Ace The Private Credit Interview: 5 Dos And Don'ts For Success

Table of Contents

- DO: Thoroughly Research the Firm and the Role

- Understand the Firm's Investment Strategy

- Tailor Your Responses to the Specific Role

- DO: Showcase Your Financial Modeling and Analytical Skills

- Be Prepared for Technical Questions

- Demonstrate Problem-Solving Abilities

- DO: Highlight Relevant Soft Skills

- Emphasize Communication and Teamwork

- Demonstrate Your Professionalism and Work Ethic

- DON'T: Overstate Your Experience or Expertise

- Be Honest and Transparent

- Don't Criticize Previous Employers

- DON'T: Neglect the Importance of Networking and Follow-Up

- Network Strategically

- Send a Thank-You Note

- Conclusion

DO: Thoroughly Research the Firm and the Role

Before you even think about answering interview questions, thorough preparation is key. This means going beyond a cursory glance at the company website. A successful private credit interview hinges on demonstrating a genuine understanding of the firm and the specific role you're applying for.

Understand the Firm's Investment Strategy

Private credit firms vary significantly in their investment strategies. Some focus on distressed debt, others on mezzanine financing, and still others on direct lending. Understanding their specific niche is crucial.

- Analyze their website: Pay close attention to their "About Us" section, investment strategy pages, and portfolio company listings.

- Explore press releases and news articles: Search for recent news and press releases mentioning the firm's activities, recent deals, and performance.

- Review LinkedIn profiles: Familiarize yourself with the key personnel, their backgrounds, and their experience within the private credit industry. This will help you tailor your answers and show you've done your homework.

- Industry publications: Read relevant industry publications and research reports to gain further insights into the firm's market positioning and competitive landscape.

Tailor Your Responses to the Specific Role

Generic answers won't cut it in a private credit interview. You need to demonstrate how your skills and experience directly align with the specific requirements outlined in the job description.

- Prepare specific examples: For each key skill mentioned (financial modeling, credit analysis, due diligence, portfolio management), prepare a concise example from your previous experience showcasing your proficiency. Use the STAR method (Situation, Task, Action, Result) to structure your responses effectively.

- Quantify your achievements: Instead of saying "I improved efficiency," say "I streamlined the due diligence process, resulting in a 15% reduction in processing time." Numbers speak louder than words.

- Highlight relevant projects: Focus on projects that directly relate to the role's responsibilities and demonstrate your ability to handle the challenges of private credit.

DO: Showcase Your Financial Modeling and Analytical Skills

Private credit roles demand a strong foundation in financial modeling and analysis. Be prepared to demonstrate your expertise.

Be Prepared for Technical Questions

Expect in-depth questions on various aspects of financial analysis:

- Financial statement analysis: Be ready to discuss key ratios, trends, and potential red flags in financial statements.

- Valuation methodologies: Demonstrate your understanding of discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and other relevant valuation techniques. Be prepared to walk through a simple model, explaining your assumptions and conclusions.

- Credit metrics: Be fluent in key credit metrics such as leverage ratios, interest coverage ratios, and debt-to-equity ratios. Understand how these metrics are used to assess credit risk.

- Risk assessment: Show your understanding of various credit risks and how to mitigate them.

Demonstrate Problem-Solving Abilities

Beyond technical knowledge, private credit professionals need sharp problem-solving skills.

- Case studies: Practice case studies that involve analyzing a company's financial situation, identifying potential risks and opportunities, and recommending a course of action.

- Hypothetical scenarios: Be ready to address hypothetical situations requiring critical thinking and quick decision-making.

- Structured approach: Use a structured approach to problem-solving, clearly outlining your thought process and methodology.

DO: Highlight Relevant Soft Skills

Technical skills are essential, but soft skills are equally crucial in the collaborative environment of private credit.

Emphasize Communication and Teamwork

Private credit professionals work closely with various stakeholders, both internally and externally. Excellent communication skills are paramount.

- Teamwork examples: Share examples of successful team projects where you played a significant role, emphasizing your collaboration and communication skills.

- Explaining complex concepts: Demonstrate your ability to explain complex financial information clearly and concisely to both financial and non-financial audiences.

Demonstrate Your Professionalism and Work Ethic

A strong work ethic and a professional demeanor are highly valued in private credit.

- Dedication and attention to detail: Provide examples illustrating your dedication, meticulousness, and ability to meet deadlines, even under pressure.

- Initiative and proactive approach: Showcase instances where you took initiative to improve processes or identify and address potential problems.

DON'T: Overstate Your Experience or Expertise

Honesty and integrity are vital in any financial role, especially in private credit.

Be Honest and Transparent

It's far better to admit any gaps in your knowledge than to try to bluff your way through.

- Acknowledge knowledge gaps: If you are unfamiliar with a specific concept, admit it honestly and express your willingness to learn and quickly acquire the necessary knowledge.

- Focus on learning: Emphasize your eagerness to learn and grow within the firm.

Don't Criticize Previous Employers

Keep your responses professional and avoid negativity.

- Focus on positive aspects: Concentrate on the positive aspects of your previous roles and how they have prepared you for this opportunity.

- Constructive framing: If you need to address a negative experience, frame it constructively, focusing on lessons learned and personal growth.

DON'T: Neglect the Importance of Networking and Follow-Up

Networking and follow-up are crucial steps in the job search process.

Network Strategically

Networking can significantly enhance your chances of securing an interview and ultimately, a job offer.

- Industry events: Attend industry conferences and networking events to meet professionals in the private credit field.

- LinkedIn connections: Use LinkedIn to connect with professionals in private credit and learn more about their experiences and career paths.

- Informational interviews: Reach out to professionals for informational interviews to gain insights into the industry and potential opportunities.

Send a Thank-You Note

A timely and personalized thank-you note demonstrates professionalism and helps you stand out from other candidates.

- Personalized message: Craft a personalized thank-you note reiterating your interest in the position and highlighting key discussion points.

- Prompt delivery: Send the note within 24 hours of the interview.

Conclusion

Acing a private credit interview requires thorough preparation, confidence, and a strategic approach. By following these dos and don'ts, you can significantly increase your chances of success. Remember to thoroughly research the firm and role, showcase your analytical abilities and financial modeling skills, emphasize your relevant soft skills, and avoid overstating your experience. Mastering these elements will help you confidently navigate the interview process and ultimately land your dream job in the exciting world of private credit. Start preparing today and ace your next private credit interview!

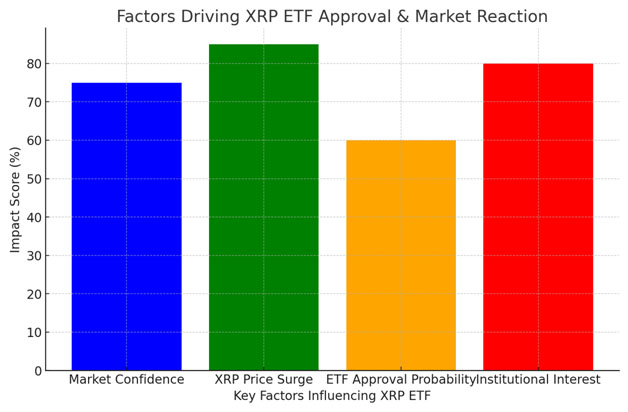

5880 Potential This Altcoin Could Be The Next Xrp

5880 Potential This Altcoin Could Be The Next Xrp

Luis Enrique Ja Cilet Lojtare Te Psg Se Do Largohen

Luis Enrique Ja Cilet Lojtare Te Psg Se Do Largohen

Uber Auto Service A Cash Only Transition

Uber Auto Service A Cash Only Transition

Este Betis Historico El Legado De Un Equipo Inolvidable

Este Betis Historico El Legado De Un Equipo Inolvidable

Inter Milan Vs Fc Barcelona Watch The Champions League Live

Inter Milan Vs Fc Barcelona Watch The Champions League Live