5 Steps To Success: Do's And Don'ts For Private Credit Job Applications

Table of Contents

Step 1: Tailoring Your Resume and Cover Letter for Private Credit Roles

Your resume and cover letter are your first impression – make it count! These documents must clearly demonstrate your suitability for private credit jobs.

Highlighting Relevant Skills and Experience

Your resume needs to be more than a chronological list of your work history. It should showcase your qualifications for private credit roles.

- Quantifiable Achievements: Instead of simply stating your responsibilities, quantify your accomplishments. For example, instead of "Managed a portfolio of loans," write "Managed a $50 million portfolio of loans, resulting in a 15% reduction in non-performing assets."

- Relevant Keywords: Incorporate keywords from the job description, such as financial modeling, underwriting, due diligence, credit analysis, portfolio management, leveraged finance, distressed debt, and private debt.

- Software Proficiency: Mention any relevant software expertise, including Bloomberg Terminal, Argus, Bloomberg AIM, and other financial modeling tools.

- Market Understanding: Demonstrate a clear understanding of private credit markets, investment strategies (e.g., direct lending, mezzanine financing), and current market trends.

Crafting a Compelling Cover Letter

Your cover letter should go beyond simply summarizing your resume. It's your chance to connect your experiences to the specific requirements of the private credit job and highlight your passion.

- Passion for Private Credit: Express your genuine interest in private credit and the specific firm you're applying to.

- Career Trajectory: Explain your career path and how it has led you to this specific opportunity.

- Connecting Experiences: Clearly connect your past experiences to the specific requirements and responsibilities outlined in the job description.

- Company Research: Demonstrate that you've researched the company's investment strategy, recent deals, and culture.

- Strong Call to Action: End with a confident and persuasive call to action, reiterating your interest and enthusiasm.

Step 2: Mastering the Private Credit Interview Process

The interview stage is crucial. You need to demonstrate both technical proficiency and strong interpersonal skills.

Preparing for Behavioral Questions

Behavioral questions assess your soft skills and how you've handled past situations. Prepare using the STAR method (Situation, Task, Action, Result).

- STAR Method Examples: Practice using the STAR method to answer questions about teamwork, problem-solving, conflict resolution, and handling pressure.

- Weaknesses and Failures: Prepare thoughtful answers about your weaknesses, focusing on areas you're actively working to improve. Frame past failures as learning experiences.

- Practice: Practice answering common interview questions aloud to build confidence and refine your responses.

Demonstrating Technical Proficiency

Private credit interviews often involve technical assessments of your financial skills.

- Case Studies: Be prepared to analyze case studies involving financial statements, valuation, and credit analysis.

- Financial Statement Analysis: Demonstrate a deep understanding of financial statements (balance sheet, income statement, cash flow statement) and key financial ratios.

- Valuation Methodologies: Show your proficiency in various valuation methodologies, such as discounted cash flow (DCF) analysis, comparable company analysis, and precedent transactions.

- Credit Underwriting & Due Diligence: Explain your experience with credit underwriting, due diligence processes, and risk assessment.

Researching the Firm and Interviewers

Thorough research is key to a successful interview.

- Investment Strategy: Understand the firm's investment focus, target industries, and investment strategies.

- Interviewer Backgrounds: Research the interviewers' backgrounds and experience to tailor your responses and demonstrate shared interests.

- Intelligent Questions: Prepare insightful questions to ask the interviewers, demonstrating your interest and engagement.

Step 3: Networking Your Way to Success in Private Credit

Networking is essential for landing a private credit job.

Leveraging LinkedIn and Professional Networks

Utilize online platforms to connect with professionals in the field.

- LinkedIn Optimization: Optimize your LinkedIn profile with relevant keywords, accomplishments, and a professional headshot.

- Connecting with Professionals: Connect with professionals in private credit, engaging with their posts and sharing relevant content.

- Relevant Groups: Join relevant LinkedIn groups and participate in discussions to expand your network.

- Industry News: Follow industry news and thought leaders to stay informed and contribute to conversations.

Attending Industry Conferences and Events

Networking in person is invaluable.

- Networking Opportunities: Attend industry conferences and events to network with recruiters and hiring managers.

- Learning about Opportunities: Learn about new opportunities and gain insights into the private credit landscape.

- Building Relationships: Build relationships with potential colleagues and mentors.

Informational Interviews

Reach out to professionals for advice and insights.

- Seeking Advice: Contact professionals in private credit for informational interviews to learn about their experiences and gain valuable industry knowledge.

- Relationship Building: Use informational interviews to build relationships and expand your network.

- Gaining Knowledge: Gather insights into specific firms, roles, and career paths.

Step 4: Negotiating Your Private Credit Job Offer

Once you've received a job offer, be prepared to negotiate.

Understanding Your Market Value

Know your worth before entering negotiations.

- Salary Research: Research salary ranges for similar private credit roles in your location and with your experience level.

- Benefits and Perks: Consider the overall compensation package, including benefits, bonuses, and perks.

- Total Compensation: Assess the total compensation package to determine its value.

Presenting Your Case Confidently

Negotiate strategically while maintaining professionalism.

- Highlighting Skills: Clearly articulate your skills, experience, and the value you bring to the firm.

- Expressing Enthusiasm: Express your enthusiasm for the opportunity while demonstrating confidence in your abilities.

- Strategic Negotiation: Negotiate salary, benefits, and other aspects of the offer strategically, knowing your bottom line.

- Knowing Your Bottom Line: Determine your minimum acceptable offer before entering negotiations.

Step 5: Common Mistakes to Avoid in Private Credit Job Applications

Avoid these pitfalls to significantly improve your chances of success.

Resume and Cover Letter Don'ts

- Generic Applications: Avoid generic resumes and cover letters – tailor each application to the specific job and company.

- Typos and Errors: Proofread carefully to eliminate typos and grammatical errors.

- Lack of Quantification: Quantify your achievements to demonstrate the impact of your contributions.

- Omitting Relevant Skills: Ensure your resume and cover letter highlight all relevant skills and experiences.

Interview Don'ts

- Lack of Preparation: Thorough preparation is crucial for a successful interview.

- Poor Communication: Practice clear and concise communication to convey your ideas effectively.

- Negative Comments: Avoid making negative comments about previous employers or experiences.

- Failing to Ask Questions: Prepare insightful questions to demonstrate your interest and engagement.

Conclusion: Securing Your Future in Private Credit

Landing your dream private credit job requires a strategic approach. By tailoring your application materials, mastering the interview process, networking effectively, negotiating confidently, and avoiding common mistakes, you significantly increase your chances of success. Start implementing these five steps today to boost your chances of securing your dream private credit job! Don't let another private credit job application slip away – use this guide to make your application stand out!

Featured Posts

-

Hollywood Nepotism Debate Amanda Seyfrieds Unfiltered Response

Apr 26, 2025

Hollywood Nepotism Debate Amanda Seyfrieds Unfiltered Response

Apr 26, 2025 -

Improved Services At Dong Duong Hotel Hue Thanks To Fusion

Apr 26, 2025

Improved Services At Dong Duong Hotel Hue Thanks To Fusion

Apr 26, 2025 -

Ftc To Challenge Court Ruling On Microsoft Activision Deal

Apr 26, 2025

Ftc To Challenge Court Ruling On Microsoft Activision Deal

Apr 26, 2025 -

Damens Nieuwe Combat Support Schip Een Mijlpaal Voor De Nederlandse Marine

Apr 26, 2025

Damens Nieuwe Combat Support Schip Een Mijlpaal Voor De Nederlandse Marine

Apr 26, 2025 -

Conflictul De La Santierul Naval Mangalia Sindicalistul Naval Cere Ajutorul Ambasadei Olandei

Apr 26, 2025

Conflictul De La Santierul Naval Mangalia Sindicalistul Naval Cere Ajutorul Ambasadei Olandei

Apr 26, 2025

Latest Posts

-

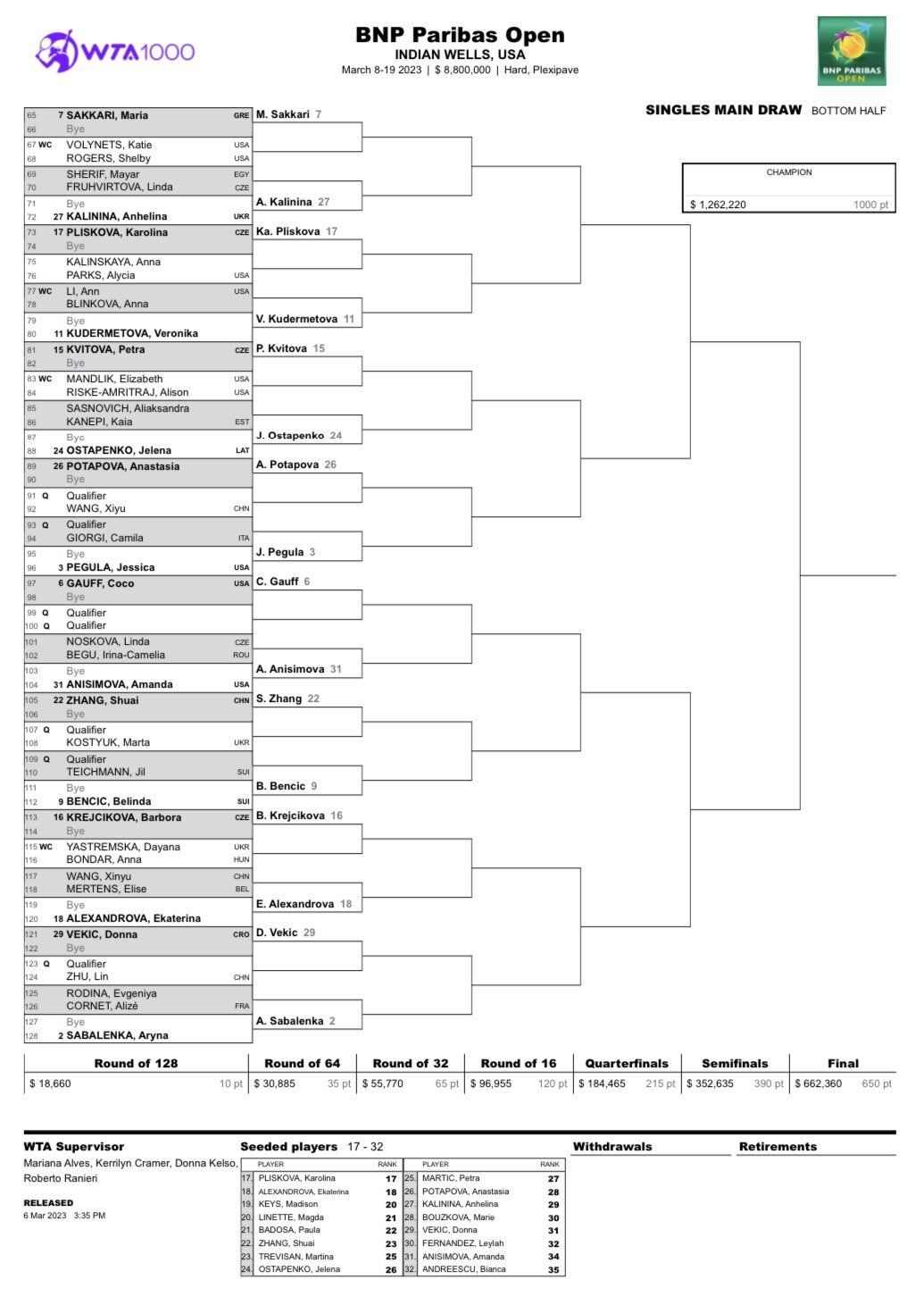

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025

Eliminacion De Paolini Y Pegula En El Wta 1000 De Dubai

Apr 27, 2025 -

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025

Dubai Dice Adios A Paolini Y Pegula En El Wta 1000

Apr 27, 2025 -

Wta 1000 Dubai Paolini Y Pegula Fuera De Competencia

Apr 27, 2025

Wta 1000 Dubai Paolini Y Pegula Fuera De Competencia

Apr 27, 2025 -

Paolini Y Pegula Caen En Dubai Fin Prematuro En El Wta 1000

Apr 27, 2025

Paolini Y Pegula Caen En Dubai Fin Prematuro En El Wta 1000

Apr 27, 2025 -

Paolini Y Pegula Sorpresa En Dubai Eliminadas De La Wta 1000

Apr 27, 2025

Paolini Y Pegula Sorpresa En Dubai Eliminadas De La Wta 1000

Apr 27, 2025