ABN Amro's Bonus Practices Under Investigation By De Nederlandsche Bank

Table of Contents

The Scope of De Nederlandsche Bank's Investigation

The DNB's investigation into ABN Amro's bonus practices is far-reaching and multifaceted. It aims to ensure full compliance with all relevant regulations.

Focus on Compliance with Banking Regulations

The primary focus of the DNB's investigation is to determine whether ABN Amro's bonus schemes adhere to both European and Dutch banking regulations designed to prevent reckless risk-taking. This involves a detailed examination of several key areas:

- Scrutiny of bonus structures across various departments within ABN Amro. The investigation will likely analyze bonus schemes implemented across different divisions within the bank to ensure consistency and compliance.

- Review of the methodology used for calculating bonuses. The DNB will scrutinize the formulas and criteria used to determine bonus payouts, looking for potential flaws that might incentivize short-term gains over long-term stability.

- Examination of the relationship between bonus payouts and risk-taking behavior. A critical aspect of the investigation will be determining whether the bonus system inadvertently encourages excessive risk-taking to achieve short-term performance targets.

- Assessment of the bank's internal controls related to bonus payments. The DNB will review ABN Amro's internal processes and controls to ensure that they adequately mitigate the risks associated with bonus schemes.

Potential Violations and Penalties

If the investigation uncovers violations of banking regulations, ABN Amro could face substantial penalties. The severity of any sanctions would depend on the nature and scale of the identified infractions. Potential consequences include:

- Potential fines under Dutch and European Union banking regulations. These fines could be substantial, potentially running into millions of euros.

- Reputational damage and loss of investor confidence. Negative publicity surrounding the investigation could severely damage ABN Amro's reputation and lead to a decline in investor confidence.

- Possible restrictions on future bonus payouts. The DNB might impose restrictions on the size and structure of future bonus payments to mitigate the risks associated with excessive incentives.

- Mandatory changes to ABN Amro's bonus structure. The bank may be required to overhaul its entire bonus system to ensure compliance with regulations and responsible remuneration practices.

The Context of Responsible Remuneration in the Banking Sector

The ABN Amro bonus investigation is set against the backdrop of significantly tightened regulations following the 2008 financial crisis. These regulations are designed to prevent a recurrence of the irresponsible risk-taking that contributed to the global financial meltdown.

Post-Financial Crisis Regulations

The investigation highlights the continued emphasis on responsible remuneration within the banking sector, a direct result of the lessons learned from the 2008 crisis.

- Discussion of relevant EU directives on banking remuneration. The investigation will likely involve a review of several key EU directives aiming to establish responsible and sustainable practices in banking compensation.

- Explanation of the DNB's role in overseeing responsible remuneration practices. The DNB's active role underscores its commitment to ensuring that Dutch banks operate within the boundaries of responsible financial conduct.

- Comparison to similar investigations in other European countries. The DNB's action is likely to spark further scrutiny of bonus practices in other European banking institutions, creating a ripple effect across the continent.

Public Opinion and Stakeholder Concerns

Beyond regulatory concerns, the investigation reflects growing public and stakeholder anxieties about fairness and transparency in banking compensation.

- Public perception of excessive executive pay in the banking industry. There is a widespread perception that executive pay in the banking sector is often excessive, disconnected from bank performance, and socially unjust.

- Concerns about the social impact of high bonuses. Many believe that high bonuses can contribute to income inequality and a lack of social responsibility within the financial sector.

- Pressure from shareholders and other stakeholders for greater accountability. Shareholders and other stakeholders are demanding more accountability and transparency regarding bank compensation practices.

Implications for ABN Amro and the Wider Banking Industry

The outcome of the DNB's investigation will have significant ramifications for ABN Amro and the broader Dutch banking landscape.

Impact on ABN Amro's Reputation and Stock Price

The investigation's findings will substantially influence ABN Amro's reputation and, consequently, its stock price.

- Potential for negative media coverage and public backlash. Negative publicity could severely damage the bank's image, leading to public criticism and potential boycotts.

- Impact on ABN Amro's credit rating. A negative outcome could trigger a downgrade in the bank's credit rating, potentially increasing its borrowing costs.

- Potential for shareholder lawsuits. If the investigation reveals serious breaches of regulations, shareholders may initiate legal action against ABN Amro.

Implications for Other Banks in the Netherlands

This investigation serves as a stark warning to other Dutch banks, urging them to ensure complete compliance with regulations governing bonus structures and responsible remuneration.

- Increased scrutiny of bonus practices across the Dutch banking sector. The DNB's action is likely to prompt increased scrutiny of compensation practices across the entire Dutch banking system.

- Potential for similar investigations targeting other financial institutions. Other banks in the Netherlands may face similar investigations if their bonus schemes are deemed to violate regulations.

- Need for enhanced internal controls and risk management procedures. The investigation emphasizes the importance of robust internal controls and risk management practices in mitigating the risks associated with bonus schemes.

Conclusion

The De Nederlandsche Bank's ABN Amro bonus investigation underscores the ongoing emphasis on responsible remuneration in the banking sector. The findings will significantly impact ABN Amro, potentially affecting its reputation, financial performance, and future bonus policies. This situation underlines the crucial need for strict compliance with banking regulations regarding bonus structures and serves as a vital reminder for all financial institutions to prioritize responsible remuneration practices. Stay informed about further developments in the ABN Amro bonus investigation and its implications for the Dutch banking industry.

Featured Posts

-

From Reddit Viral Story To Movie Star The I Pretended To Be Missing Girl Saga

May 22, 2025

From Reddit Viral Story To Movie Star The I Pretended To Be Missing Girl Saga

May 22, 2025 -

Pub Landlords Foul Mouthed Rant Staff Members Notice And Heated Exchange

May 22, 2025

Pub Landlords Foul Mouthed Rant Staff Members Notice And Heated Exchange

May 22, 2025 -

Juergen Klopp Nereye Gidiyor En Guencel Transfer Haberleri

May 22, 2025

Juergen Klopp Nereye Gidiyor En Guencel Transfer Haberleri

May 22, 2025 -

Dont Miss Vapors Of Morphine Live In Northcote

May 22, 2025

Dont Miss Vapors Of Morphine Live In Northcote

May 22, 2025 -

Reddit Prica Postaje Film Sa Sydney Sweeney

May 22, 2025

Reddit Prica Postaje Film Sa Sydney Sweeney

May 22, 2025

Latest Posts

-

La Fire Aftermath Price Gouging Concerns Raised By Reality Tv Star

May 22, 2025

La Fire Aftermath Price Gouging Concerns Raised By Reality Tv Star

May 22, 2025 -

Real Estate Agent Accuses La Landlords Of Exploiting Fire Victims

May 22, 2025

Real Estate Agent Accuses La Landlords Of Exploiting Fire Victims

May 22, 2025 -

Boe Rate Cut Probability Falls Pound Rises On Cooling Uk Inflation

May 22, 2025

Boe Rate Cut Probability Falls Pound Rises On Cooling Uk Inflation

May 22, 2025 -

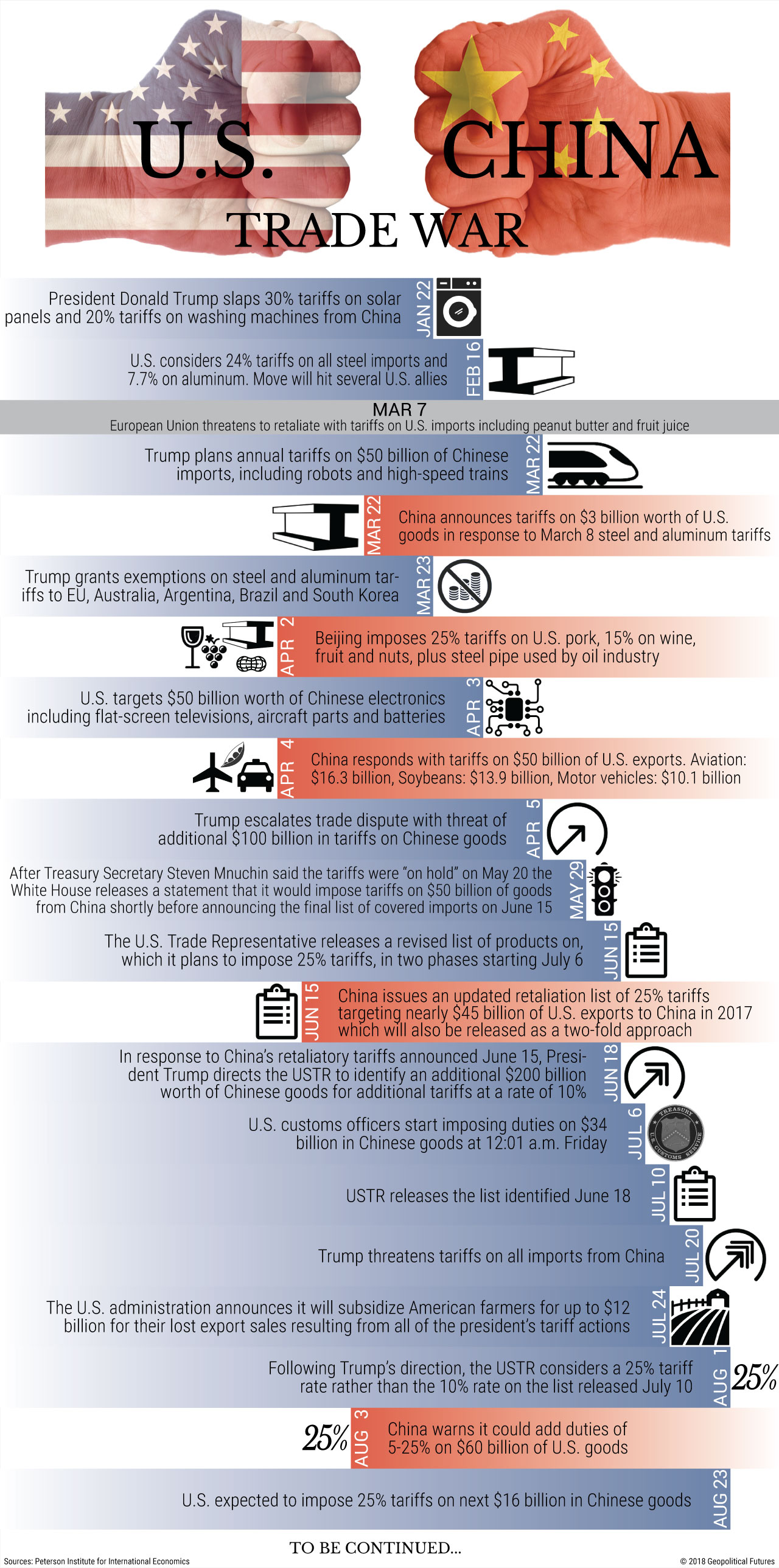

China And Us Trade Navigating The Path To A New Trade Agreement

May 22, 2025

China And Us Trade Navigating The Path To A New Trade Agreement

May 22, 2025 -

The Ftc Investigates Open Ai Implications For Ai Development

May 22, 2025

The Ftc Investigates Open Ai Implications For Ai Development

May 22, 2025