AbbVie (ABBV): Exceeding Expectations - Revised Profit Guidance Highlights Success

Table of Contents

Strong Performance of Key Drugs Driving Revenue Growth

AbbVie's revenue surge is largely attributable to the exceptional performance of its blockbuster drugs. Humira, Rinvoq, and Skyrizi have significantly contributed to the company's impressive financial figures. These pharmaceutical sales powerhouses continue to dominate their respective markets, fueling significant revenue growth.

- Humira Sales: Despite facing increased generic competition, Humira continues to generate substantial revenue, showcasing its enduring market dominance and strong brand loyalty. (Note: Insert specific sales figures or percentage increases here if available, comparing to previous quarters or years. Include data on market share).

- Rinvoq Revenue: Rinvoq's revenue has shown impressive growth, solidifying its position as a key contributor to AbbVie's overall performance. (Note: Insert specific sales figures or percentage increases here if available, comparing to previous quarters or years. Include data on market share).

- Skyrizi Performance: Skyrizi continues to demonstrate strong performance, expanding its market share and exceeding expectations. (Note: Insert specific sales figures or percentage increases here if available, comparing to previous quarters or years. Include data on market share).

This exceptional performance highlights AbbVie's success in developing and marketing highly effective and sought-after pharmaceutical products. The continued success of these drugs, alongside any new product launches, will be crucial for maintaining future revenue growth.

Successful Execution of AbbVie's Strategic Initiatives

AbbVie's financial success isn't solely reliant on its blockbuster drugs. The company's strategic initiatives have played a crucial role in driving profitability and operational efficiency. Strategic acquisitions, investments in R&D, and cost-cutting measures have all contributed to the positive results.

- Strategic Acquisitions: (Note: Insert details on any recent successful acquisitions, highlighting their contribution to AbbVie's revenue or pipeline). This demonstrates AbbVie's ability to strategically expand its product portfolio and market reach.

- R&D Pipeline: AbbVie's robust R&D pipeline showcases a commitment to innovation, ensuring a steady stream of potential future blockbuster drugs. (Note: Mention specific examples of promising drugs in the pipeline and their potential market impact).

- Cost Optimization: AbbVie's commitment to cost optimization and operational efficiency has enhanced profitability without compromising innovation or product quality. (Note: Provide specific examples of cost-cutting measures and their positive impacts on the company's financials).

Revised Profit Guidance: Implications for Investors

The revised profit guidance paints a positive picture for investors. The increased earnings per share (EPS) and adjusted revenue expectations reflect the company's strong performance and future outlook. This upward revision suggests a strong belief in sustained growth.

- Increased EPS: (Note: Insert the specific increase in EPS projections). This directly impacts shareholder value and potential dividend payouts.

- Adjusted Revenue Expectations: (Note: Insert the specific increase in adjusted revenue expectations). This reinforces the overall positive financial outlook for AbbVie.

- Analyst Ratings and Predictions: (Note: Mention any relevant analyst ratings and predictions following the revised guidance, providing context for investor confidence).

The revised profit guidance significantly impacts the stock price forecast, making AbbVie (ABBV) an attractive proposition for investors looking for growth opportunities within the pharmaceutical investment sector. The increased market capitalization and potential dividend yield further enhance its appeal.

Risks and Challenges Facing AbbVie in the Future

While the outlook is positive, it is essential to acknowledge potential risks and challenges. AbbVie faces the typical challenges of the pharmaceutical industry, including patent expirations, intense generic competition, and the complexities of regulatory approvals.

- Patent Cliff: The eventual patent expiry of key drugs poses a risk to future revenue streams. AbbVie must effectively mitigate this risk through innovation and strategic planning.

- Generic Competition: The ever-present threat of generic competition requires AbbVie to continuously innovate and develop new products to maintain its market share.

- Regulatory Approvals: Securing regulatory approvals for new drugs can be a lengthy and complex process, creating uncertainty and potential delays in product launches.

Addressing these challenges through proactive strategies will be vital for AbbVie's continued success and sustained long-term growth.

Conclusion: Investing in AbbVie (ABBV): A Strong Performer

AbbVie's strong financial performance, driven by the exceptional success of its key drugs and effective strategic initiatives, has led to a significantly revised profit guidance. This positive outlook presents compelling opportunities for investors seeking exposure to the pharmaceutical sector. The implications for investors are positive, with increased EPS, adjusted revenue expectations, and a potentially higher stock price. Consider adding AbbVie (ABBV) to your investment portfolio, backed by its strong performance and revised profit guidance, but always conduct thorough due diligence before investing and consult with a financial advisor. AbbVie's commitment to innovation and strategic management positions it favorably for continued long-term growth, making it a potentially profitable investment.

Featured Posts

-

Thaksins Political Comeback And Its Impact On Us Thai Trade Agreements

Apr 26, 2025

Thaksins Political Comeback And Its Impact On Us Thai Trade Agreements

Apr 26, 2025 -

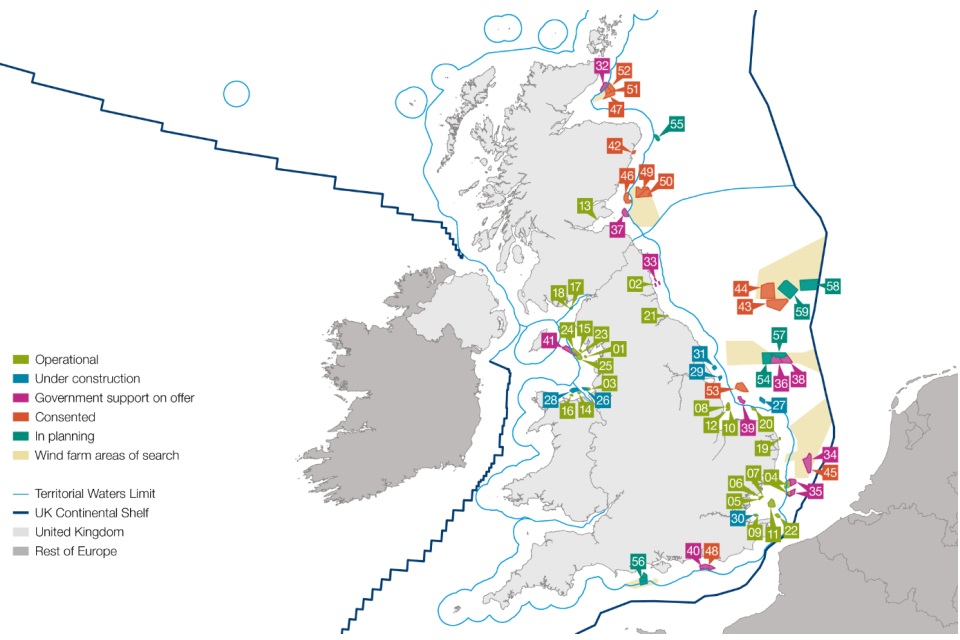

Vestas Investment Warning Proposed Uk Wind Auction Changes Cause Concern

Apr 26, 2025

Vestas Investment Warning Proposed Uk Wind Auction Changes Cause Concern

Apr 26, 2025 -

Den Helder Doop Van Damens Nieuwste Combat Support Schip Voor De Koninklijke Marine

Apr 26, 2025

Den Helder Doop Van Damens Nieuwste Combat Support Schip Voor De Koninklijke Marine

Apr 26, 2025 -

Mission Impossible 7 Svalbard Filming Locations And Bts Footage

Apr 26, 2025

Mission Impossible 7 Svalbard Filming Locations And Bts Footage

Apr 26, 2025 -

20

Apr 26, 2025

20

Apr 26, 2025

Latest Posts

-

Charleston Tennis Pegula Triumphs Over Collins

Apr 27, 2025

Charleston Tennis Pegula Triumphs Over Collins

Apr 27, 2025 -

Charleston Open Pegula Upsets Defending Champion Collins

Apr 27, 2025

Charleston Open Pegula Upsets Defending Champion Collins

Apr 27, 2025 -

Pegulas Comeback Victory Over Collins In Charleston

Apr 27, 2025

Pegulas Comeback Victory Over Collins In Charleston

Apr 27, 2025 -

Charleston Open Pegula Upsets Collins In Thrilling Match

Apr 27, 2025

Charleston Open Pegula Upsets Collins In Thrilling Match

Apr 27, 2025 -

Pegula Rallies Past Collins To Win Charleston Title

Apr 27, 2025

Pegula Rallies Past Collins To Win Charleston Title

Apr 27, 2025