Activision Blizzard Acquisition: FTC's Appeal Against Microsoft

Table of Contents

The FTC's Case Against the Merger

Anti-Competitive Concerns

The FTC's primary argument centers on the potential for anti-competitive behavior following the merger. Their core concern revolves around the future of popular franchises like Call of Duty, a title with massive global appeal.

- Call of Duty Exclusivity: The FTC argues that Microsoft could leverage its ownership of Activision Blizzard to make Call of Duty exclusive to its Xbox console and Game Pass subscription service, effectively locking out PlayStation players and diminishing competition. This would significantly reduce consumer choice and potentially harm PlayStation's market share.

- Impact on Other Developers: The FTC also expresses concern that Microsoft's increased market power, fueled by the acquisition, could negatively impact other game developers and publishers. Smaller studios may face unfair competition, and innovation within the industry could be stifled.

- Evidence and Legal Arguments: The FTC has presented extensive evidence, including internal Microsoft documents and expert testimony, to support its claim that the merger would substantially lessen competition in the video game market. Their legal arguments focus on the potential for monopolization and the harm to consumers resulting from reduced choice and higher prices.

Market Dominance and Power

Microsoft already holds a significant share of the gaming market, and the Activision Blizzard acquisition would undeniably bolster its position.

- Xbox Market Share and Game Pass: Microsoft's Xbox console competes directly with Sony's PlayStation. Adding Activision Blizzard's portfolio to its Game Pass subscription service would give Microsoft a massive advantage, potentially drawing many gamers away from competing platforms.

- Microsoft's Existing Gaming Assets: Beyond Xbox, Microsoft possesses other significant gaming assets, including Bethesda Softworks (creators of The Elder Scrolls and Fallout), which further strengthens their position within the gaming market. This consolidation of power concerns the FTC.

- Negative Impact on Innovation: The FTC argues that such dominance could stifle innovation. With less competition, Microsoft might have less incentive to invest in new technologies and create innovative gaming experiences, potentially leading to a less dynamic and competitive market for consumers.

Microsoft's Defense Strategy

Arguments in Favor of the Merger

Microsoft vigorously defends its acquisition, emphasizing its commitment to a competitive gaming market.

- Call of Duty Cross-Platform Availability: A key component of Microsoft's defense is its repeated promise to keep Call of Duty available on PlayStation and other platforms. They have offered long-term licensing agreements to Sony and other competitors as evidence of their commitment to maintaining cross-platform availability.

- Game Pass Expansion and Benefits: Microsoft argues that integrating Activision Blizzard's games into Game Pass will benefit consumers by expanding the service's already impressive catalog, offering more value for subscribers. This, they say, increases competition, rather than reducing it.

- Increased Competition and Innovation: Microsoft contends that the merger will actually lead to increased competition and innovation, spurring the development of new games and technologies.

Addressing FTC Concerns

Microsoft has attempted to address the FTC's concerns through various concessions and commitments.

- Licensing Agreements and Commitments: Microsoft has offered long-term licensing agreements to ensure the continued availability of Call of Duty on PlayStation. They've also made commitments regarding cross-platform play and fair access to other Activision Blizzard titles.

- Negotiations and Concessions: Microsoft has engaged in extensive negotiations with the FTC and other regulatory bodies, making several concessions to mitigate their concerns. The specifics of these negotiations remain largely confidential.

The Appeal Process and Potential Outcomes

Legal Procedures and Timeline

The FTC's appeal against the merger is a complex legal process involving numerous stages.

- Court Jurisdiction and Procedures: The appeal is currently being heard in the relevant court. Specific legal procedures will follow the established court guidelines.

- Timeline and Key Dates: The appeal process will likely unfold over several months, with key dates and deadlines determining the progression. Possible outcomes include an affirmation of the lower court ruling, a reversal, or other procedural resolutions.

- Potential Outcomes: The potential outcomes range from the FTC successfully blocking the merger to Microsoft winning the appeal and the acquisition proceeding as planned. A decision in either direction will have significant implications for the future of the gaming industry.

Implications for the Gaming Industry

The outcome of this case will set a critical precedent for future mergers and acquisitions in the gaming sector.

- Impact on Future Mergers: The ruling could significantly impact other game publishers considering mergers or acquisitions, potentially creating more stringent regulatory scrutiny.

- Regulatory Landscape: The FTC's actions indicate a shift in the regulatory landscape for the gaming industry, with increased focus on antitrust and competition concerns.

- Consumer Prices and Choice: The outcome will impact consumer prices and choice, with the possibility of both increased costs and limited options if the FTC's concerns regarding reduced competition are realized.

International Regulatory Scrutiny

The FTC's appeal is not an isolated event. Other countries have also reviewed the Microsoft-Activision Blizzard deal.

- EU, UK, and Other Regions: Regulatory bodies in the European Union, the United Kingdom, and other major regions have conducted their own reviews of the merger, leading to varying decisions.

- Alignment and Contrasts: While some regulatory bodies have approved the merger with conditions, the FTC's approach differs significantly, highlighting the variations in regulatory viewpoints across different jurisdictions. This underscores the complexity of international antitrust law.

Conclusion

The FTC's appeal against Microsoft's acquisition of Activision Blizzard represents a pivotal moment for the gaming industry. The core arguments center on the FTC's concern over anti-competitive practices and Microsoft's counter-arguments regarding increased competition and consumer benefits. The appeal process itself is complex and has potentially far-reaching implications, setting a precedent for future mergers and acquisitions. The ultimate outcome remains uncertain, but the impact on the gaming landscape, consumer choice, and the future of antitrust regulation within the tech sector will be profound. Follow the developments in the Activision Blizzard acquisition case to stay informed about this landmark legal battle. Stay updated on the FTC's appeal against Microsoft and learn more about the implications of this major antitrust case.

Featured Posts

-

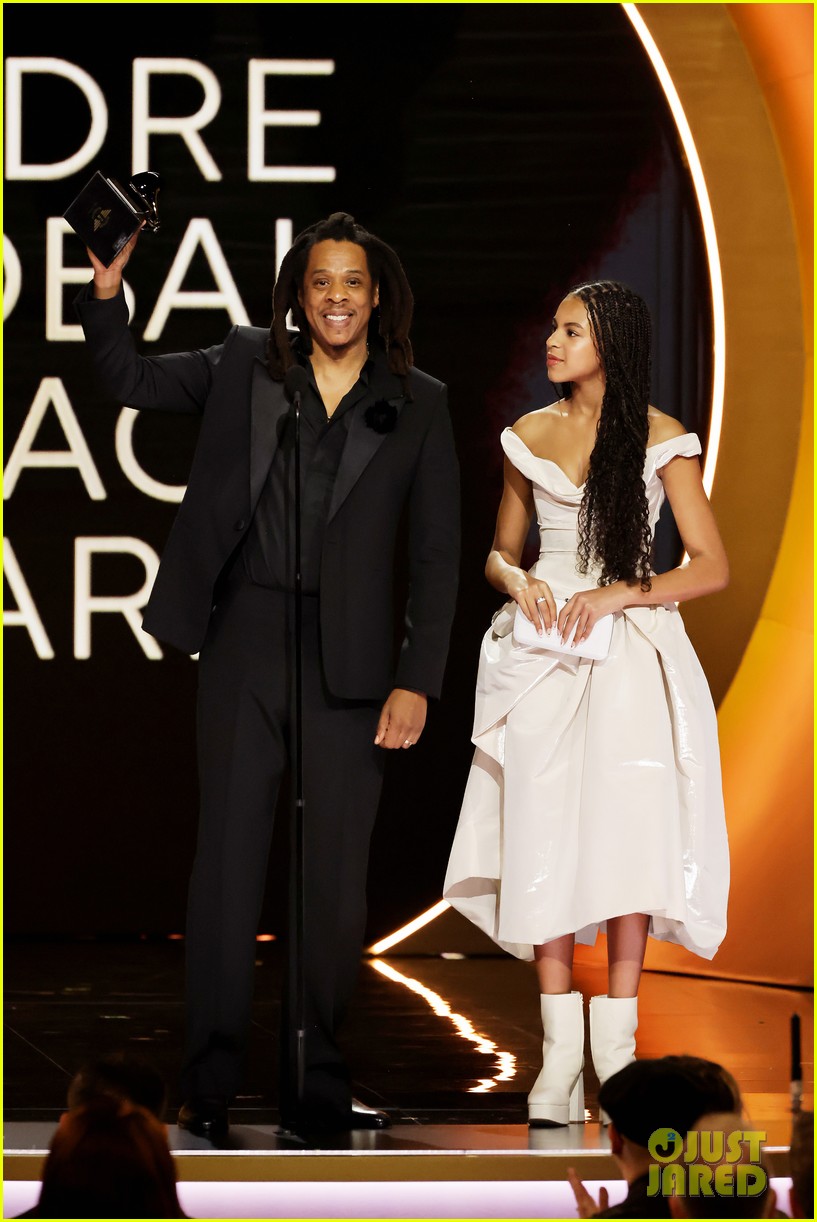

Public Reaction To Blue Ivy Carters Super Bowl Appearance A Critical Analysis Of Beyonce And Jay Zs Choices

Apr 30, 2025

Public Reaction To Blue Ivy Carters Super Bowl Appearance A Critical Analysis Of Beyonce And Jay Zs Choices

Apr 30, 2025 -

Naacp Image Awards Celebrating Beyonce Blue Ivy Carter And Kendrick Lamars Success

Apr 30, 2025

Naacp Image Awards Celebrating Beyonce Blue Ivy Carter And Kendrick Lamars Success

Apr 30, 2025 -

Earth Day Fun At Pocono Center Educational Activities And Community Engagement

Apr 30, 2025

Earth Day Fun At Pocono Center Educational Activities And Community Engagement

Apr 30, 2025 -

Ru Pauls Drag Race Season 17 Episode 6 Things Get Fishy Full Breakdown

Apr 30, 2025

Ru Pauls Drag Race Season 17 Episode 6 Things Get Fishy Full Breakdown

Apr 30, 2025 -

Ftc Challenges Court Ruling On Microsoft Activision Merger

Apr 30, 2025

Ftc Challenges Court Ruling On Microsoft Activision Merger

Apr 30, 2025

50 Godini Praznuva Lyubimetst Na Milioni

50 Godini Praznuva Lyubimetst Na Milioni