ABN AMRO En Transferz: Partnership Voor Innovatieve Digitale Oplossingen

Table of Contents

Verbeterde Klantenservice door Digitale Innovatie (Improved Customer Service through Digital Innovation)

The core of the ABN AMRO Transferz partnership lies in significantly improving customer service through digital innovation. This is achieved through streamlined processes and a personalized approach, resulting in a more efficient and satisfying banking experience.

Gestroomlijnde Betalingsprocessen (Streamlined Payment Processes):

Transferz's technology integrates seamlessly with ABN AMRO's existing systems, resulting in faster, more secure transactions. This translates to a superior customer experience in several key ways:

- Faster and more secure transactions: Transferz's advanced security protocols ensure that payments are processed quickly and safely, minimizing the risk of fraud.

- Reduced processing times and improved accuracy: Automation reduces manual intervention, leading to significantly faster processing times and fewer errors.

- Seamless integration: The integration with ABN AMRO's systems provides a cohesive and user-friendly experience for customers.

- 24/7 availability: Customers can make payments at any time, enhancing convenience and flexibility.

- Improved fraud detection and prevention mechanisms: Advanced algorithms actively monitor transactions for suspicious activity, providing an extra layer of security.

Gepersonaliseerde Klantervaring (Personalized Customer Experience):

The partnership aims to deliver a truly personalized banking experience. This involves tailoring solutions and communication to individual customer needs:

- Tailored financial solutions: ABN AMRO can offer customized financial products and services based on individual customer profiles and financial goals.

- Proactive customer support and notifications: Customers receive timely updates and support, reducing the need for proactive contact.

- Seamless access to financial information: Intuitive digital interfaces provide easy access to account information, transaction history, and other important details.

- Improved customer engagement: Personalized communication channels, such as targeted emails and in-app messages, keep customers informed and engaged.

- Data-driven insights: Analysis of customer data allows ABN AMRO to optimize service strategies and anticipate customer needs.

Verhoogde Efficiëntie en Schaalbaarheid (Increased Efficiency and Scalability)

The ABN AMRO Transferz partnership is not only about improving customer service; it's also about enhancing operational efficiency and scalability for ABN AMRO.

Automatisering van Processen (Automation of Processes):

Automation is a key component of this collaboration, leading to significant improvements in efficiency and cost savings:

- Reduction of manual tasks: Automated workflows streamline numerous processes, freeing up staff for more complex tasks.

- Improved operational efficiency and cost savings: Automation leads to significant cost reductions and improved resource allocation.

- Scalable solutions: The partnership provides scalable solutions that can easily adapt to future growth and increased customer demand.

- Increased accuracy and reduced human error: Automation minimizes the risk of human error, resulting in more accurate and reliable processing.

- Real-time monitoring and performance tracking: ABN AMRO gains real-time insights into the performance of its systems, enabling proactive management and optimization.

Verbeterde Data-analyse (Improved Data Analysis):

The partnership leverages data analytics to gain valuable insights and improve decision-making:

- Data-driven decision-making: Real-time data analysis provides valuable insights into customer behavior and market trends.

- Identification of trends and opportunities: ABN AMRO can identify areas for service improvement and develop new products and services.

- Enhanced risk management: Advanced data analytics improves risk assessment and mitigation strategies.

- Development of innovative financial products and services: Data-driven insights enable the creation of innovative and customer-centric financial solutions.

- Optimized resource allocation and improved profitability: Data analysis helps to optimize resource allocation and improve the overall profitability of ABN AMRO.

De Toekomst van het Bankieren met ABN AMRO en Transferz (The Future of Banking with ABN AMRO and Transferz)

The ABN AMRO Transferz partnership is a long-term commitment to innovation in the banking sector. The collaboration aims to continuously explore new technologies and expand into new markets and services.

- Long-term goals: The partnership aims to establish a leading position in the digital banking landscape.

- Expansion into new markets and services: The collaboration will explore opportunities to expand into new markets and offer a broader range of financial services.

- Focus on innovation: The partnership is committed to continuous innovation and leveraging technological advancements.

- The role of AI and machine learning: AI and machine learning will play a significant role in enhancing customer experiences and improving operational efficiency.

- Sustainable and responsible banking practices: The partnership is committed to integrating sustainable and responsible banking practices into its operations.

Conclusie:

The ABN AMRO and Transferz partnership represents a significant leap forward in the Dutch banking sector. This powerful ABN AMRO Transferz partnership, focused on innovative digital solutions, is setting a new standard for customer service, efficiency, and scalability. By embracing technology and prioritizing customer needs, this collaboration is shaping the future of banking. Learn more about the innovative digital solutions offered through the ABN AMRO Transferz partnership and experience the future of banking today!

Featured Posts

-

Trans Australia Run New Attempt To Break The World Record

May 22, 2025

Trans Australia Run New Attempt To Break The World Record

May 22, 2025 -

Cassidy Hutchinson Memoir A Deeper Look At The January 6th Events

May 22, 2025

Cassidy Hutchinson Memoir A Deeper Look At The January 6th Events

May 22, 2025 -

Razvod Vanje Mijatovic Sta Se Zapravo Dogodilo

May 22, 2025

Razvod Vanje Mijatovic Sta Se Zapravo Dogodilo

May 22, 2025 -

Cybersecurity Failure At Marks And Spencer Costs 300 Million

May 22, 2025

Cybersecurity Failure At Marks And Spencer Costs 300 Million

May 22, 2025 -

Where To Buy Dexter Original Sin Steelbook Blu Ray For Dexter Fans

May 22, 2025

Where To Buy Dexter Original Sin Steelbook Blu Ray For Dexter Fans

May 22, 2025

Latest Posts

-

The Fdas Clampdown On Unapproved Ozempic Copies Supply Chain Disruptions

May 22, 2025

The Fdas Clampdown On Unapproved Ozempic Copies Supply Chain Disruptions

May 22, 2025 -

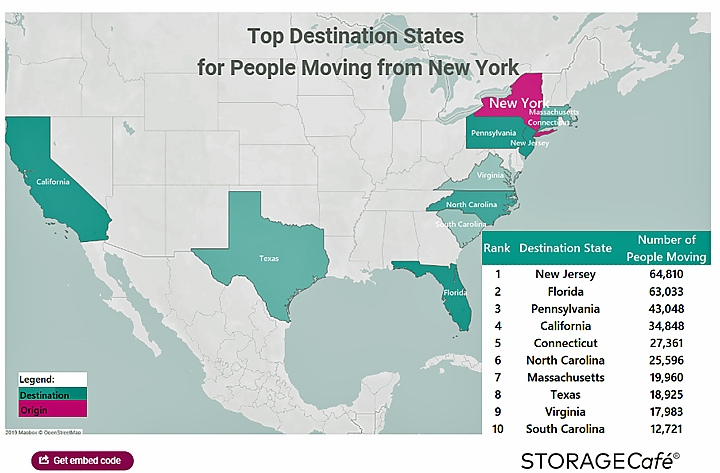

Manhattans Downtown Shift Why Affluent New Yorkers Are Relocating

May 22, 2025

Manhattans Downtown Shift Why Affluent New Yorkers Are Relocating

May 22, 2025 -

Is This Summers Air Travel Doomed Airlines Face Staffing And Infrastructure Challenges

May 22, 2025

Is This Summers Air Travel Doomed Airlines Face Staffing And Infrastructure Challenges

May 22, 2025 -

The Ford Nissan Battery Plant An Exclusive Analysis Of The Ev Industrys Future

May 22, 2025

The Ford Nissan Battery Plant An Exclusive Analysis Of The Ev Industrys Future

May 22, 2025 -

600 Year Old Chinese Tower Partially Collapses Tourists Scramble To Safety

May 22, 2025

600 Year Old Chinese Tower Partially Collapses Tourists Scramble To Safety

May 22, 2025