AAPL Stock: Crucial Price Levels And Future Predictions

Table of Contents

Analyzing Current AAPL Stock Price and Support/Resistance Levels

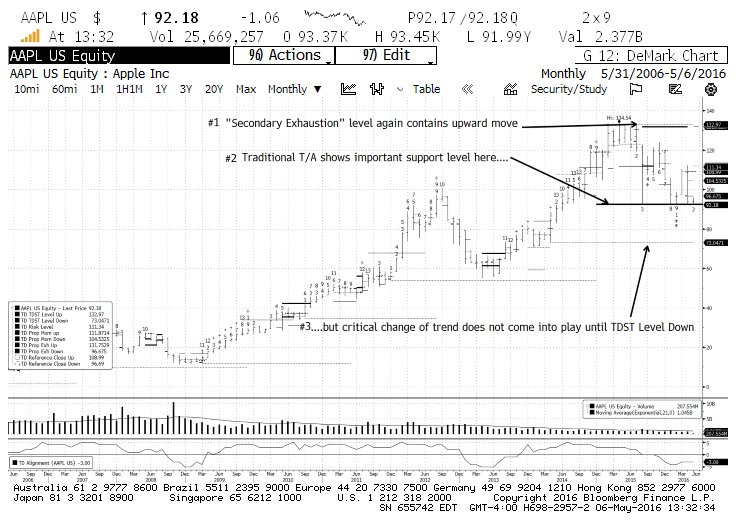

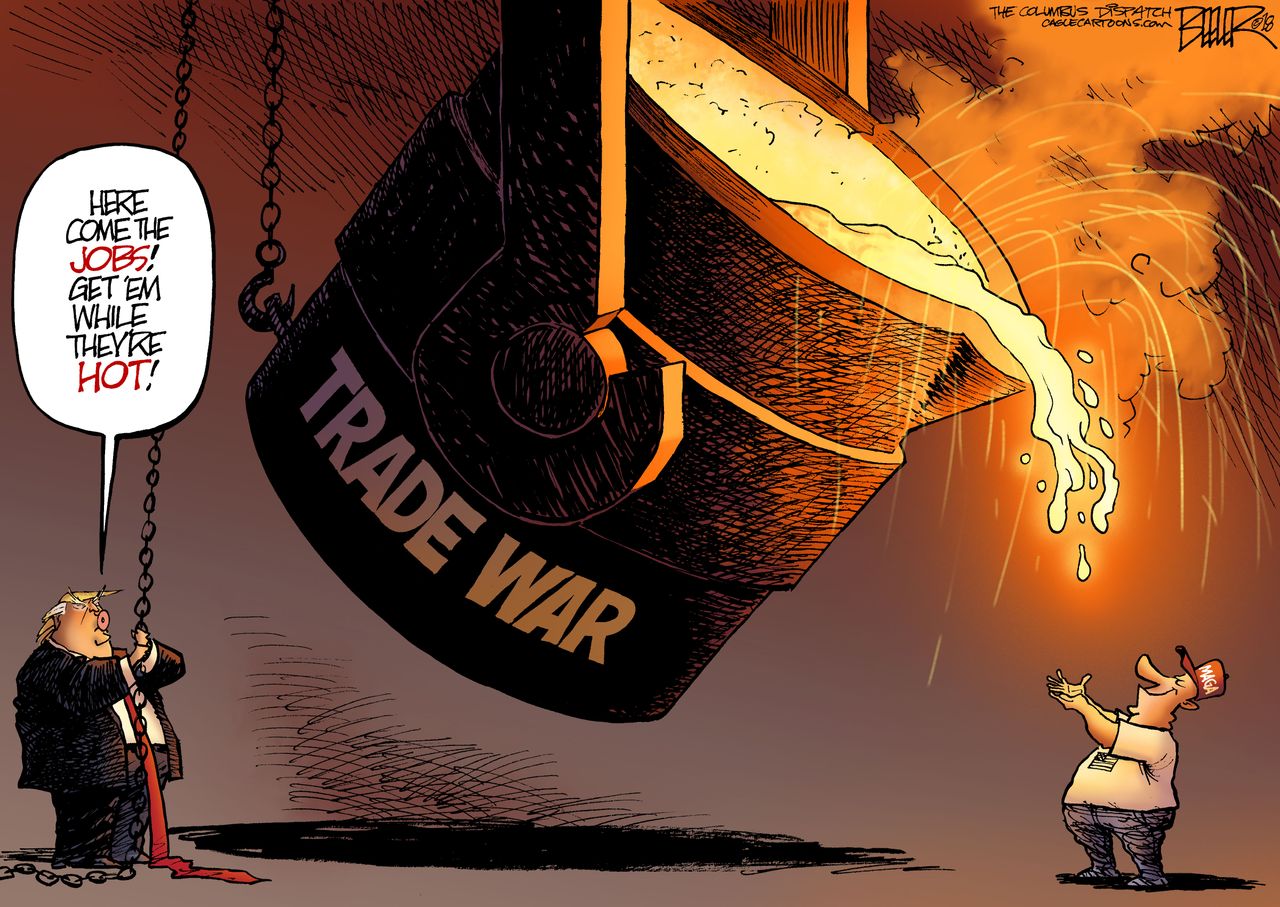

Understanding support and resistance levels is crucial for any AAPL stock investment strategy. These levels represent price points where the stock price has historically struggled to break through, either on the upside (resistance) or the downside (support). Identifying these levels can help you anticipate potential price movements and inform your buy or sell decisions.

Identifying Key Support Levels

Support levels act as a floor for the stock price. When the price falls to a support level, buying pressure often increases, preventing further declines. For AAPL stock, identifying these levels requires careful technical analysis.

- Technical Indicators: We can use various technical analysis indicators to identify key support levels. Moving averages (e.g., 50-day, 200-day) are commonly used. Fibonacci retracements can also identify potential support based on previous price swings.

- Historical Support: Examining AAPL's historical chart reveals previous instances where the price found support. These past support levels can often act as support again in the future. For example, a price level that held support multiple times in the past might be considered a significant support area.

- Chart Illustration: [Insert chart illustrating key AAPL support levels with clear labeling of moving averages, Fibonacci levels, and historical support points].

Identifying Key Resistance Levels

Resistance levels act as a ceiling for the stock price. When the price rises to a resistance level, selling pressure often increases, preventing further gains. For AAPL, identifying resistance levels is as critical as finding support.

- Technical Indicators: Moving averages, trendlines, and other technical tools are employed to spot resistance levels. A consistently unbroken trendline, for instance, represents strong resistance.

- Historical Resistance: Examining historical AAPL charts highlights previous resistance levels. These levels can act as hurdles for future price increases. Repeated failures to break through a certain price point suggests significant resistance.

- Chart Illustration: [Insert chart illustrating key AAPL resistance levels with clear labeling of moving averages, trendlines, and historical resistance points].

Factors Influencing Future AAPL Stock Performance

Predicting the future of AAPL stock hinges on understanding various factors that influence its price. These factors range from Apple's own product innovations to broader macroeconomic conditions.

Product Launches and Innovation

Apple's stock price is heavily influenced by its product launches and ongoing innovation. New iPhones, Macs, wearables, and services all directly impact revenue and investor sentiment.

- Upcoming Products: The anticipation and release of new products like the iPhone 15, new MacBooks, and updates to the Apple Watch series are significant events for AAPL stock. Positive reviews and strong initial sales can boost the stock price significantly.

- Historical Correlation: Historically, Apple's stock price has generally shown a positive correlation with successful new product releases. Innovative features and strong demand drive increased sales and profits, which positively affect stock prices.

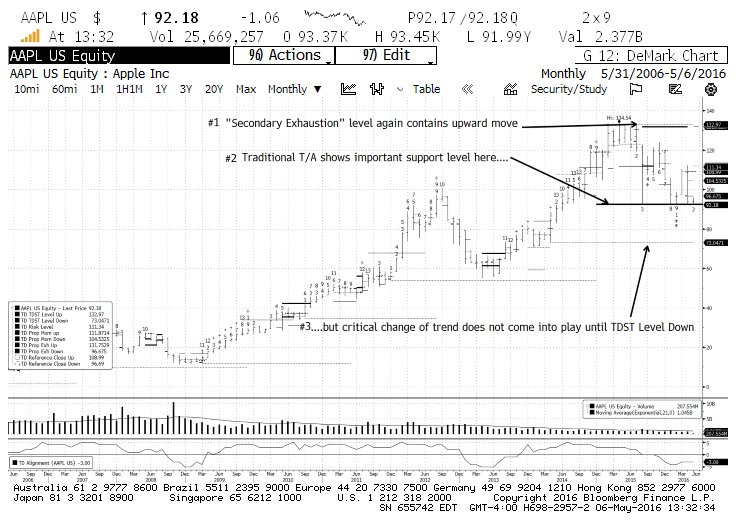

Global Economic Conditions and Market Sentiment

Macroeconomic factors play a major role in AAPL stock performance. Global economic downturns can negatively impact consumer spending and investor confidence, thereby influencing AAPL's stock price.

- Inflation and Interest Rates: High inflation and rising interest rates can dampen consumer spending and increase borrowing costs for businesses, potentially negatively impacting Apple's sales and profits. Conversely, lower inflation and interest rates can have the opposite effect.

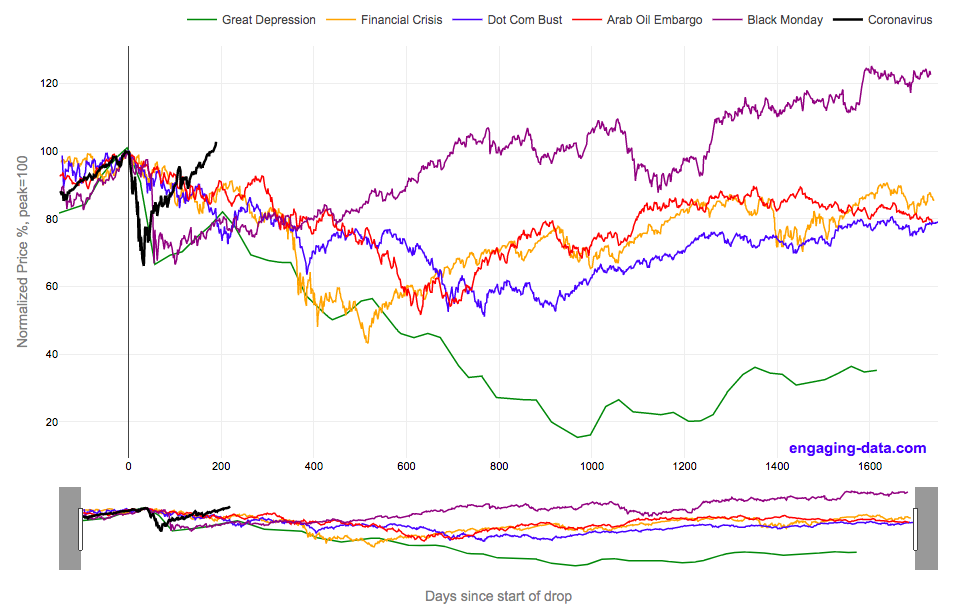

- Market Volatility and Geopolitical Events: Global uncertainties, such as geopolitical tensions and trade wars, create market volatility that impacts the stock price of even established companies like Apple.

Competition and Market Share

Apple faces stiff competition in various markets. Its market share and competitive position directly impact its stock performance.

- Key Competitors: Samsung in the smartphone market and Google in the mobile operating system and services space are Apple's primary competitors. The success or failure of competing products directly affects Apple's sales and market share.

- Market Share Dynamics: Maintaining or increasing market share is crucial for AAPL's continued growth. Loss of market share due to increased competition can put downward pressure on the stock price.

AAPL Stock Predictions and Investment Strategies

Predicting AAPL stock's future requires considering short-term price movements and long-term growth potential. Remember, these are not financial recommendations.

Short-Term Predictions

Based on current price levels and market analysis, short-term predictions for AAPL stock remain uncertain.

- Potential Price Targets: Short-term price targets should be based on technical analysis, considering support and resistance levels. However, these predictions are subject to significant fluctuations due to market volatility.

- Uncertainty: Short-term predictions for AAPL stock, or any stock for that matter, are inherently speculative.

Long-Term Outlook for AAPL Stock

Apple's long-term growth prospects appear strong due to its diversified business model, continued innovation, and expanding services revenue.

- Factors for Growth: Apple's robust ecosystem, strong brand loyalty, and expansion into new service areas (like Apple TV+ and Apple Music) contribute to its long-term growth.

- Long-Term Perspective: While risks remain, Apple's consistent innovation and strong brand position suggest continued long-term growth potential.

Diversification and Risk Management

It's crucial to diversify your investment portfolio and implement appropriate risk management strategies.

- Risk Mitigation: Don't put all your eggs in one basket. Diversifying your investment portfolio across different asset classes can reduce risk associated with AAPL stock fluctuations.

- Financial Advisor: Always consult with a qualified financial advisor before making any significant investment decisions.

Conclusion

This article has analyzed crucial price levels and attempted to offer insights into future predictions for AAPL stock. While predicting the future of any stock is inherently uncertain, understanding support and resistance levels, coupled with a thorough analysis of influencing factors, can significantly improve your investment decision-making process. Remember to always conduct your own research and consider consulting a financial advisor before investing in AAPL stock or any other security. Don’t hesitate to regularly revisit our analysis of AAPL stock to stay updated on crucial price levels and the latest predictions. Make informed decisions regarding your AAPL stock investments.

Featured Posts

-

Significant Stock Market Drop In Amsterdam 7 Decline Due To Trade War

May 25, 2025

Significant Stock Market Drop In Amsterdam 7 Decline Due To Trade War

May 25, 2025 -

Naujas Porsche Elektromobiliu Ikrovimo Centras Europoje Patogumas Ir Greitis

May 25, 2025

Naujas Porsche Elektromobiliu Ikrovimo Centras Europoje Patogumas Ir Greitis

May 25, 2025 -

Mamma Mia The Hottest New Ferrari Hot Wheels Cars

May 25, 2025

Mamma Mia The Hottest New Ferrari Hot Wheels Cars

May 25, 2025 -

M56 Motorway Closed Due To Accident Real Time Traffic And Travel News

May 25, 2025

M56 Motorway Closed Due To Accident Real Time Traffic And Travel News

May 25, 2025 -

Pameran Seni Dan Mobil Klasik Porsche Indonesia Classic Art Week 2025

May 25, 2025

Pameran Seni Dan Mobil Klasik Porsche Indonesia Classic Art Week 2025

May 25, 2025

Latest Posts

-

Covid 19 Pandemic Lab Owners Guilty Plea For Falsified Test Results

May 25, 2025

Covid 19 Pandemic Lab Owners Guilty Plea For Falsified Test Results

May 25, 2025 -

Why Did Trump Target Europe In His Trade Battles A Deep Dive

May 25, 2025

Why Did Trump Target Europe In His Trade Battles A Deep Dive

May 25, 2025 -

Trumps Trade War With Europe Understanding The Reasons Behind His Outrage

May 25, 2025

Trumps Trade War With Europe Understanding The Reasons Behind His Outrage

May 25, 2025 -

Rowing For A Sons Life One Fathers 2 2 Million Challenge

May 25, 2025

Rowing For A Sons Life One Fathers 2 2 Million Challenge

May 25, 2025 -

2 2 Million Treatment A Fathers Perseverance And Rowing Feat

May 25, 2025

2 2 Million Treatment A Fathers Perseverance And Rowing Feat

May 25, 2025