5 Key Actions To Secure A Role In The Booming Private Credit Industry

Table of Contents

Develop In-Demand Skills for Private Credit Careers

The private credit industry demands a specific skillset. To stand out, you need to master key areas:

Master Financial Modeling & Analysis

Private credit professionals are constantly building and analyzing financial models. This requires proficiency in:

- Advanced Excel Skills: Become highly proficient in Excel, mastering functions like XIRR, NPV, and scenario planning. The ability to build complex financial models, including discounted cash flow (DCF) analysis and leveraged buyout (LBO) models, is crucial.

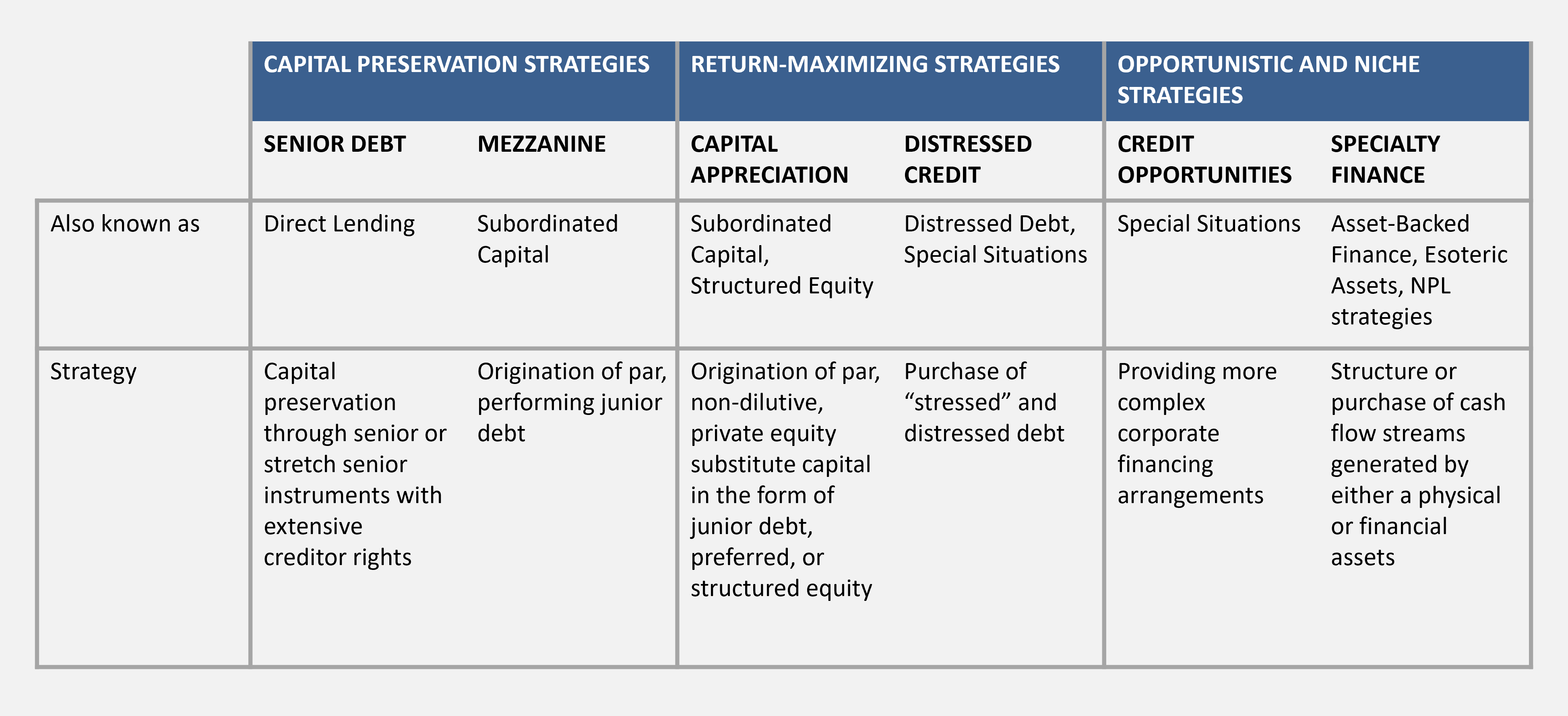

- Private Credit Transaction Modeling: Practice creating models for various private credit transactions such as unitranche loans, second-lien debt, and mezzanine financing. This demonstrates a practical understanding of the market.

- Relevant Certifications: Consider pursuing certifications like the Financial Modeling & Valuation Analyst (FMVA) designation to further enhance your credentials.

Understand Credit Analysis & Risk Assessment

Thorough credit analysis is the cornerstone of private credit. You need to understand:

- Financial Statement Analysis: Develop a deep understanding of interpreting balance sheets, income statements, and cash flow statements to assess a borrower's financial health.

- Credit Risk Assessment: Learn how to evaluate credit risk, considering factors like debt levels, cash flow projections, collateral values, and industry trends.

- Credit Rating Agencies: Familiarize yourself with the methodologies of major credit rating agencies and how they assess creditworthiness.

- Industry Risk Analysis: Gain experience analyzing various industries and their associated risks, understanding cyclical factors and specific industry dynamics.

Gain Expertise in Legal and Regulatory Frameworks

Navigating the legal and regulatory landscape is essential in private credit. Develop knowledge of:

- Loan Documentation: Understand the intricacies of loan agreements, including covenants, security interests, and repayment terms.

- Regulatory Compliance: Become familiar with relevant laws and regulations, such as those related to lending, security, and reporting requirements.

- Industry Best Practices: Stay updated on industry best practices and ethical considerations related to lending and investment.

Network Strategically Within the Private Credit Community

Building a strong professional network is crucial for securing a private credit role.

Attend Industry Conferences and Events

- Targeted Events: Attend conferences and networking events specifically focused on private credit, leveraged finance, alternative investments, and related fields.

- Engaging with Professionals: Actively participate in discussions, exchange business cards, and follow up with meaningful connections after the event.

Leverage Professional Networking Platforms (LinkedIn)

- Optimize Your Profile: Create a compelling LinkedIn profile that highlights your skills and experience relevant to private credit. Use keywords relevant to the industry.

- Strategic Connections: Connect with professionals working in private credit, including those at firms you admire.

- Group Participation: Join relevant LinkedIn groups and actively participate in discussions to demonstrate your knowledge and engage with the community.

Informational Interviews

- Reaching Out: Proactively reach out to individuals working in private credit for informational interviews.

- Value-Added Conversations: Prepare thoughtful questions and actively listen to learn about their career paths and the industry. Express your genuine interest in private credit.

Gain Relevant Experience Through Internships or Entry-Level Positions

Practical experience is highly valued in the private credit industry.

Target Relevant Internships

- Strategic Internship Selection: Seek internships at private credit firms, investment banks with strong private credit practices, or accounting firms specializing in private credit services.

- Highlighting Your Interest: Clearly express your passion for private credit in your cover letter and during interviews.

Consider Entry-Level Roles in Related Fields

- Building Foundational Skills: Consider entry-level positions in financial analysis, accounting, or legal, which provide valuable foundational skills and experience transferable to private credit.

Craft a Compelling Resume and Cover Letter

Your resume and cover letter are your first impression.

Highlight Relevant Skills and Experience

- Tailored Application: Tailor your resume and cover letter to each specific job description, using keywords directly from the posting.

- Quantifiable Achievements: Quantify your achievements whenever possible, using data to demonstrate your impact.

Showcase Your Knowledge of the Private Credit Industry

- Market Awareness: Demonstrate your understanding of current market trends, investment strategies, and key players within the private credit space.

- Expressing Admiration: Mention specific private credit firms or funds that you admire and explain why.

Proofread Carefully

Ensure your resume and cover letter are free of grammatical errors and typos.

Prepare for the Private Credit Interview Process

Thorough preparation is crucial for success in private credit interviews.

Practice Behavioral Interview Questions

Prepare answers to common behavioral interview questions, focusing on your skills and experiences relevant to private credit. Use the STAR method (Situation, Task, Action, Result) to structure your responses.

Prepare Technical Interview Questions

Expect technical questions on financial modeling, credit analysis, and industry knowledge. Practice walking through your thought process and explaining your solutions clearly.

Conclusion

Securing a role in the booming private credit industry requires strategic planning and focused effort. By developing in-demand skills, networking effectively, gaining relevant experience, crafting a compelling application, and preparing thoroughly for interviews, you can significantly increase your chances of success. Don't delay – start taking action today to build your career in the exciting world of private credit. Use these five key actions to launch your private credit career and capitalize on this dynamic market. Begin building your expertise in private debt and alternative credit strategies today!

Featured Posts

-

Principals Anzac Day Decision At Sherwood Ridge Public School Causes Outcry

Apr 25, 2025

Principals Anzac Day Decision At Sherwood Ridge Public School Causes Outcry

Apr 25, 2025 -

Memorial Event For Wwii Anniversary Russian Ambassadors Attendance

Apr 25, 2025

Memorial Event For Wwii Anniversary Russian Ambassadors Attendance

Apr 25, 2025 -

Yak Zminyuvalasya Pozitsiya Trampa Schodo Viyni V Ukrayini

Apr 25, 2025

Yak Zminyuvalasya Pozitsiya Trampa Schodo Viyni V Ukrayini

Apr 25, 2025 -

Taylors Of Harrogate Wins Gold A Celebratory Moment

Apr 25, 2025

Taylors Of Harrogate Wins Gold A Celebratory Moment

Apr 25, 2025 -

Retegui El Favorito Sorpresivo Para La Bota De Oro Analisis De Sus Estadisticas

Apr 25, 2025

Retegui El Favorito Sorpresivo Para La Bota De Oro Analisis De Sus Estadisticas

Apr 25, 2025

Latest Posts

-

Young Thugs New Album Uy Scuti When Can We Expect It

May 10, 2025

Young Thugs New Album Uy Scuti When Can We Expect It

May 10, 2025 -

Elon Musks Space X A 43 Billion Windfall Over Tesla Holdings

May 10, 2025

Elon Musks Space X A 43 Billion Windfall Over Tesla Holdings

May 10, 2025 -

Uy Scuti Young Thug Offers Clues On Upcoming Album Release

May 10, 2025

Uy Scuti Young Thug Offers Clues On Upcoming Album Release

May 10, 2025 -

43 Billion Boost Space X Stake Now Outweighs Elon Musks Tesla Investment

May 10, 2025

43 Billion Boost Space X Stake Now Outweighs Elon Musks Tesla Investment

May 10, 2025 -

Analyzing Mariah The Scientists Burning Blue Sound And Significance

May 10, 2025

Analyzing Mariah The Scientists Burning Blue Sound And Significance

May 10, 2025