ABN Amro: Potential Fine From Dutch Central Bank Over Bonuses

Table of Contents

The Nature of the Alleged Violations

The DNB's investigation centers around concerns regarding ABN Amro's bonus payouts. The specific allegations haven't been fully disclosed publicly, maintaining a degree of confidentiality typical in ongoing regulatory investigations. However, reports suggest that the DNB’s concerns revolve around several key areas: excessive bonus payments, a misalignment between bonuses and actual performance, and a potential link between the bonus structure and risky behavior by employees. This aligns with a broader global trend of scrutinizing banking bonuses to curb excessive risk-taking.

- Details about the alleged irregularities: While specifics are limited, the investigation likely involves scrutinizing ABN Amro's internal bonus calculations, the criteria used for awarding bonuses, and the overall structure of the compensation scheme across different departments.

- Examples of potential violations: Potential violations could include non-compliance with Dutch banking regulations concerning maximum bonus payouts, failure to adequately link bonuses to long-term sustainable performance, and deficiencies in risk assessment related to bonus incentives.

- Specific concerns raised by the DNB: The DNB likely focuses on whether the bonus system incentivized short-term gains at the expense of long-term stability and prudent risk management, potentially violating regulatory principles aimed at maintaining financial stability within the Netherlands.

Potential Implications of the Fine

The potential financial penalties for ABN Amro could be substantial, impacting its profitability and financial stability. The exact amount of the fine remains unknown, but based on similar cases, it could run into tens or even hundreds of millions of euros. This financial burden would directly affect ABN Amro's bottom line, potentially necessitating cost-cutting measures.

- Estimated size of the potential fine: While speculation abounds, the size of the potential fine depends on the severity of the violations and the DNB's assessment of ABN Amro's culpability. Past fines levied by the DNB for similar regulatory breaches provide some indication, though each case is unique.

- Impact on ABN Amro's profitability and financial stability: A large fine will undeniably strain ABN Amro's profitability. Depending on the size of the fine, it could also impact the bank's credit rating and access to capital markets.

- Potential effects on investor sentiment and stock market performance: News of the investigation and potential fine has likely already impacted investor confidence. A substantial fine could further negatively affect ABN Amro's stock price and its ability to attract new investors.

- Damage to the bank's reputation and public image: Beyond the financial implications, a fine would severely damage ABN Amro's reputation, affecting its public image and potentially impacting customer trust.

ABN Amro's Response and Future Actions

ABN Amro has publicly acknowledged the DNB investigation and has stated its commitment to cooperating fully. The bank has also initiated an internal review to assess its bonus practices and identify any areas needing improvement. This suggests a proactive approach to addressing the concerns raised by the DNB and mitigating potential further penalties.

- Summary of ABN Amro's official statement: ABN Amro's public statements should be carefully reviewed for specific details regarding the nature of the investigation and the steps the bank is taking to address the concerns.

- Measures being undertaken to improve internal controls and compliance: These measures might include reviewing and revising internal policies, strengthening risk management frameworks, enhancing employee training on regulatory compliance, and improving internal auditing procedures.

- Plans to revise bonus structures to meet regulatory requirements: ABN Amro will likely revise its bonus structure to better align with regulatory requirements and promote long-term sustainable performance. This might involve modifying bonus calculation methodologies, implementing stricter performance targets, and enhancing transparency.

- Potential changes to corporate governance procedures: The investigation might also lead to changes in corporate governance procedures, including enhanced oversight of executive compensation and improved risk management committees.

Comparison to Similar Cases

The ABN Amro case echoes similar instances where banks faced regulatory scrutiny and fines for bonus-related issues. International comparisons reveal a global trend towards stricter regulation of executive compensation in the banking sector, emphasizing the importance of responsible risk management and aligning incentives with long-term value creation. Best practices involve designing bonus structures that promote prudent risk-taking and avoid rewarding short-term gains at the expense of long-term sustainability.

Conclusion

The DNB investigation into ABN Amro's bonus practices highlights the increasing scrutiny of executive compensation within the banking industry. The potential for a substantial fine underscores the importance of regulatory compliance and robust risk management. ABN Amro's response and future actions will be crucial in determining the final outcome and shaping the future of its bonus schemes. The implications extend beyond ABN Amro, serving as a reminder to other financial institutions of the need for careful consideration of bonus structures and their potential impact.

Call to Action: Stay informed on the developments in this significant case concerning ABN Amro and the ongoing investigation into its bonus schemes. Regularly check for updates on the DNB's findings and ABN Amro's response to understand the full implications of this major financial event. Follow [link to reputable news source/ABN Amro website] for the latest news on the ABN Amro bonus fine and related developments.

Featured Posts

-

Investing In Middle Managers Maximizing Return For Companies And Employees

May 21, 2025

Investing In Middle Managers Maximizing Return For Companies And Employees

May 21, 2025 -

Novelistes A L Espace Julien Avant Le Hellfest Une Ambiance Unique

May 21, 2025

Novelistes A L Espace Julien Avant Le Hellfest Une Ambiance Unique

May 21, 2025 -

The Goldbergs A Complete Guide To The Hit Tv Show

May 21, 2025

The Goldbergs A Complete Guide To The Hit Tv Show

May 21, 2025 -

Javier Baez Enfocandose En La Salud Y El Exito

May 21, 2025

Javier Baez Enfocandose En La Salud Y El Exito

May 21, 2025 -

Buy Canadian Analyzing The Effects Of Tariffs On Local Beauty

May 21, 2025

Buy Canadian Analyzing The Effects Of Tariffs On Local Beauty

May 21, 2025

Latest Posts

-

Abc Cbs Nbc News Coverage Scrutinized Following New Mexico Gop Arson

May 21, 2025

Abc Cbs Nbc News Coverage Scrutinized Following New Mexico Gop Arson

May 21, 2025 -

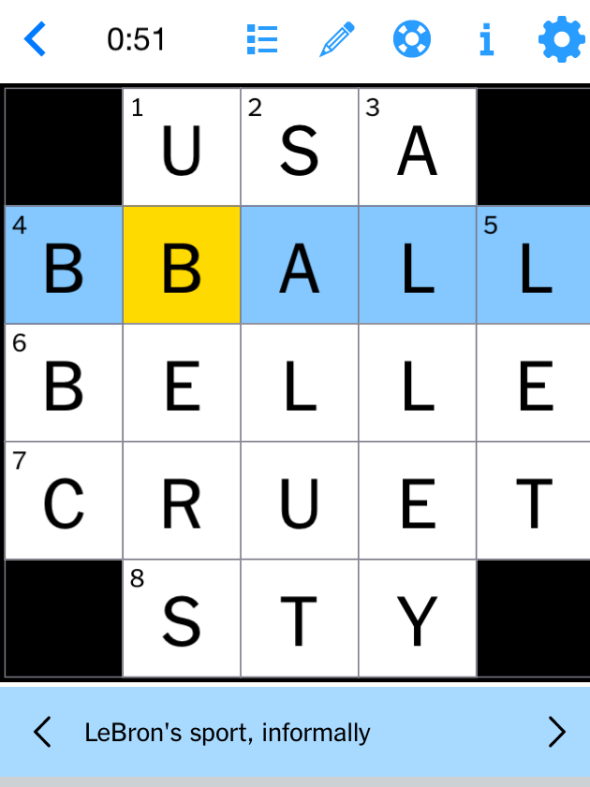

Get Help With The Nyt Mini Crossword April 26 2025

May 21, 2025

Get Help With The Nyt Mini Crossword April 26 2025

May 21, 2025 -

Wlos Hosts Good Morning Americas Ginger Zee For Asheville Rising Helene Preview

May 21, 2025

Wlos Hosts Good Morning Americas Ginger Zee For Asheville Rising Helene Preview

May 21, 2025 -

The New Mexico Gop Arson Attack A Look At Abc Cbs And Nbcs Reporting

May 21, 2025

The New Mexico Gop Arson Attack A Look At Abc Cbs And Nbcs Reporting

May 21, 2025 -

April 26 2025 Nyt Mini Crossword Puzzle Hints

May 21, 2025

April 26 2025 Nyt Mini Crossword Puzzle Hints

May 21, 2025