ABN Amro Facing Dutch Central Bank Scrutiny Over Bonus Payments

Table of Contents

The Nature of the Investigation

The DNB's investigation into ABN Amro's bonus structure is focused on several key areas. Scrutiny centers around the size of the bonuses awarded to executives, the criteria used to determine bonus eligibility, and the alignment of the bonus system with the bank's overall risk management strategies. The DNB is particularly interested in whether ABN Amro's bonus policies adequately incentivize responsible risk-taking and comply with existing Dutch and European Union regulations.

- Timeline: The investigation began in [Insert Start Date, if known; otherwise, use phrasing like "in recent months"]. The DNB has not yet publicly disclosed a projected completion date.

- DNB Concerns: The specific concerns raised by the DNB remain largely confidential, but reports suggest worries about potential misalignment between awarded bonuses and the bank's actual performance, as well as concerns that the bonus structure might have encouraged excessive risk-taking.

- ABN Amro's Response: ABN Amro has publicly stated its commitment to cooperating fully with the DNB's investigation. [Insert any official statements released by ABN Amro, if available]. The bank has also emphasized its ongoing efforts to improve its risk management frameworks and ensure compliance with all relevant regulations.

- Potential Ramifications: The investigation could result in substantial financial penalties for ABN Amro if violations are found. Depending on the severity of any breaches, the bank could face significant fines and other regulatory sanctions.

Potential Implications for ABN Amro

The consequences of the DNB's investigation could be far-reaching for ABN Amro. A negative outcome could severely damage the bank's reputation, impacting its ability to attract and retain both clients and top talent.

- Financial Penalties: Significant fines are a likely possibility, potentially impacting the bank's profitability and shareholder value.

- Reputational Damage: Negative publicity surrounding the investigation could erode public trust and damage ABN Amro's brand image, potentially leading to a loss of business.

- Shareholder Confidence: The investigation's outcome will likely influence investor confidence, potentially affecting the bank's share price and access to capital markets.

- Policy Changes: The investigation might lead to significant changes in ABN Amro's bonus policies and executive compensation structures, potentially requiring a complete overhaul of its reward systems.

- Business Operations: A severe outcome could lead to operational disruptions, increased regulatory oversight, and difficulties in conducting business.

Wider Context: Banking Regulation and Executive Compensation in the Netherlands

This investigation isn't an isolated incident. It reflects a broader European and global conversation about the role of executive compensation in the financial industry and the need for robust regulatory frameworks.

- Dutch Banking Regulations: The Netherlands has strict regulations regarding executive compensation in the banking sector, aiming to prevent excessive risk-taking driven by bonus incentives. These regulations align with broader EU directives on banking supervision.

- International Comparisons: The Dutch approach to regulating bonuses can be compared to similar regulations in other European countries like the UK and Germany, revealing both similarities and differences in approaches to executive compensation and risk management within the banking industry.

- Public Opinion and Media: The investigation has drawn significant media attention and public debate in the Netherlands, highlighting concerns about fairness, transparency, and accountability within the financial sector. Public opinion often leans toward stricter regulations on executive bonuses in the wake of financial scandals.

- Ethical Considerations: The ethical dimensions of high executive bonuses, especially in the context of potential risk-taking and the broader societal impact of financial decisions, are central to this discussion.

The Role of the Dutch Central Bank (DNB)

The DNB plays a crucial role in overseeing the Dutch financial system and ensuring the stability of the banking sector. Its authority extends to investigating matters related to executive compensation and enforcing compliance with relevant regulations.

- Regulatory Powers: The DNB possesses broad powers to investigate banks, impose sanctions, and take other enforcement actions when necessary to maintain financial stability and protect consumers.

- Past Actions: The DNB has taken similar actions against other Dutch banks in the past, indicating a commitment to rigorous enforcement of banking regulations and promoting responsible lending practices.

- Supervisory Approach: The DNB’s supervisory approach emphasizes a proactive and risk-based methodology, focusing on early identification and mitigation of potential threats to the financial system.

Conclusion

The DNB's investigation into ABN Amro's bonus payments highlights crucial issues surrounding executive compensation, risk management, and the importance of robust financial regulation in the Netherlands and beyond. The potential consequences for ABN Amro – including financial penalties, reputational damage, and changes to its business practices – underscore the need for transparency and accountability in the banking sector. The outcome of this investigation will likely have significant implications for the Dutch banking industry and the broader debate surrounding responsible executive compensation. Stay informed about the ongoing investigation and developments in Dutch banking regulation by following [Your Website/News Source] for the latest updates on this significant case of ABN Amro facing scrutiny over bonus payments. This situation reinforces the critical importance of responsible executive compensation and strong financial regulation.

Featured Posts

-

Canadas Response To Oxford Report Us Tariffs Largely Unchanged

May 21, 2025

Canadas Response To Oxford Report Us Tariffs Largely Unchanged

May 21, 2025 -

Abn Amro Toenemende Vraag Naar Occasions Stimuleert Verkoopcijfers

May 21, 2025

Abn Amro Toenemende Vraag Naar Occasions Stimuleert Verkoopcijfers

May 21, 2025 -

Paris Prochaine Etape Pour La Chanteuse Suisse Stephane

May 21, 2025

Paris Prochaine Etape Pour La Chanteuse Suisse Stephane

May 21, 2025 -

Sydney Sweeney And Julianne Moore In Echo Valley New Images Offer A Glimpse Of The Thriller

May 21, 2025

Sydney Sweeney And Julianne Moore In Echo Valley New Images Offer A Glimpse Of The Thriller

May 21, 2025 -

College De Clisson Le Port De La Croix Catholique Questionne

May 21, 2025

College De Clisson Le Port De La Croix Catholique Questionne

May 21, 2025

Latest Posts

-

Abc Cbs Nbc News Coverage Scrutinized Following New Mexico Gop Arson

May 21, 2025

Abc Cbs Nbc News Coverage Scrutinized Following New Mexico Gop Arson

May 21, 2025 -

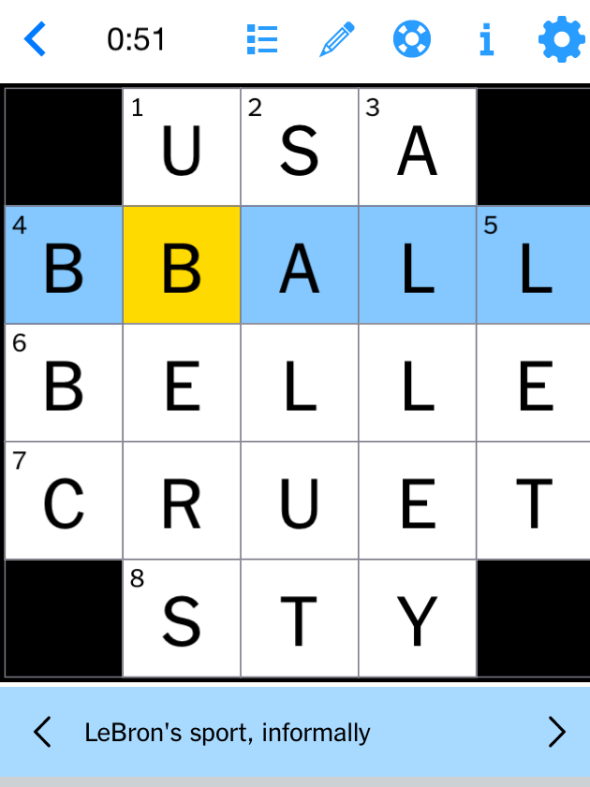

Get Help With The Nyt Mini Crossword April 26 2025

May 21, 2025

Get Help With The Nyt Mini Crossword April 26 2025

May 21, 2025 -

Wlos Hosts Good Morning Americas Ginger Zee For Asheville Rising Helene Preview

May 21, 2025

Wlos Hosts Good Morning Americas Ginger Zee For Asheville Rising Helene Preview

May 21, 2025 -

The New Mexico Gop Arson Attack A Look At Abc Cbs And Nbcs Reporting

May 21, 2025

The New Mexico Gop Arson Attack A Look At Abc Cbs And Nbcs Reporting

May 21, 2025 -

April 26 2025 Nyt Mini Crossword Puzzle Hints

May 21, 2025

April 26 2025 Nyt Mini Crossword Puzzle Hints

May 21, 2025