A Costly Childcare Choice: $3K Babysitter Leads To $3.6K Daycare Bill

Table of Contents

The Initial Babysitter Situation: A Seemingly Affordable Option

Initially, the family opted for a private babysitter at $3,000 per month. This seemed like a cost-effective solution compared to the high daycare costs in their area. The perceived advantages were significant: flexibility to accommodate their work schedules, personalized care tailored to their child's needs, and the potential for a stronger bond between the child and caregiver.

- Initial cost savings: The family initially projected significant savings compared to local daycare centers averaging $2,500-$4,000 per month.

- Benefits of one-on-one care: The dedicated attention and individualized learning environment offered by a babysitter were appealing.

- Overlooked drawbacks: What they hadn't fully considered were the potential drawbacks. There was less structure and fewer learning opportunities compared to a licensed daycare, and the risk of inconsistency due to illness or personal emergencies with the babysitter. This lack of backup plan proved to be costly.

The Unexpected Daycare Bill: Unforeseen Circumstances and Hidden Costs

The family's carefully laid childcare budget was shattered when the babysitter fell ill unexpectedly. This forced them to scramble for emergency daycare, a situation made more expensive by:

- Higher hourly/daily rates: Emergency daycare services often charge significantly higher hourly or daily rates than long-term arrangements.

- Unexpected fees: They encountered additional charges like registration fees and late pick-up penalties, adding considerably to the overall expense.

The resulting $3,600 daycare bill for a single month underscores the unpredictable nature of childcare expenses and the importance of planning for contingencies. The initial seemingly affordable $3,000 babysitter option ultimately proved to be much more costly due to unforeseen circumstances.

Navigating the High Cost of Childcare: Budgeting and Planning Strategies

Managing childcare costs requires proactive planning and strategic budgeting. Here's how to approach it:

- Create a realistic childcare budget: Factor in not only the base cost but also potential extra expenses like sick days, vacation coverage, and unexpected fees.

- Research different childcare providers: Compare costs across various options, including daycare centers, in-home daycare, nannies, and family assistance. Consider location, hours of operation, and the level of care provided.

- Explore subsidies and financial assistance programs: Many states and local governments offer subsidies or financial assistance to help families afford childcare. Investigate these options to potentially reduce your financial burden.

- Negotiate rates with providers: Don't be afraid to negotiate rates, especially if you're signing a long-term contract or enrolling multiple children.

- Utilize childcare cost calculators: Many online resources offer childcare cost calculators to estimate expenses in your area.

Long-Term Financial Planning for Childcare Expenses

The financial impact of childcare extends far beyond the monthly bill. Long-term planning is crucial:

- Saving for childcare expenses in advance: Begin saving as early as possible to create a dedicated childcare fund.

- Adjusting family budget to accommodate childcare costs: Integrate childcare expenses into your overall budget, prioritizing this essential expense.

- Exploring flexible work arrangements: Consider flexible work options like telecommuting or part-time work to potentially reduce the need for full-time, expensive childcare.

- Considering the trade-offs between career and childcare costs: Weigh the financial implications of your career choices against the cost of childcare to make informed decisions.

Conclusion: Making Informed Choices About Costly Childcare

The unpredictable nature of childcare costs, as illustrated by the initial $3,000 babysitter leading to a $3,600 daycare bill, underscores the importance of thorough planning. A seemingly affordable childcare choice can quickly escalate into a significant financial burden if unforeseen circumstances arise. Don't let a costly childcare choice catch you off guard. Plan ahead, research your options thoroughly, and explore available subsidies and financial assistance programs to secure affordable and reliable care for your child. Start by using a childcare cost calculator and researching your local childcare options today! [Link to childcare cost calculator] [Link to local resources for childcare assistance].

Featured Posts

-

Jeanine Pirros Biography Exploring Her Education Net Worth And Legal Achievements

May 09, 2025

Jeanine Pirros Biography Exploring Her Education Net Worth And Legal Achievements

May 09, 2025 -

Office365 Security Breach Leads To Multi Million Dollar Loss

May 09, 2025

Office365 Security Breach Leads To Multi Million Dollar Loss

May 09, 2025 -

France And Poland To Formalize Friendship Treaty In Upcoming Month

May 09, 2025

France And Poland To Formalize Friendship Treaty In Upcoming Month

May 09, 2025 -

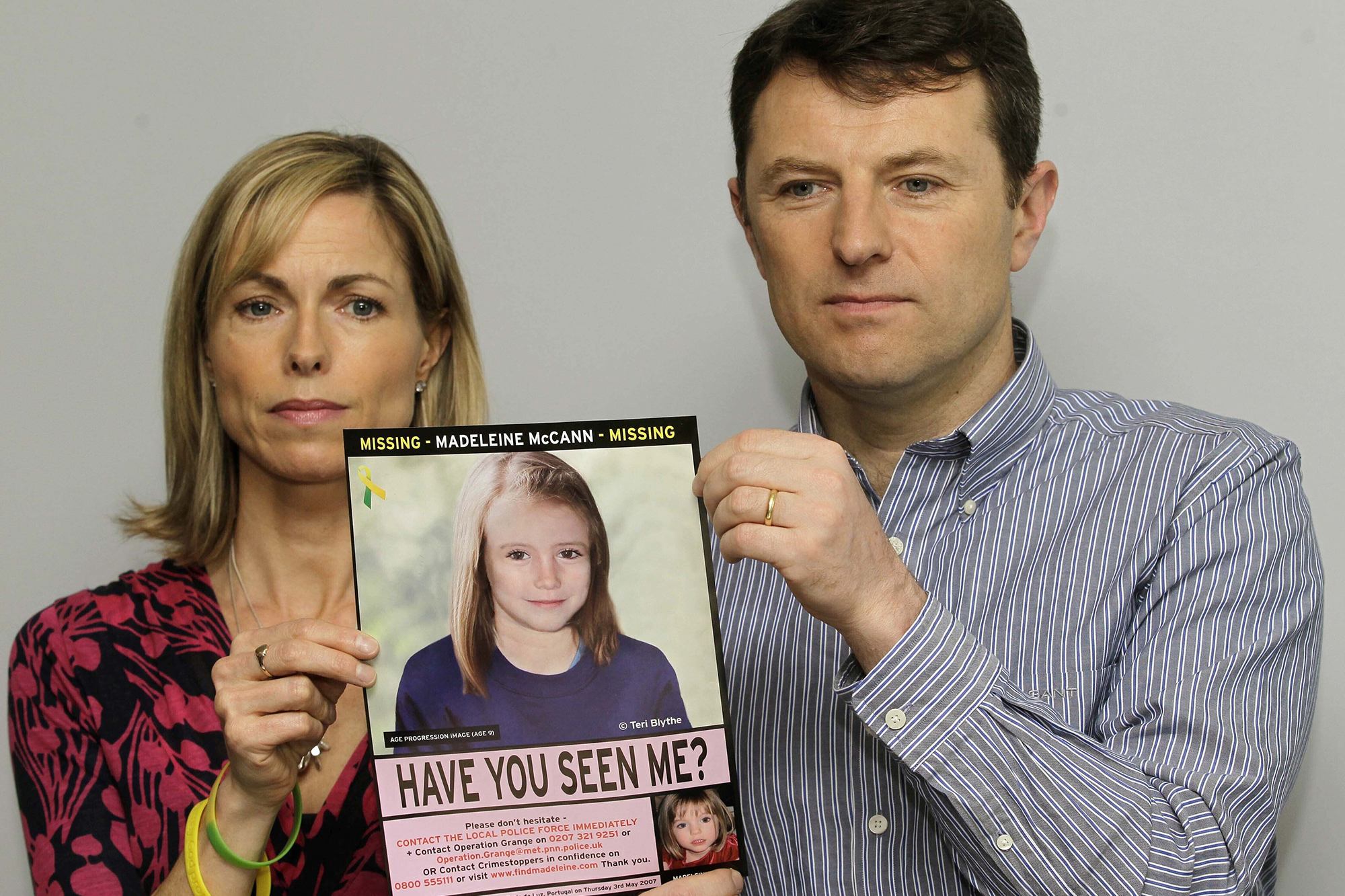

Madeleine Mc Cann Case New Dna Evidence And A 23 Year Olds Claim

May 09, 2025

Madeleine Mc Cann Case New Dna Evidence And A 23 Year Olds Claim

May 09, 2025 -

Abrz Njwm Krt Alqdm Aldhyn Kanwa Mdkhnyn Drast Fy Tathyr Altdkhyn Ela Aladae Alryady

May 09, 2025

Abrz Njwm Krt Alqdm Aldhyn Kanwa Mdkhnyn Drast Fy Tathyr Altdkhyn Ela Aladae Alryady

May 09, 2025