ABN Amro Faces Potential Fine Over Executive Bonuses

Table of Contents

The Alleged Violations of ABN Amro's Bonus Scheme

The regulatory investigation centers around allegations that ABN Amro's executive bonus scheme violates several key aspects of EU directives and Dutch banking regulations.

Non-Compliance with EU Directives

ABN Amro is allegedly in breach of EU directives designed to curb excessive risk-taking within the financial sector. Specifically, the investigation focuses on whether the bank's bonus scheme adheres to the Capital Requirements Directive IV (CRD IV) and the Capital Requirements Regulation (CRR), particularly concerning the limitations on the size of bonuses and the criteria used for their calculation. These regulations aim to align executive compensation with long-term sustainable growth rather than short-term gains.

- Size of Bonuses: The investigation scrutinizes whether the bonuses paid were disproportionately large compared to the bank's overall performance and the salaries of other employees.

- Performance Metrics: The metrics used to determine bonus payouts are being examined. Concerns exist that the metrics may have incentivized excessive risk-taking or failed to adequately account for long-term sustainability.

- Lack of Clawback Provisions: The absence of robust clawback provisions – mechanisms to reclaim bonuses if performance targets are not met or if misconduct occurs – is another area of concern.

- Non-compliance with Article 92 of CRD IV: This article specifically addresses the limitations on variable remuneration. ABN Amro's scheme may be found deficient in adherence to the ratios specified regarding the relationship between fixed and variable compensation.

Potential Conflicts of Interest

The investigation also explores potential conflicts of interest embedded within the bonus structure. The concern is that the design of the bonus scheme might unintentionally incentivize risky behavior or prioritize short-term profits over the long-term health and stability of the bank. This could lead to decisions that benefit executives in the short term but harm the bank and its stakeholders in the long run.

- Short-term Focus: The structure might disproportionately reward short-term performance, potentially encouraging executives to take on excessive risk to achieve immediate gains.

- Lack of Transparency: Opacity in the bonus calculation methodology could create opportunities for manipulation or favoritism.

The Potential Financial Penalties and their Impact

The potential financial penalties ABN Amro faces are significant and could have far-reaching consequences.

Size of the Potential Fine

The fine's magnitude is uncertain but could range from tens of millions to hundreds of millions of Euros, depending on the severity of the alleged violations. Similar cases in the EU and the Netherlands offer some precedent, with fines often proportionate to the size of the bank and the nature of the infraction. The regulatory authority will consider the scale of the non-compliance, its duration, and any mitigating factors when determining the final amount.

Impact on ABN Amro's Reputation and Share Price

A substantial fine would severely damage ABN Amro's reputation, potentially eroding investor confidence and leading to a decline in its share price. The negative publicity associated with such a penalty could affect the bank's ability to attract and retain both customers and high-caliber employees. The reputational damage might extend beyond the immediate financial impact, impacting long-term business prospects.

Regulatory Response and Future Implications for the Banking Sector

The regulatory response to this case will set a precedent for future executive compensation practices.

The Regulatory Authority's Investigation

The Dutch Central Bank (De Nederlandsche Bank – DNB) is the primary regulatory body conducting the investigation. The timeline of the investigation is ongoing, and the DNB has not yet released a definitive statement on the findings. However, the potential for further investigations into other Dutch banks, and indeed across the EU banking sector, cannot be ruled out. The implications are far-reaching, signaling a heightened focus on regulatory compliance within the financial industry.

Implications for Executive Compensation Practices

This case is likely to influence future executive compensation policies across the Dutch and wider European banking sectors. Expect a tightening of regulations, increased scrutiny of bonus schemes, and a greater emphasis on transparency and accountability. Banks might proactively adjust their bonus structures to align with stricter regulatory requirements, prioritizing long-term stability over short-term gains. We might also see a greater use of clawback provisions to mitigate risks.

Conclusion

ABN Amro's potential fine highlights the increased regulatory pressure on executive compensation within the banking industry. The alleged violations of EU directives concerning executive bonuses, the potential conflicts of interest within the bonus scheme, and the resulting potential financial penalties underscore the need for responsible remuneration practices. This case will likely influence future regulatory actions and executive compensation policies across the European banking sector. Stay informed about the ongoing developments in the ABN Amro executive bonus investigation and the potential impact of the resulting fine. Follow our updates for the latest news on ABN Amro executive bonuses and regulatory changes in the Dutch banking sector. Learn more about the implications of this case for executive compensation policies by continuing to follow our coverage.

Featured Posts

-

How Declining College Enrollment Impacts Local Economies A Case Study Of Boom Towns

May 21, 2025

How Declining College Enrollment Impacts Local Economies A Case Study Of Boom Towns

May 21, 2025 -

The Rise Of Femicide Causes And Consequences

May 21, 2025

The Rise Of Femicide Causes And Consequences

May 21, 2025 -

The Extreme Cost Of Broadcoms V Mware Acquisition At And Ts Concerns

May 21, 2025

The Extreme Cost Of Broadcoms V Mware Acquisition At And Ts Concerns

May 21, 2025 -

Is Betting On Los Angeles Wildfires The Next Big Thing

May 21, 2025

Is Betting On Los Angeles Wildfires The Next Big Thing

May 21, 2025 -

Controverse A Clisson Trop De Croix Autour Du Cou Au College

May 21, 2025

Controverse A Clisson Trop De Croix Autour Du Cou Au College

May 21, 2025

Latest Posts

-

Weather Anchor Ginger Zee Hits Back At Age Related Comment

May 21, 2025

Weather Anchor Ginger Zee Hits Back At Age Related Comment

May 21, 2025 -

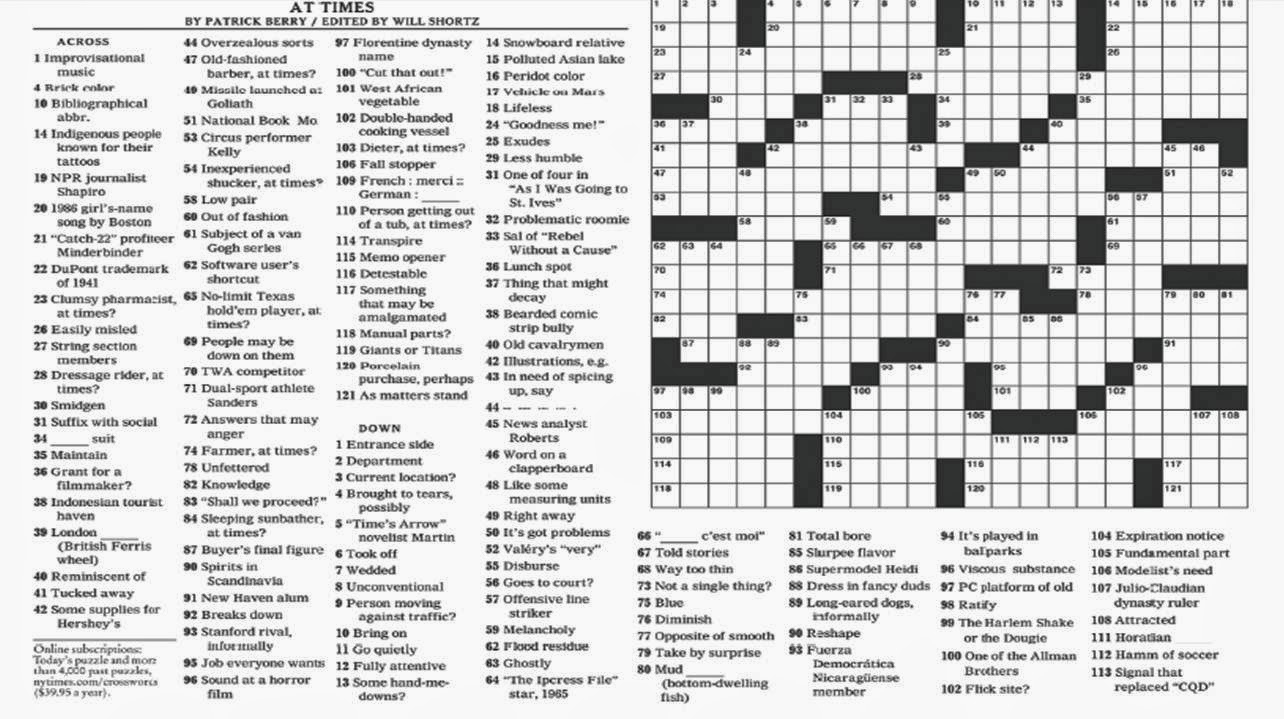

Nyt Mini Crossword April 20 2025 Solutions And Clues

May 21, 2025

Nyt Mini Crossword April 20 2025 Solutions And Clues

May 21, 2025 -

Sabalenka Cruises Past Mertens To Advance At Madrid Open

May 21, 2025

Sabalenka Cruises Past Mertens To Advance At Madrid Open

May 21, 2025 -

Madrid Tennis Sabalenka And Zverev Secure Next Round Spots

May 21, 2025

Madrid Tennis Sabalenka And Zverev Secure Next Round Spots

May 21, 2025 -

Madrid Open Sabalenka Triumphs Over Mertens

May 21, 2025

Madrid Open Sabalenka Triumphs Over Mertens

May 21, 2025