAPE ratio), interest rate movements (both short-term and long-term), inflation rates (CPI, PPI), consumer confidence indices, and corporate earnings growth.

- BofA's Stance on Valuations: While BofA acknowledges the robust performance of certain sectors, their overall stance often suggests that valuations in some areas are stretched, potentially indicating a degree of overvaluation. They carefully differentiate between justified high valuations based on strong fundamentals and unsustainable valuations driven by speculation.

- Overvalued and Undervalued Sectors (Example): BofA's analysis may highlight technology as a potentially overvalued sector due to high growth expectations, while sectors like energy or financials might be viewed as relatively undervalued depending on the prevailing market conditions and economic forecasts. (Note: Specific sector assessments are subject to change and should be verified with the latest BofA reports.)

Factors Contributing to Elevated Stock Market Valuations

According to BofA's analysis, several macroeconomic factors contribute to the current elevated stock market valuations. These are interconnected and influence investor behavior and market sentiment.

- Low Interest Rates: Historically low interest rates have reduced the opportunity cost of investing in stocks, encouraging greater risk-taking and driving up demand, thus pushing valuations higher.

- Quantitative Easing (QE) and Monetary Policies: Central banks' implementation of QE programs and other stimulative monetary policies has injected significant liquidity into the financial system, further fueling asset price inflation.

- Strong Corporate Earnings (Conditional): Periods of robust corporate earnings growth can support higher valuations, provided that this growth is sustainable and justified by underlying fundamentals. BofA's analysis would scrutinize the quality and sustainability of such earnings.

- Geopolitical Events: Geopolitical uncertainties and events, while often creating volatility, can also influence investor sentiment and drive capital flows into perceived safe-haven assets, indirectly impacting valuations across different sectors.

BofA's Predictions and Recommendations

BofA typically presents various scenarios for future market performance, acknowledging the inherent uncertainty. Their predictions concerning elevated stock market valuations are usually nuanced and cautious.

- Potential Scenarios: BofA might outline scenarios including continued moderate growth, a significant market correction, or even a prolonged period of sideways trading. The likelihood of each scenario is often expressed with varying degrees of probability.

- Investment Strategies: BofA's recommended strategies often emphasize diversification across asset classes (stocks, bonds, real estate, etc.) and a sector rotation approach, suggesting adjustments to portfolio allocations based on their assessment of relative valuations and risk.

- Cautions and Warnings: BofA frequently cautions investors against chasing high-flying stocks and emphasizes the importance of thorough due diligence, risk management, and aligning investment strategies with their risk tolerance and long-term financial goals.

Alternative Perspectives and Considerations

It's crucial to acknowledge that perspectives on stock market valuations vary across financial institutions. While BofA's analysis is respected, it's not the only viewpoint.

- Other Financial Institutions' Perspectives: Other prominent banks and investment firms may offer contrasting assessments, highlighting different indicators and drawing alternative conclusions. Consulting multiple sources ensures a more comprehensive understanding.

- Conflicting Data and Analyses: Different methodologies and data sets can lead to variations in valuation estimates, emphasizing the need for critical evaluation and independent verification.

- Limitations and Biases: It's important to acknowledge potential limitations and biases inherent in any analysis, including BofA's. Factors such as data selection, model assumptions, and even potential conflicts of interest should be considered.

Addressing Elevated Stock Market Valuations – Next Steps

BofA's analysis consistently underscores the elevated nature of current stock market valuations, highlighting the need for careful consideration by investors. Several key factors, including low interest rates, QE policies, and varying corporate earnings growth, contribute to this situation. While BofA's recommendations often favor diversification and a cautious approach, investors should conduct their own thorough research and consult with a financial advisor before making any investment decisions. Understanding the complexities of elevated stock market valuations is crucial for navigating the current market environment successfully. Subscribe to our newsletter to receive future updates on market analysis and insights.

Featured Posts

-

Vatican In Crisis Convicted Cardinal Seeks Role In Papal Conclave

Apr 25, 2025

Vatican In Crisis Convicted Cardinal Seeks Role In Papal Conclave

Apr 25, 2025 -

Caso Arrayanes Familia Recibe Oferta De G 1 250 Millones Tras Homicidio Culposo

Apr 25, 2025

Caso Arrayanes Familia Recibe Oferta De G 1 250 Millones Tras Homicidio Culposo

Apr 25, 2025 -

Ftc Probe Into Open Ai Implications For The Future Of Ai

Apr 25, 2025

Ftc Probe Into Open Ai Implications For The Future Of Ai

Apr 25, 2025 -

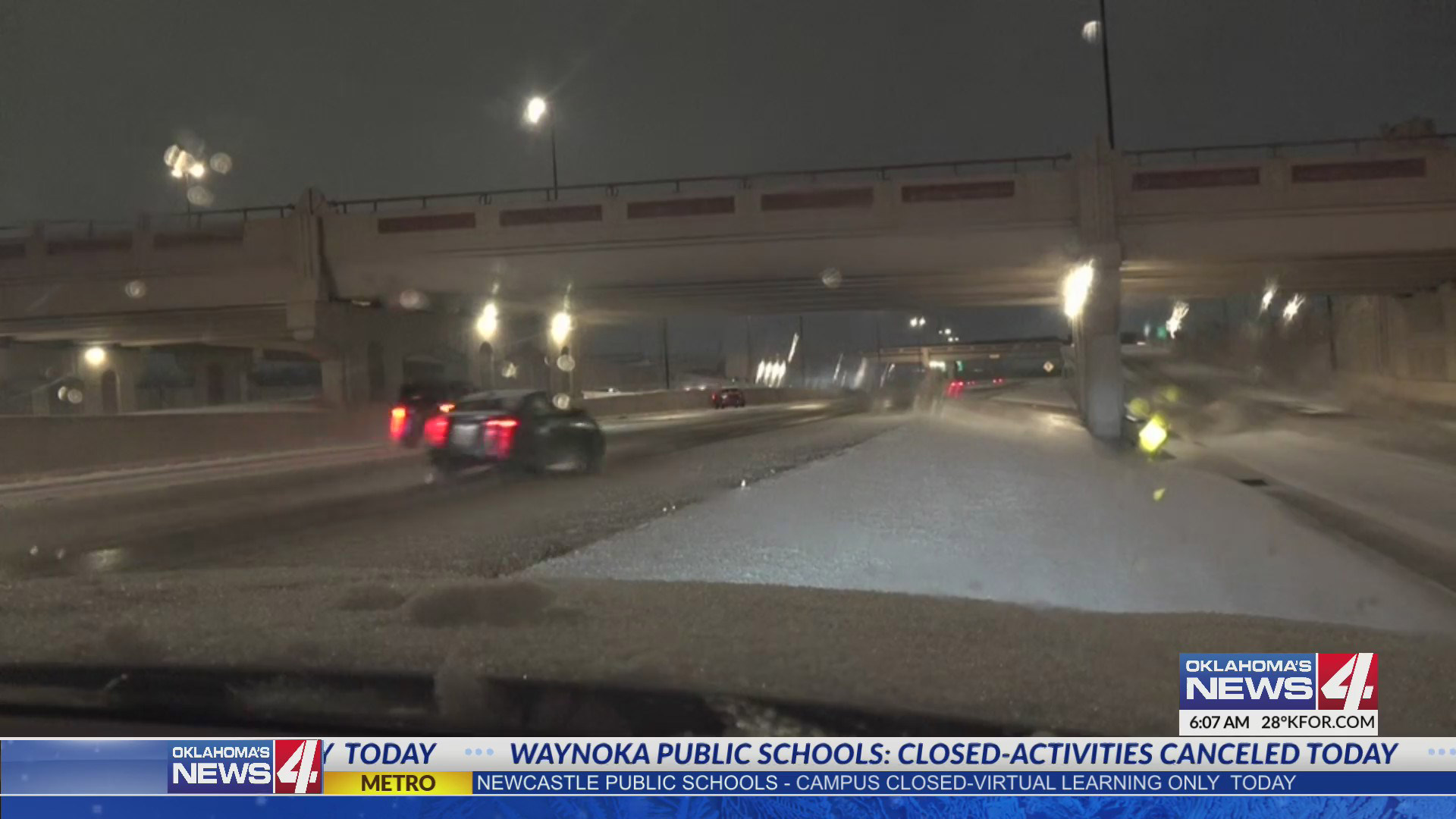

Severe Icy Conditions Impacting Okc Roads Travel Advisory

Apr 25, 2025

Severe Icy Conditions Impacting Okc Roads Travel Advisory

Apr 25, 2025 -

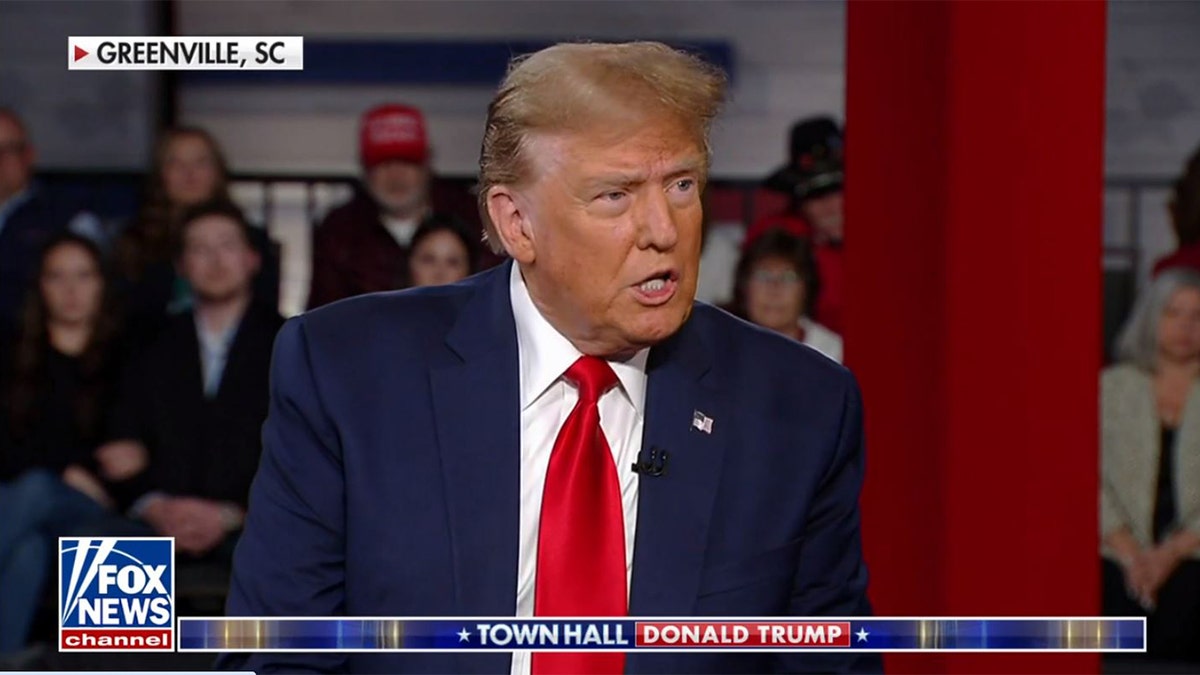

The Zuckerberg Trump Dynamic Implications For The Tech Industry

Apr 25, 2025

The Zuckerberg Trump Dynamic Implications For The Tech Industry

Apr 25, 2025

Latest Posts

-

Meet Jeanine Pirro Education Net Worth And Career Highlights

May 09, 2025

Meet Jeanine Pirro Education Net Worth And Career Highlights

May 09, 2025 -

Aoc Vs Fox News Airing Grievances Against Trump

May 09, 2025

Aoc Vs Fox News Airing Grievances Against Trump

May 09, 2025 -

Exclusive Judge Jeanine Pirro On Her Fears And A Deeply Personal Confession

May 09, 2025

Exclusive Judge Jeanine Pirro On Her Fears And A Deeply Personal Confession

May 09, 2025 -

Aoc Condemns Trump On Fox News Sharp Exchange

May 09, 2025

Aoc Condemns Trump On Fox News Sharp Exchange

May 09, 2025 -

Fox News Judge Jeanine Pirro Opens Up Her Greatest Fears And A Revealing Confession

May 09, 2025

Fox News Judge Jeanine Pirro Opens Up Her Greatest Fears And A Revealing Confession

May 09, 2025