ABN Amro: Dutch Central Bank Investigates Bonus Payments

Table of Contents

The Scope of the Investigation

The DNB's investigation into ABN Amro's bonus scheme is a significant development, focusing on the details of bonus payments awarded to employees over a specific period. While the exact timeframe remains officially undisclosed, early reports suggest the investigation spans several years and encompasses various bonus types, from performance-based incentives to annual and retention bonuses. This comprehensive approach suggests that the DNB is undertaking a thorough review of ABN Amro's regulatory compliance. The investigation's trigger remains unclear, though speculation points to potential breaches of regulatory guidelines surrounding executive compensation and risk management practices. The lack of transparency surrounding the exact parameters of the investigation adds to the intrigue and emphasizes the seriousness of the DNB’s actions.

- Specific years under investigation: Although not publicly confirmed, sources suggest the investigation covers at least the past five years.

- Types of bonuses involved: Performance-based bonuses, annual bonuses, and retention bonuses are all understood to be under scrutiny.

- Number of employees affected: The exact number of employees affected by the investigation remains undisclosed, but it is likely to encompass a significant number of ABN Amro’s staff.

- Potential regulatory breaches: The investigation focuses on whether ABN Amro adhered to regulations concerning bonus caps, transparency, and the link between bonuses and risk-taking behavior.

Potential Reasons Behind the Investigation

The DNB's decision to launch this investigation likely stems from several converging factors. Concerns about excessive risk-taking within ABN Amro, potentially leading to irresponsible lending practices, are at the forefront. Furthermore, a lack of transparency in the bank's bonus structure, possibly creating conflicts of interest, is a major point of concern. The investigation might also be linked to broader issues within the financial sector, such as the lingering effects of past financial crises and a general push towards greater corporate governance.

- Link to past controversies: While ABN Amro hasn’t faced major scandals recently, any previous issues related to risk management or ethical conduct could be relevant to the current investigation.

- Impact on financial stability: The investigation highlights concerns that excessive bonuses might encourage excessive risk-taking, potentially jeopardizing the stability of the Dutch financial system.

- Analysis of risk management practices: The DNB’s investigation likely involves a thorough review of ABN Amro’s internal risk management controls and their effectiveness in mitigating the risks associated with bonus schemes.

Potential Consequences for ABN Amro

If found to be in violation of regulations, ABN Amro faces significant consequences. The most immediate would be substantial financial penalties imposed by the DNB. Beyond monetary repercussions, the bank risks severe reputational damage, eroding customer trust and potentially impacting its ability to attract and retain both clients and talent. This reputational damage could translate to a negative impact on the bank’s stock price, impacting shareholder value. Further, legal ramifications cannot be ruled out.

- Examples of previous penalties: The DNB has previously imposed significant fines on other Dutch banks for similar breaches of regulations, providing a precedent for potential penalties in this case.

- Impact on future business prospects: Negative publicity and regulatory action could severely hamper ABN Amro’s future business prospects, affecting its competitiveness in the Dutch and international markets.

- Changes in executive compensation policies: It is highly likely that the outcome of this investigation will lead to significant changes in ABN Amro’s executive compensation policies, aiming for greater transparency and alignment with responsible banking practices.

Broader Implications for the Dutch Banking Sector

The ABN Amro investigation has implications extending beyond a single institution. It highlights the ongoing need for stringent regulatory oversight within the Dutch banking sector and could prompt a review of existing regulations concerning executive compensation and risk management. The investigation's findings could influence broader financial sector reform in the Netherlands, potentially leading to stricter regulations aligned with EU banking rules and international standards like the Basel Accords. This could involve increased transparency requirements for bonus structures, stricter caps on bonus payments, and more robust risk management frameworks.

- Comparison to other European countries: The investigation will be closely observed by regulators in other European countries, potentially influencing their approach to similar issues.

- Increased regulatory oversight: The DNB’s actions suggest a likely increase in regulatory oversight of Dutch banks’ compensation and risk management practices.

- Influence on future banking legislation: This investigation could serve as a catalyst for changes in Dutch banking legislation, aimed at preventing similar issues from arising in the future.

Conclusion

The Dutch Central Bank's investigation into ABN Amro's bonus payments underscores the growing importance of responsible banking practices and rigorous regulatory oversight. The potential consequences for ABN Amro, ranging from substantial financial penalties to severe reputational damage, are significant. Furthermore, this investigation has broader implications for the entire Dutch banking sector, potentially leading to stricter regulations and increased scrutiny of bonus structures and risk management practices. Stay updated on developments regarding the ABN Amro bonus payments investigation and its impact on Dutch banking regulations. Follow [your website/news source] for further insights into the evolving situation and its consequences for ABN Amro and the financial sector; including updates on the ABN Amro bonus scandal and the implications for Dutch banking.

Featured Posts

-

Saskatchewan Politics Examining The Impact Of The Costco Campaign

May 21, 2025

Saskatchewan Politics Examining The Impact Of The Costco Campaign

May 21, 2025 -

Gma Shakeup Robin Roberts Comments On Layoffs And Future Of The Show

May 21, 2025

Gma Shakeup Robin Roberts Comments On Layoffs And Future Of The Show

May 21, 2025 -

Prica S Reddita Sydney Sweeney U Novoj Filmskoj Adaptaciji

May 21, 2025

Prica S Reddita Sydney Sweeney U Novoj Filmskoj Adaptaciji

May 21, 2025 -

The Amazing World Of Gumball Hulu Drops Premiere Teaser Trailer

May 21, 2025

The Amazing World Of Gumball Hulu Drops Premiere Teaser Trailer

May 21, 2025 -

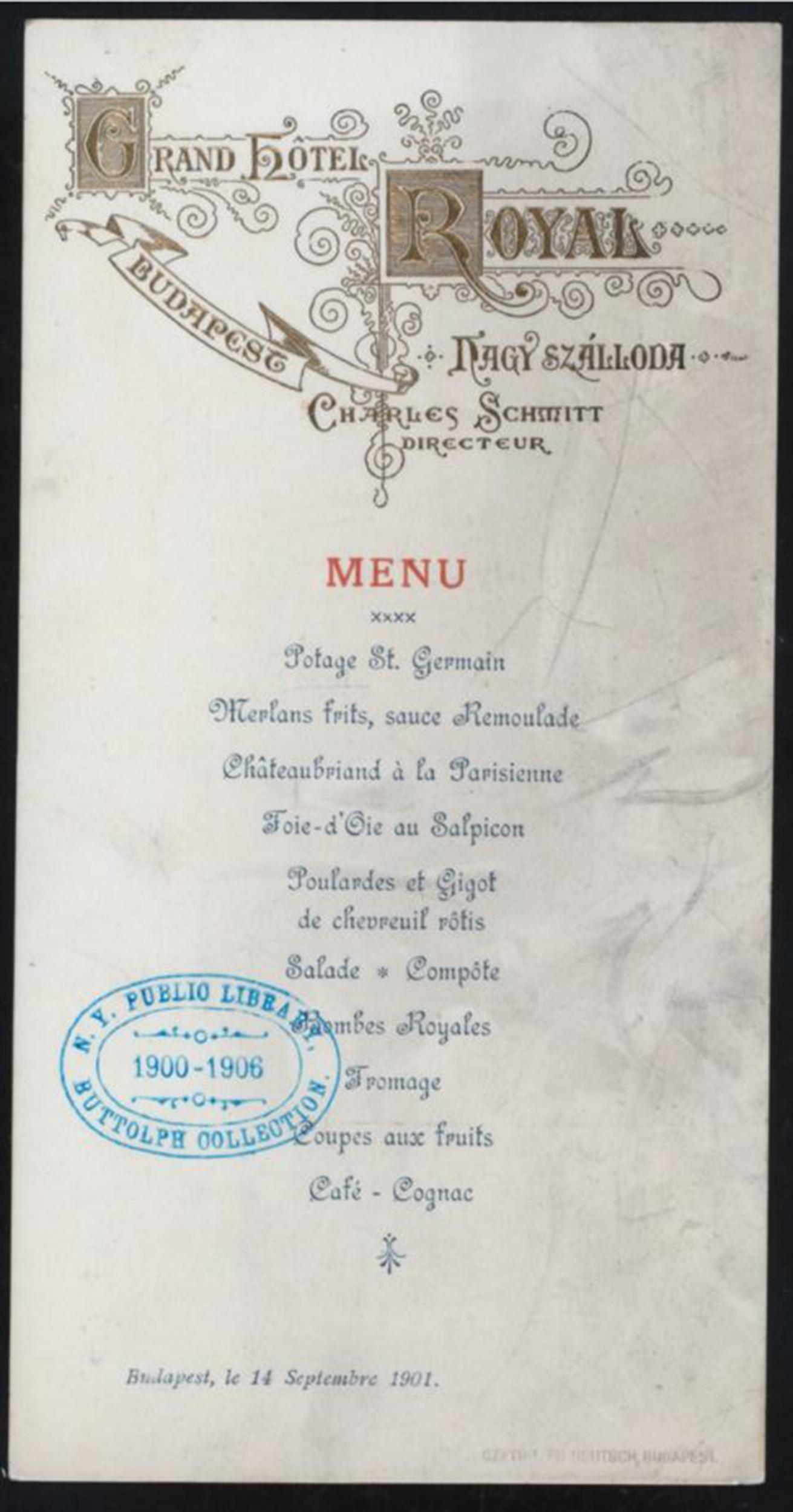

Discover Unusual Eats At The Manhattan Forgotten Foods Festival

May 21, 2025

Discover Unusual Eats At The Manhattan Forgotten Foods Festival

May 21, 2025

Latest Posts

-

The Inside Story How Michael Strahan Secured A Key Interview Amidst Stiff Competition

May 21, 2025

The Inside Story How Michael Strahan Secured A Key Interview Amidst Stiff Competition

May 21, 2025 -

Michael Strahans Interview A Case Study In Ratings Domination

May 21, 2025

Michael Strahans Interview A Case Study In Ratings Domination

May 21, 2025 -

Did Michael Strahan Outmaneuver The Competition For This Exclusive Interview

May 21, 2025

Did Michael Strahan Outmaneuver The Competition For This Exclusive Interview

May 21, 2025 -

Analyzing Michael Strahans Winning Interview Strategy During A Ratings War

May 21, 2025

Analyzing Michael Strahans Winning Interview Strategy During A Ratings War

May 21, 2025 -

Understanding Michael Strahans Competitive Interview Strategy

May 21, 2025

Understanding Michael Strahans Competitive Interview Strategy

May 21, 2025