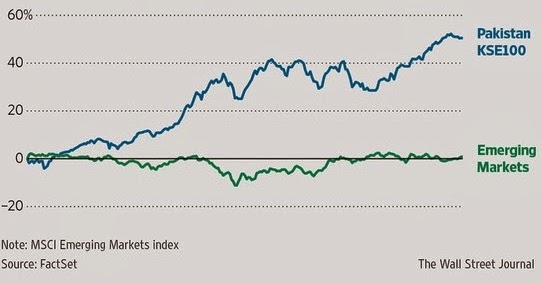

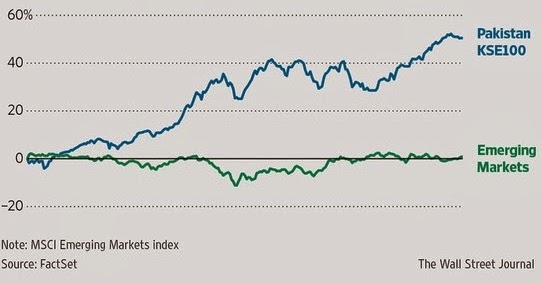

6% Market Crash: Operation Sindoor Shakes Pakistan's KSE 100

Table of Contents

Operation Sindoor: Unveiling the Cause of the Market Shakeup

What is Operation Sindoor?

Operation Sindoor, a recent crackdown on alleged illegal activities within the financial sector, is widely believed to be the primary catalyst for the KSE 100 crash. While the specifics of the operation remain somewhat opaque, reports suggest a focus on tackling stock market manipulation, insider trading, and other illicit practices. This crackdown, while aimed at improving market integrity and transparency, inadvertently triggered widespread panic selling, leading to the sharp decline in the KSE 100 index. Understanding the Operation Sindoor details is crucial to grasping the full extent of its impact on the PSX. Keywords like Operation Sindoor details, crackdown on illegal activities, stock market manipulation help illuminate the situation.

The Ripple Effect

Operation Sindoor's impact extended far beyond the immediate suspects. Its actions created a ripple effect across various sectors of the Pakistani economy.

- Specific Sectors Affected: The banking, construction, and energy sectors were particularly hard hit, experiencing significant declines in their stock valuations.

- Companies Experiencing Significant Losses: Several prominent companies listed on the KSE 100 suffered substantial losses, impacting investor portfolios and eroding confidence.

- Domino Effect on Related Industries: The downturn in these key sectors triggered a domino effect, impacting related industries and further exacerbating the overall market decline. Analyzing the sectoral impact, economic consequences, and KSE 100 index components reveals the interconnected nature of this crisis.

Investor Sentiment and Market Volatility Following the Crash

Investor Confidence Eroded

The KSE 100 crash severely eroded investor confidence, both domestically and internationally.

- Panic Selling: The sudden and sharp drop triggered widespread panic selling, as investors rushed to offload their holdings to minimize losses.

- Decline in Foreign Investment: Foreign portfolio investment, already fragile, experienced a further decline, exacerbating the downward pressure on the KSE 100.

- Psychological Impact on Investors: The crash had a significant psychological impact on investors, creating uncertainty and hesitancy regarding future investments in the Pakistani market. This negative investor sentiment, market panic, and decreased foreign portfolio investment all contributed to the volatility.

Government Response and Regulatory Measures

In response to the crisis, the Pakistani government implemented several measures aimed at stabilizing the market and restoring investor confidence.

- Specific Measures Implemented: These included policy changes designed to address market manipulation and enhance regulatory oversight. Specific regulatory announcements aimed at boosting confidence were also made.

- Effectiveness of Measures: The effectiveness of these measures remains to be seen, as the market continues to exhibit volatility.

- Future Regulatory Changes: The government has signaled its intention to implement further regulatory changes to prevent similar occurrences in the future. The government intervention, regulatory response, and market stabilization efforts will be crucial for the market's recovery.

Analyzing the Long-Term Implications of the KSE 100 Crash

Economic Growth Projections

The KSE 100 crash casts a shadow over Pakistan's economic growth projections. The short-term impact is likely to be a slowdown in economic activity, while the long-term consequences depend heavily on the success of the government's recovery efforts. The impact on GDP growth, economic outlook, and long-term economic impact needs close monitoring.

Rebuilding Investor Trust

Rebuilding investor trust and attracting foreign investment back to the KSE 100 will be crucial for Pakistan's economic recovery. This requires a multifaceted approach. Strategies need to focus on transparency, improved regulatory frameworks, and a commitment to tackling corruption. Success in restoring investor confidence recovery, attracting foreign investment, and implementing market recovery strategies is vital for the PSX's future.

Conclusion: Navigating the Aftermath of the KSE 100 Crash and Operation Sindoor's Impact

The 6% plunge in the KSE 100 index, largely attributed to Operation Sindoor, represents a significant setback for the Pakistani economy. The crash severely impacted investor sentiment, triggering panic selling and a decline in foreign investment. The government's response and subsequent regulatory measures will be key determinants of the market's recovery trajectory. Understanding the ongoing implications of Operation Sindoor and the market's volatility is crucial. Stay informed about KSE 100 updates and market analysis to navigate this period of uncertainty. The road to recovery requires sustained effort to rebuild investor confidence and ensure the long-term stability of the Pakistan stock market. Keep monitoring KSE 100 updates, market analysis, and Pakistan stock market recovery developments closely.

Featured Posts

-

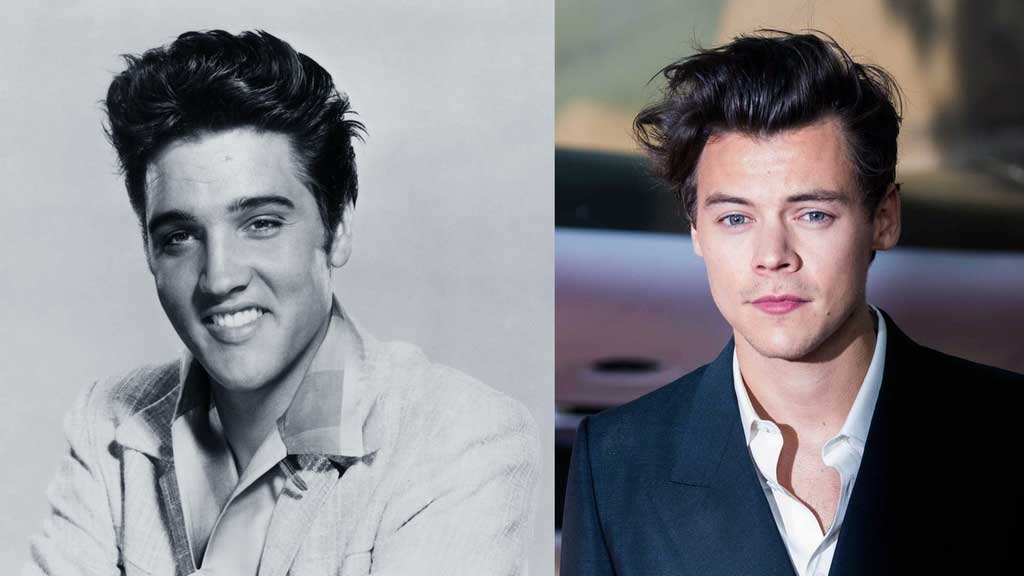

Snls Impression Of Harry Styles The Singers Disappointed Response

May 09, 2025

Snls Impression Of Harry Styles The Singers Disappointed Response

May 09, 2025 -

The Epstein Client List Ag Pam Bondis Claims And Their Implications

May 09, 2025

The Epstein Client List Ag Pam Bondis Claims And Their Implications

May 09, 2025 -

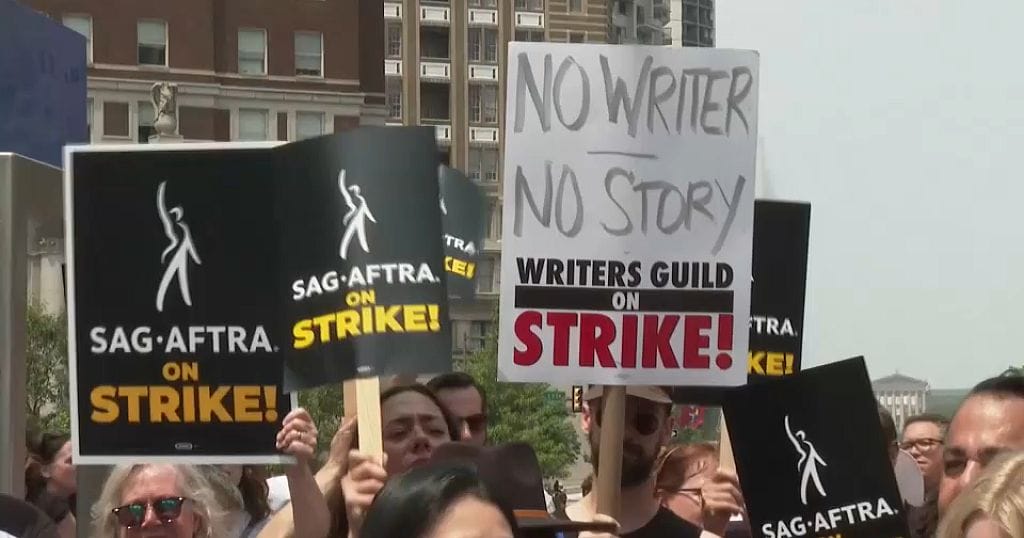

The Impact Of The Dual Hollywood Strike Actors And Writers Unite

May 09, 2025

The Impact Of The Dual Hollywood Strike Actors And Writers Unite

May 09, 2025 -

Apple At A Crossroads The Future Of Ai And Its Impact

May 09, 2025

Apple At A Crossroads The Future Of Ai And Its Impact

May 09, 2025 -

Municipales Dijon 2026 Le Projet Ecologiste

May 09, 2025

Municipales Dijon 2026 Le Projet Ecologiste

May 09, 2025