$9 Billion Budget Boost: Australia's Opposition Unveils Economic Plan

Table of Contents

Australia's political landscape is buzzing with the announcement of a substantial $9 billion budget boost proposed by the Opposition. This ambitious economic plan promises to address key issues facing the nation, sparking debate and anticipation ahead of the upcoming elections. This article delves into the details of this significant proposal, examining its core components and potential consequences for the Australian economy.

Key Pillars of the $9 Billion Economic Plan

The Opposition's $9 billion economic plan rests on three main pillars: cost of living relief, substantial infrastructure investment, and targeted tax reforms. These interconnected strategies aim to stimulate economic growth, create jobs, and improve the overall well-being of Australians.

-

Cost of Living Relief: The plan prioritizes easing the burden on households grappling with rising living expenses. Specific measures include:

- Targeted Tax Cuts: Significant tax relief for low- and middle-income earners, aiming to boost disposable income and stimulate consumer spending. This includes adjustments to tax brackets and potential increases to the low-income tax offset. Keywords: cost of living, tax relief, tax cuts, disposable income.

- Energy Bill Subsidies: Direct subsidies to help households manage soaring energy costs, particularly electricity and gas. This could involve rebates, tax credits, or direct payments. Keywords: energy subsidies, energy bill relief, cost of living crisis.

-

Infrastructure Investment: A significant portion of the $9 billion is earmarked for crucial infrastructure projects designed to boost productivity and create jobs. This includes:

- Transport Infrastructure: Investment in upgrading roads, railways, and public transport systems across the country, focusing on efficiency and reducing congestion. Keywords: infrastructure investment, transport infrastructure, road upgrades, railway improvements.

- Renewable Energy Projects: Funding for renewable energy initiatives, including solar farms, wind farms, and smart grid technologies, to create jobs in the burgeoning green economy and contribute to a more sustainable future. Keywords: renewable energy projects, green energy jobs, sustainable infrastructure.

-

Tax Reforms: The plan proposes several tax reforms aimed at fostering business investment and economic growth. These include:

- Corporate Tax Adjustments: Potential adjustments to corporate tax rates to incentivize business investment and job creation. Keywords: corporate tax, tax reform, business investment.

- Capital Gains Tax Review: A review of the current capital gains tax system to ensure its fairness and effectiveness. Keywords: capital gains tax, tax reform, investment incentives.

Potential Economic Impact of the $9 Billion Boost

The $9 billion budget boost holds both potential benefits and risks for the Australian economy.

-

Positive Impacts:

- Job Creation and Economic Growth: The infrastructure investment and tax cuts are expected to generate significant job creation and stimulate economic growth, leading to an increase in GDP. Keywords: economic growth, job creation, GDP growth, economic stimulus.

- Improved Living Standards: Cost of living relief measures will directly improve the living standards of many Australians, boosting consumer confidence and spending. Keywords: living standards, consumer confidence, economic wellbeing.

-

Potential Negative Impacts:

- Inflationary Pressures: The significant injection of funds into the economy could potentially exacerbate existing inflationary pressures, leading to increased interest rates. Keywords: inflation, interest rates, economic stability, monetary policy.

- Budget Sustainability Concerns: Critics may raise concerns about the long-term sustainability of the plan and its potential impact on the national debt. Keywords: fiscal responsibility, budget sustainability, national debt.

Political Implications and Public Reaction

The Opposition's $9 billion economic plan has significant political implications and has garnered considerable public and expert attention.

- Public Opinion and Media Coverage: Initial public opinion polls suggest a positive response to the plan's cost of living relief measures, although the long-term impact and potential inflationary pressures remain key concerns. Media coverage has been extensive, with varying perspectives on the plan's feasibility and effectiveness. Keywords: public opinion, media coverage, political analysis, public response.

- Expert Reactions: Economists and industry experts have offered mixed reactions, with some praising the plan's potential to stimulate growth while others warn of potential risks to economic stability. The debate centers around the balance between short-term relief and long-term fiscal responsibility. Keywords: economic analysis, expert opinion, industry response, economic forecasts.

- Comparison to Government Policies: The Opposition's plan is being contrasted with the current government's economic policies, highlighting key differences in approach and priorities. This comparison is crucial in shaping public debate and influencing voter choices in the upcoming election. Keywords: government policy, economic comparison, policy differences, political debate.

Conclusion

The Opposition's $9 billion budget boost represents a significant intervention in the Australian economy, promising relief for struggling households and investment in crucial infrastructure. The plan's success will hinge on its ability to stimulate economic growth while managing potential inflationary pressures and ensuring long-term fiscal responsibility. The political ramifications are substantial, and public reaction will undoubtedly shape the upcoming election.

Call to Action: Stay informed on the latest developments regarding this crucial $9 billion budget boost and its potential impact on the Australian economy. Continue to follow our coverage for in-depth analysis and expert commentary on the Opposition's economic plan and the government's response. Learn more about the specifics of the $9 billion economic plan by [link to further resources].

Featured Posts

-

Fortnite Update 34 20 Server Downtime And Whats New Is Fortnite Down

May 02, 2025

Fortnite Update 34 20 Server Downtime And Whats New Is Fortnite Down

May 02, 2025 -

Popular Indigenous Arts Festival Cancelled Due To Economic Recession

May 02, 2025

Popular Indigenous Arts Festival Cancelled Due To Economic Recession

May 02, 2025 -

Fortnite Refund Signals Potential Cosmetic Changes

May 02, 2025

Fortnite Refund Signals Potential Cosmetic Changes

May 02, 2025 -

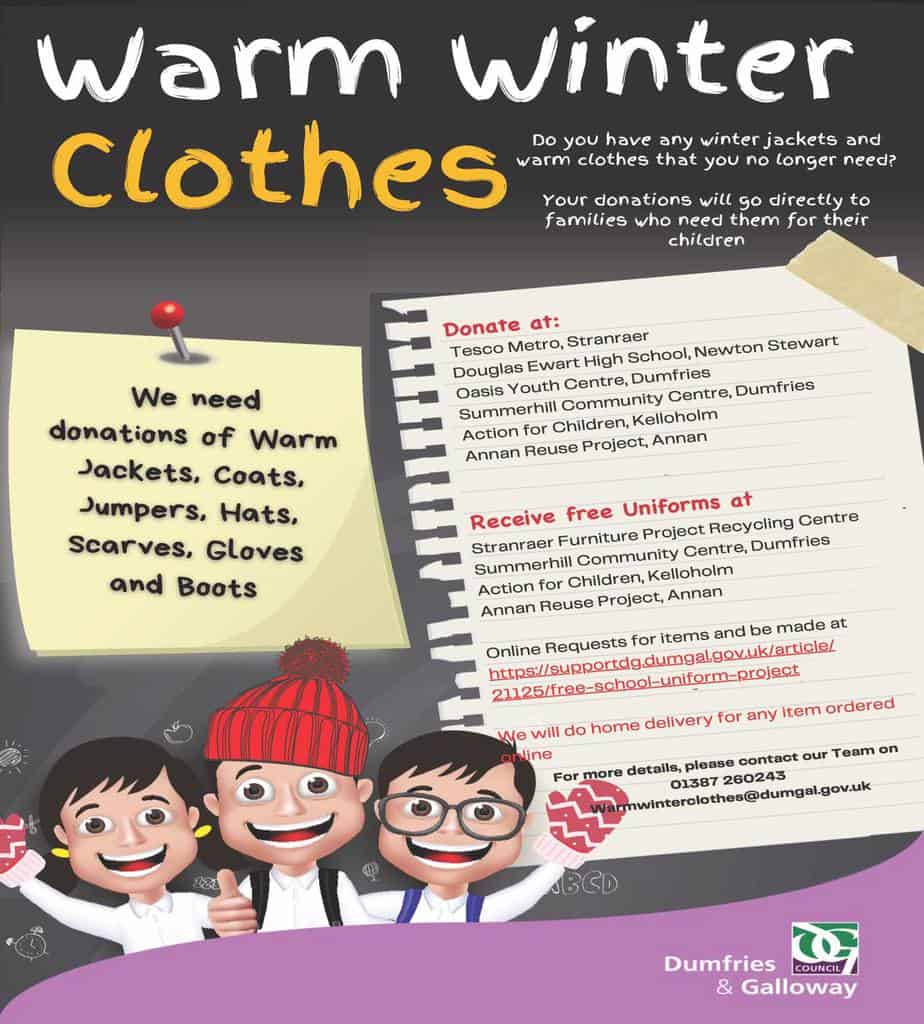

Help Tulsas Homeless This Winter Donate Warm Clothes To The Day Center

May 02, 2025

Help Tulsas Homeless This Winter Donate Warm Clothes To The Day Center

May 02, 2025 -

April 16 2025 Lotto Results Winning Numbers

May 02, 2025

April 16 2025 Lotto Results Winning Numbers

May 02, 2025