AbbVie's (ABBV) Upgraded Profit Guidance: A Deep Dive Into The Financial Results

Table of Contents

Key Drivers Behind AbbVie's Upgraded Profit Guidance

The positive revision in AbbVie's profit guidance stems from a confluence of factors, demonstrating strong performance across several key areas. Let's break down the major contributors:

-

Strong Performance of Key Drugs: AbbVie's blockbuster drugs continue to drive significant revenue growth. For example, [Specific drug name 1], a key component of AbbVie's portfolio, saw [percentage]% year-over-year sales growth, exceeding initial projections. Similarly, [Specific drug name 2] contributed significantly to the overall revenue increase. These strong sales figures directly translate into increased profitability. Keywords: revenue growth, drug sales, market share.

-

Successful Product Launches and Pipeline Advancements: The successful launch of [new drug name], along with positive clinical trial results for drugs in its R&D pipeline, boosts investor confidence and anticipates future revenue streams. This successful innovation reinforces AbbVie's commitment to research and development, further strengthening its long-term growth prospects. Keywords: R&D pipeline, product launches, innovation.

-

Cost-Cutting Measures and Improved Operational Efficiency: AbbVie implemented effective cost-cutting measures, streamlining operations and enhancing efficiency. This strategic focus on operational excellence contributed to improved margins and increased profitability, even amidst economic uncertainties. Keywords: operational efficiency, cost reduction, margin improvement.

-

Positive Market Trends and Increased Demand: Favorable market trends within the pharmaceutical industry, coupled with increased demand for AbbVie's products, played a crucial role in the improved financial performance. This reflects both the effectiveness of AbbVie's marketing and sales strategies and the growing need for the treatments they offer. Keywords: market trends, industry growth, demand.

-

Impact of Acquisitions and Mergers: While not explicitly stated as a primary driver in this instance, past acquisitions and strategic partnerships can contribute to long-term growth and efficiency improvements, indirectly influencing current financial results. Any recent acquisitions should be noted here. Keywords: acquisitions, mergers, strategic partnerships.

Detailed Analysis of AbbVie's Q[Quarter] 2024 Financial Results

AbbVie's Q[Quarter] 2024 earnings report showcased impressive financial metrics, providing a solid foundation for the upgraded profit guidance. Let's examine the key figures:

-

Revenue: AbbVie reported [specific revenue figure] in Q[Quarter] 2024, representing a [percentage]% year-over-year (YOY) growth. This surpasses analyst expectations and highlights strong market performance. Keywords: revenue, year-over-year growth, financial performance.

-

Earnings Per Share (EPS): EPS reached [specific EPS figure], showcasing a [percentage]% YOY increase. This demonstrates enhanced profitability and shareholder value. Keywords: earnings per share (EPS), profitability, shareholder value.

-

Gross and Operating Margins: AbbVie maintained healthy gross and operating margins, indicating efficient cost management and pricing strategies. Specific figures should be included here, along with commentary on trends. Keywords: gross margin, operating margin, cost management.

-

Research and Development (R&D) Spending: R&D expenditure amounted to [specific figure], demonstrating AbbVie's continued commitment to innovation and future growth. This investment is crucial for sustaining long-term competitiveness. Keywords: R&D expenditure, innovation, long-term growth.

-

Debt Levels and Financial Health: AbbVie's debt levels and overall financial health remain strong, providing a stable platform for future investments and growth opportunities. Specific ratios (e.g., debt-to-equity ratio) should be included here. Keywords: debt-to-equity ratio, financial health, financial stability.

Impact of the Upgraded Guidance on AbbVie's Stock Price and Investor Sentiment

The market responded positively to AbbVie's upgraded profit guidance. Let's analyze the impact:

-

Stock Price Movement: Following the announcement, AbbVie's stock price experienced a [percentage]% increase, reflecting investor confidence in the company's future prospects. Keywords: stock price, market reaction, investor confidence.

-

Analyst Ratings and Target Price Changes: Several analysts revised their ratings and target prices for ABBV upwards, further indicating a positive outlook. Specific examples should be included. Keywords: analyst ratings, target price, stock outlook.

-

Investor Sentiment: Investor sentiment towards AbbVie has significantly improved, with many expressing optimism about the company's long-term growth potential. This positive sentiment is reflected in increased trading volume and positive media coverage. Keywords: investor sentiment, market confidence, stock outlook.

-

Comparison with Competitor Performance: AbbVie's performance stands out compared to some competitors in the pharmaceutical industry, reinforcing its position as a leading player. A brief comparison with key competitors should be included. Keywords: competitor analysis, market leadership, competitive advantage.

Risks and Challenges Facing AbbVie's Future Growth

While the outlook is positive, AbbVie faces certain challenges that need to be acknowledged:

-

Patent Expirations: The looming patent expiry of key drugs poses a potential threat to future revenue streams. AbbVie needs to actively mitigate this risk through strategic planning and diversification. Keywords: patent cliff, patent expiration, revenue risk.

-

Generic Competition: The emergence of generic competition could impact sales of some of AbbVie's established products. The company needs to develop new products and strengthen its intellectual property portfolio to stay ahead of the curve. Keywords: generic competition, intellectual property, competitive landscape.

-

Regulatory Hurdles: Navigating regulatory processes for new drug approvals can be complex and time-consuming, potentially leading to delays in product launches and impacting revenue projections. Keywords: regulatory hurdles, drug approval, regulatory compliance.

-

Economic Uncertainty and Market Volatility: Global economic uncertainty and market volatility could impact demand for pharmaceutical products and affect AbbVie's financial performance. The company needs to be prepared for such eventualities. Keywords: market volatility, economic uncertainty, risk management.

-

Challenges in Specific Therapeutic Areas: Challenges specific to the therapeutic areas AbbVie operates in may affect growth. These challenges should be mentioned specifically, if known. Keywords: therapeutic area, market dynamics, specific challenges.

Conclusion: Investing in AbbVie (ABBV) After the Upgraded Profit Guidance

AbbVie's upgraded profit guidance, driven by strong drug performance, successful product launches, and operational efficiency, paints a largely positive picture for the company's future. While risks associated with patent expirations and generic competition exist, AbbVie's proactive R&D efforts and strategic planning mitigate these concerns to some extent. The positive market reaction and analyst upgrades further reinforce this positive outlook. However, considering AbbVie's (ABBV) upgraded profit guidance and its strong performance, conducting thorough due diligence before making any investment decisions is crucial. Learn more about AbbVie's (ABBV) financial outlook and potential investment opportunities by [link to relevant resource, e.g., AbbVie investor relations website].

Featured Posts

-

127 Years Of Brewing History Anchor Brewing Company Announces Closure

Apr 26, 2025

127 Years Of Brewing History Anchor Brewing Company Announces Closure

Apr 26, 2025 -

Jorgensons Paris Nice Victory An American Triumph

Apr 26, 2025

Jorgensons Paris Nice Victory An American Triumph

Apr 26, 2025 -

Nepo Babies Dominating Television Right Now

Apr 26, 2025

Nepo Babies Dominating Television Right Now

Apr 26, 2025 -

Merliers Dominant Paris Nice Performance A Double Victory

Apr 26, 2025

Merliers Dominant Paris Nice Performance A Double Victory

Apr 26, 2025 -

Olive Oils With Southern Soul A Taste Of Tradition

Apr 26, 2025

Olive Oils With Southern Soul A Taste Of Tradition

Apr 26, 2025

Latest Posts

-

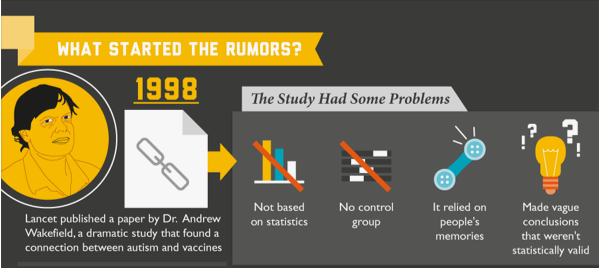

Immunization Autism Link Study Vaccine Skeptics Leadership Sparks Debate

Apr 27, 2025

Immunization Autism Link Study Vaccine Skeptics Leadership Sparks Debate

Apr 27, 2025 -

Vaccine Skeptic Leading Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025

Vaccine Skeptic Leading Federal Autism Immunization Study A Troubling Appointment

Apr 27, 2025 -

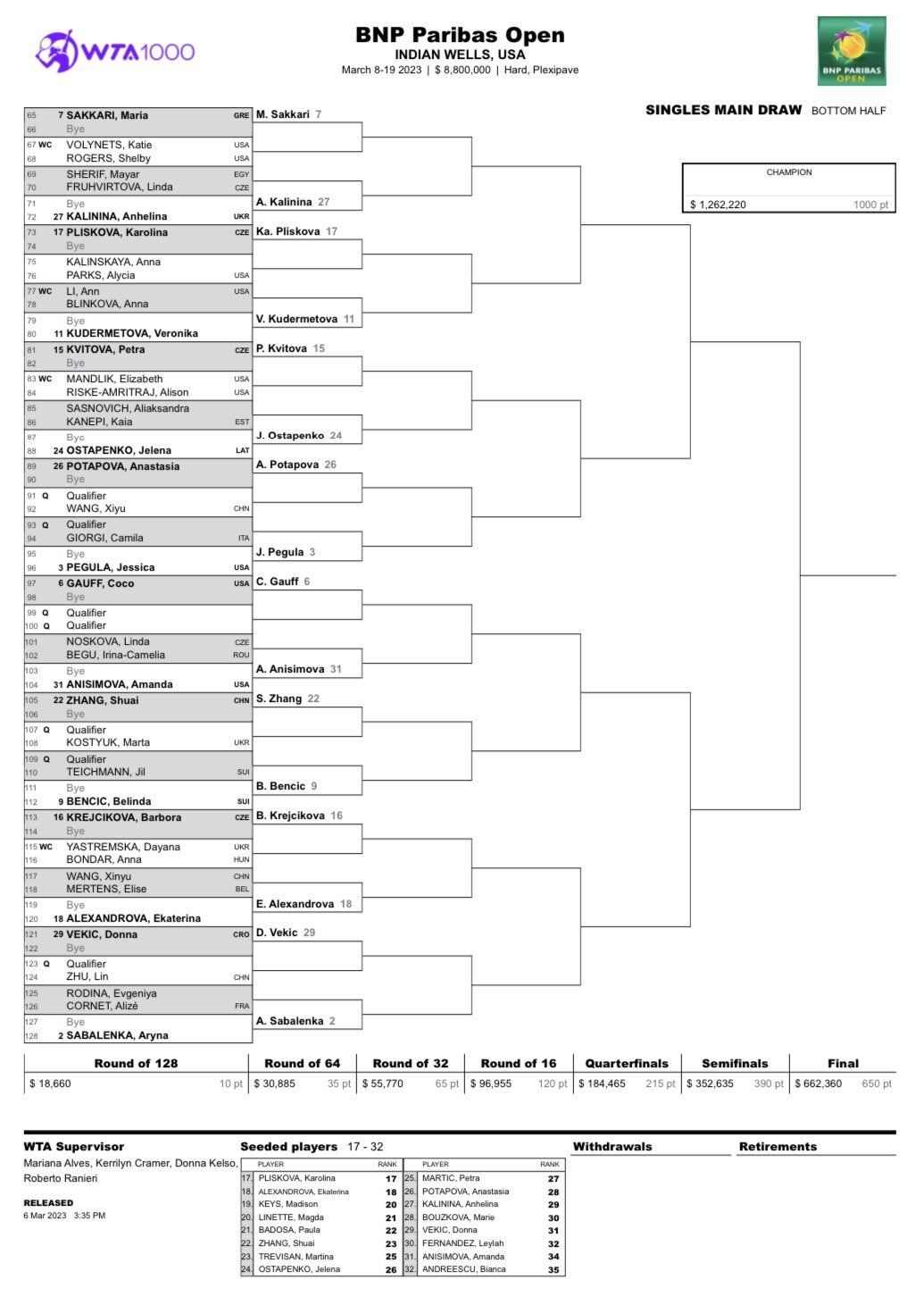

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025 -

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025 -

Wta 1000 Dubai Paolini Y Pegula Fuera De Competencia

Apr 27, 2025

Wta 1000 Dubai Paolini Y Pegula Fuera De Competencia

Apr 27, 2025