Acquisition Alert: Honeywell (HON) And Johnson Matthey's Catalyst Technology

Table of Contents

Honeywell's Strategic Rationale Behind the Acquisition

Honeywell's acquisition of Johnson Matthey's catalyst technology business is a strategic move that significantly strengthens its position in the growing market for emission control and sustainable technologies. Honeywell already possesses a robust portfolio in performance materials and technologies, including aerospace, building technologies, and process solutions. This acquisition perfectly complements its existing strengths, creating significant synergies.

The integration of Johnson Matthey's advanced catalyst technologies will allow Honeywell to:

- Increased market share in emission control catalysts: Gaining access to Johnson Matthey's established customer base and market presence will significantly boost Honeywell's market share in this crucial sector. This translates to increased revenue streams and a stronger competitive position.

- Access to Johnson Matthey's advanced technology and R&D capabilities: Johnson Matthey is renowned for its cutting-edge research and development in catalyst technologies. This acquisition provides Honeywell with access to a wealth of intellectual property and expertise, accelerating its innovation pipeline and allowing for the development of next-generation emission control solutions.

- Expansion into new geographic markets: The acquisition expands Honeywell's reach into new geographical regions where Johnson Matthey holds a strong presence, opening up new market opportunities and diversifying Honeywell's revenue streams.

- Strengthened position in the growing sustainable technology sector: The growing global demand for sustainable and environmentally friendly technologies makes this acquisition strategically important. It positions Honeywell as a leader in the green technology revolution.

- Potential for cost savings and operational efficiencies: Combining operations can lead to significant cost savings through economies of scale, streamlining processes, and eliminating redundancies.

Details of the Johnson Matthey Catalyst Technology Business

The acquired business encompasses a wide range of catalyst technologies vital for emission control in various sectors. This includes technologies crucial for automotive catalytic converters, industrial emission control systems, and other applications requiring efficient and effective catalysis.

The market for emission control catalysts is substantial and experiencing continuous growth, driven by stricter environmental regulations globally and increasing awareness of environmental concerns. Johnson Matthey's technology serves a diverse range of clients, including major automotive manufacturers, chemical companies, and other industrial players. Key features of the acquired business include:

- Specific types of catalysts acquired: This encompasses automotive catalysts (such as three-way catalysts and diesel oxidation catalysts), industrial catalysts for various chemical processes, and potentially other niche applications.

- Geographical reach of the acquired business: The global footprint of Johnson Matthey’s catalyst business provides Honeywell with access to diverse markets and customer bases worldwide.

- Market leadership position in specific niche areas: Johnson Matthey holds a strong position in certain specialized catalyst markets, bringing valuable expertise and market share to Honeywell.

- Intellectual property portfolio: The acquisition includes a valuable portfolio of patents and intellectual property related to catalyst technology, securing Honeywell's competitive advantage for years to come.

Financial Implications and Market Reaction

The financial details of the Honeywell (HON) acquisition of Johnson Matthey's catalyst technology business, including the specific acquisition price and financing methods, will significantly influence its long-term success. While the precise figures may not be immediately public, analysts will closely scrutinize the deal's financial implications.

The market's immediate reaction to the announcement will be reflected in Honeywell's stock price and analyst ratings. A positive market reaction will suggest investor confidence in the acquisition's strategic value and potential for returns. Long-term implications include:

- Acquisition price and payment terms: The price paid will determine the initial cost of the acquisition and influence the return on investment (ROI).

- Expected return on investment for Honeywell: Analysts and investors will evaluate the potential for Honeywell to generate significant returns from the acquired business.

- Impact on Honeywell's earnings per share (EPS): The acquisition's effect on Honeywell's EPS will be a key metric for evaluating its financial performance.

- Stock market performance of HON following the announcement: Changes in HON's stock price will reflect the market's assessment of the deal's impact.

- Credit rating agency perspectives: Credit rating agencies will evaluate the acquisition's influence on Honeywell's financial health and credit rating.

Competitive Landscape and Future Outlook

The emission control and catalyst technology market is highly competitive, with several established players vying for market share. Honeywell's acquisition of Johnson Matthey's catalyst technology business will undoubtedly reshape this competitive landscape. Key aspects to consider include:

- Key competitors in the market: Companies like Clariant, BASF, and others compete in this sector, and Honeywell's acquisition changes the competitive dynamics.

- Potential for further acquisitions or partnerships by Honeywell: Honeywell might seek further acquisitions or partnerships to consolidate its position in the market.

- Long-term growth projections for the acquired business: The future growth of the acquired business will depend on various factors, including technological advancements, environmental regulations, and global economic conditions.

- Technological advancements and their impact on the market: Continuous technological advancements in catalyst technology will drive future growth and innovation in the sector.

Assessing the Significance of the Honeywell (HON) Acquisition

The Honeywell (HON) acquisition of Johnson Matthey's catalyst technology business represents a significant strategic move for Honeywell, strengthening its position in the emission control and sustainable technologies sector. This deal provides access to advanced technologies, expands market reach, and enhances Honeywell's competitiveness. The financial implications will be closely watched by investors, and the long-term impact on the industry will unfold over time. The acquisition reflects a growing emphasis on clean technology and sustainable solutions within the industrial sector.

Stay informed about the unfolding impact of this significant Honeywell (HON) acquisition and its implications for the future of emission control technology. Continue to monitor our site for updates on this and other important acquisitions within the industrial sector.

Featured Posts

-

Scor Fara Echivoc Georgia Invinge Armenia Cu 6 1 In Liga Natiunilor

May 23, 2025

Scor Fara Echivoc Georgia Invinge Armenia Cu 6 1 In Liga Natiunilor

May 23, 2025 -

Big Rig Rock Report 3 12 On 99 7 The Fox A Comprehensive Overview

May 23, 2025

Big Rig Rock Report 3 12 On 99 7 The Fox A Comprehensive Overview

May 23, 2025 -

Julianne Moore And Milly Alcock In Netflixs Cult Thriller Sirens Trailer Unveiled

May 23, 2025

Julianne Moore And Milly Alcock In Netflixs Cult Thriller Sirens Trailer Unveiled

May 23, 2025 -

The Devastating Impact Of Wildfires Record High Global Forest Loss

May 23, 2025

The Devastating Impact Of Wildfires Record High Global Forest Loss

May 23, 2025 -

Lluvias Moderadas Prediccion Meteorologica Actualizada

May 23, 2025

Lluvias Moderadas Prediccion Meteorologica Actualizada

May 23, 2025

Latest Posts

-

Onlarin Cekim Guecue Seytan Tueyue Olan Burclar

May 23, 2025

Onlarin Cekim Guecue Seytan Tueyue Olan Burclar

May 23, 2025 -

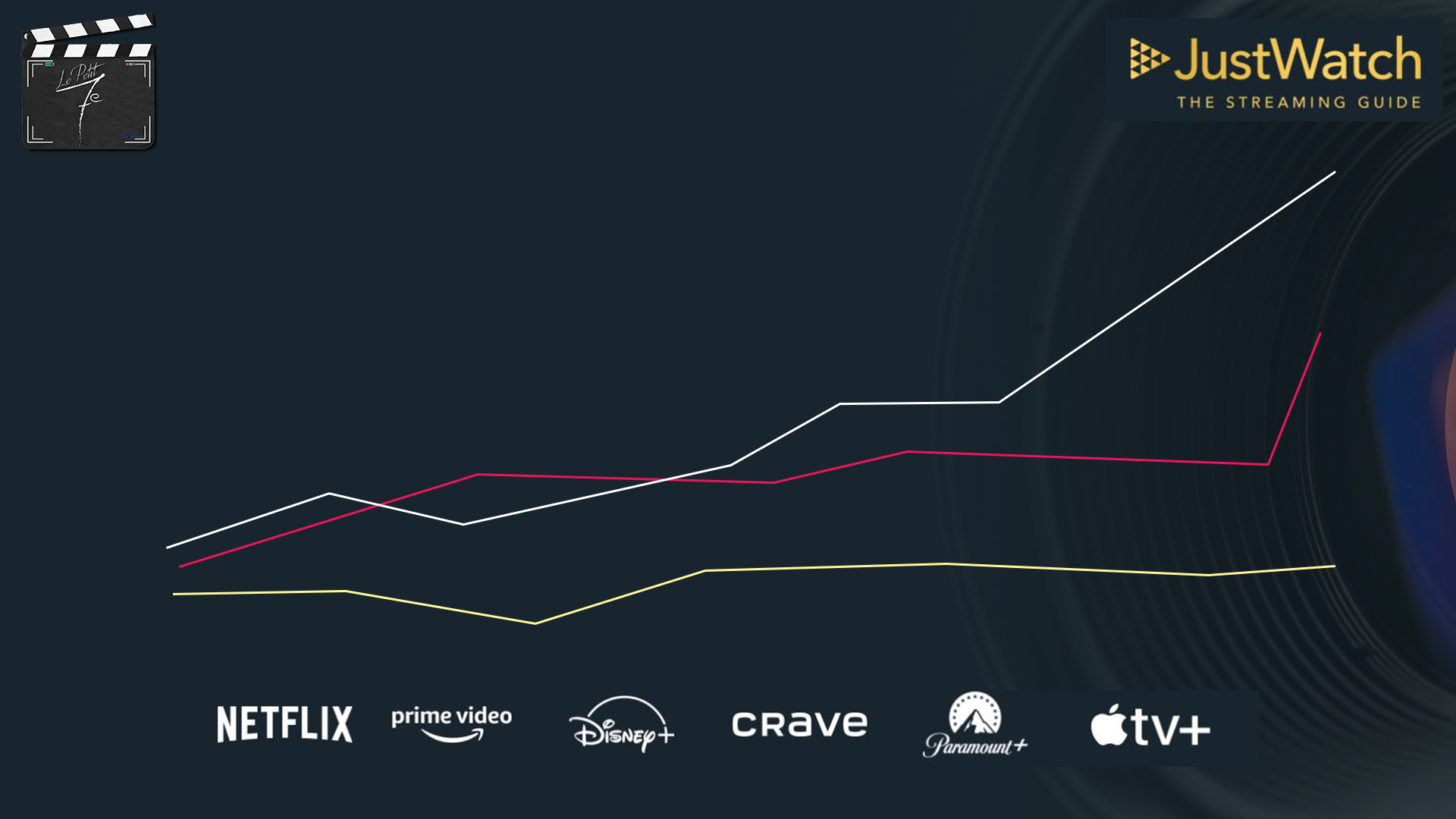

Plateformes De Streaming Au Quebec L Arrivee Des Quotas Pour Le Contenu Francophone

May 23, 2025

Plateformes De Streaming Au Quebec L Arrivee Des Quotas Pour Le Contenu Francophone

May 23, 2025 -

Nouvelles Reglementations Le Quebec Controle Le Contenu Francophone Sur Les Plateformes De Diffusion

May 23, 2025

Nouvelles Reglementations Le Quebec Controle Le Contenu Francophone Sur Les Plateformes De Diffusion

May 23, 2025 -

Canada Post Strike Averted Details On The Latest Contract Offers

May 23, 2025

Canada Post Strike Averted Details On The Latest Contract Offers

May 23, 2025 -

Le Quebec Met En Place Des Quotas Pour Les Plateformes De Streaming Une Analyse

May 23, 2025

Le Quebec Met En Place Des Quotas Pour Les Plateformes De Streaming Une Analyse

May 23, 2025