5 Reasons For Today's Sharp Increase In The Indian Stock Market (Sensex & Nifty)

Table of Contents

Positive Global Economic Indicators

Positive global economic news significantly impacts the Indian market sentiment. Improved US economic data, easing global inflation concerns, and a generally more optimistic global outlook have all contributed to today's rise. This positive sentiment translates directly into increased investment in emerging markets like India.

-

Improved global investor confidence leading to increased foreign institutional investment (FII) flows. FIIs, crucial players in the Indian stock market, are more willing to invest when global economic uncertainty reduces. This influx of capital directly boosts demand and drives up prices for Sensex and Nifty stocks.

-

Positive signals from major global indices influencing Indian market performance. When major global indices like the Dow Jones and Nasdaq perform well, it often signals broader economic health, boosting confidence and encouraging investment in related markets, including India's.

-

Reduced uncertainty about global economic slowdown. Concerns about a global recession have eased recently, leading to a more risk-on appetite among investors. This means investors are more comfortable allocating capital to potentially higher-growth markets such as India. This reduced uncertainty is a major contributor to the positive market sentiment reflected in the Sensex and Nifty’s increase.

Strong Corporate Earnings Reports

Better-than-expected earnings reports from leading Indian companies have played a crucial role in boosting market confidence. Strong performances across various sectors showcase the resilience and growth potential of the Indian economy.

-

Increased profitability of key sectors (mention specific sectors like IT, FMCG, etc.). The IT sector, for example, has shown robust growth, driven by increased global demand for technology services. Similarly, fast-moving consumer goods (FMCG) companies have reported strong sales figures, indicating positive consumer spending.

-

Positive future outlook projected by leading companies. Many leading Indian companies have expressed optimism about their future prospects, further bolstering investor confidence. These positive projections contribute to a more positive outlook for the overall market.

-

Strong revenue growth exceeding market expectations. Several companies have reported revenue growth that surpasses analysts' predictions, signaling strong underlying economic activity and contributing to the overall positive market sentiment reflected in the Sensex and Nifty.

Government's Positive Policy Initiatives

Recent government policies focusing on infrastructure development and tax reforms have significantly contributed to market optimism. These initiatives signal a commitment to long-term economic growth and attract both domestic and foreign investment.

-

Increased infrastructure investments attracting both domestic and foreign investments. The government's focus on improving infrastructure, such as roads, railways, and power, creates a more favorable investment climate, attracting both domestic and international capital.

-

Favorable tax policies boosting business confidence and investment. Tax reforms aimed at simplifying regulations and reducing the tax burden on businesses encourage investment and stimulate economic activity, further boosting the Sensex and Nifty.

-

Government initiatives promoting economic growth and development. Various government initiatives aimed at fostering economic growth and development contribute to a positive outlook, encouraging both short-term and long-term investments.

Increased Retail Investor Participation

The surge in retail investor participation has significantly impacted today's market increase. A growing number of Indian citizens are investing in the stock market, driven by increased awareness and technological advancements.

-

Rising awareness and understanding of the stock market among retail investors. Increased financial literacy and readily available information have empowered more individuals to participate in the stock market.

-

Increased use of online trading platforms. The ease of access provided by online trading platforms has lowered the barriers to entry for retail investors, making participation more convenient and accessible.

-

Growing confidence in the market's long-term potential. The overall positive sentiment surrounding the Indian economy and stock market has encouraged more retail investors to participate, fueling further growth.

Speculative Trading and Short Covering

While fundamental factors play a significant role, it's important to acknowledge the potential influence of short-term speculative trading and short covering on the market's sharp increase.

-

Short covering by investors who had previously bet against the market. Investors who had previously taken short positions (betting against the market) may have covered their positions, leading to a surge in buying activity and driving up prices.

-

Increased momentum trading leading to rapid price increases. Momentum trading, where investors buy assets based on recent price increases, can amplify market movements and contribute to rapid price increases in the Sensex and Nifty.

-

Cautionary note on the sustainability of such increases driven by speculation. It's crucial to remember that increases driven primarily by speculation may be less sustainable in the long run. Investors should always exercise caution and conduct thorough due diligence.

Conclusion

Today's sharp increase in the Indian stock market (Sensex & Nifty) can be attributed to a confluence of factors: positive global economic indicators, strong corporate earnings, supportive government policies, increased retail investor participation, and speculative trading. While these factors contributed to today's surge, investors should carefully analyze the market's long-term prospects before making investment decisions. Understanding these underlying reasons can help investors navigate the Indian stock market effectively. Stay informed about the latest developments in the Indian stock market (Sensex & Nifty) to make well-informed investment decisions.

Featured Posts

-

Sensex Live Market Gains Momentum Nifty Surges Past 17 950

May 10, 2025

Sensex Live Market Gains Momentum Nifty Surges Past 17 950

May 10, 2025 -

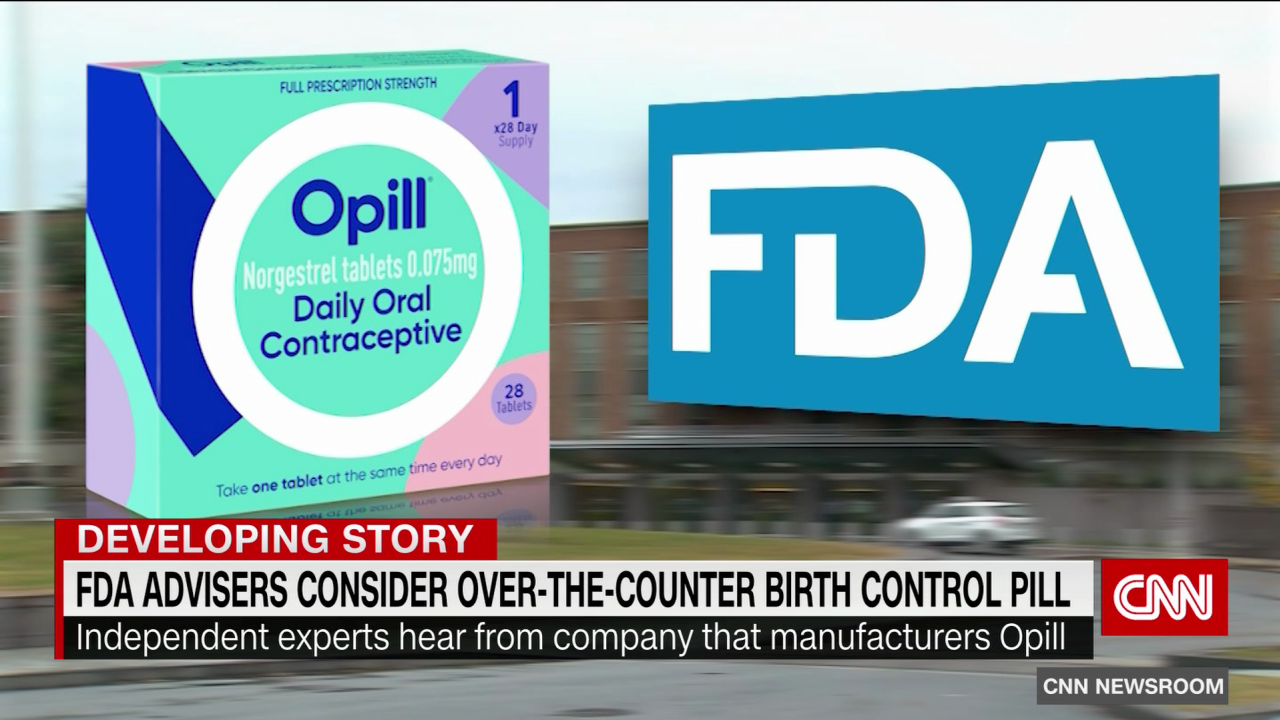

The Post Roe Landscape Examining The Implications Of Otc Birth Control

May 10, 2025

The Post Roe Landscape Examining The Implications Of Otc Birth Control

May 10, 2025 -

Edmonton Oilers Draisaitl Injury Update And Playoffs Outlook

May 10, 2025

Edmonton Oilers Draisaitl Injury Update And Playoffs Outlook

May 10, 2025 -

Fentanyl Crisis A Catalyst For Us China Trade Negotiations

May 10, 2025

Fentanyl Crisis A Catalyst For Us China Trade Negotiations

May 10, 2025 -

Are Landlords Price Gouging In The Wake Of The La Fires A Star Speaks Out

May 10, 2025

Are Landlords Price Gouging In The Wake Of The La Fires A Star Speaks Out

May 10, 2025