5 Essential Do's And Don'ts: Succeeding In The Private Credit Market

Table of Contents

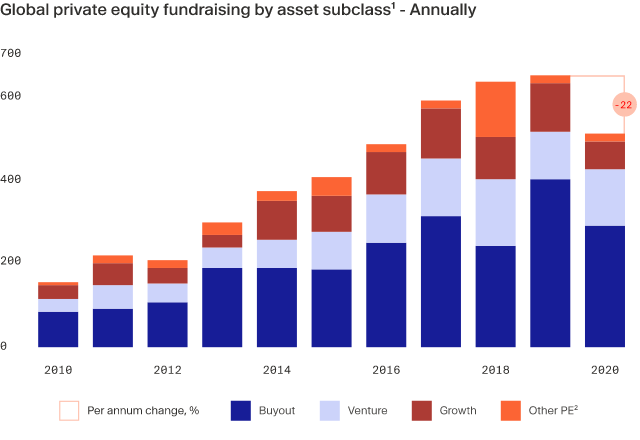

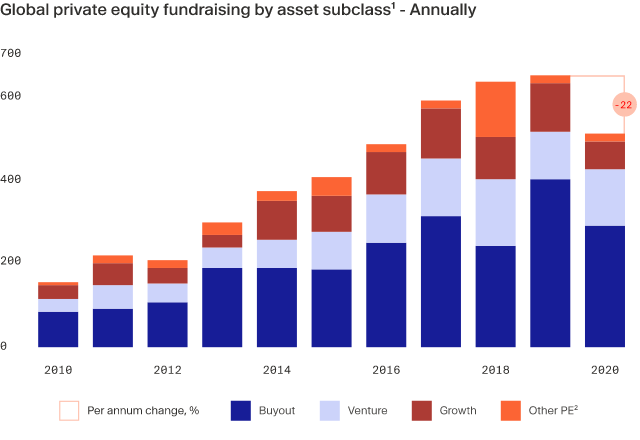

The private credit market is booming, offering attractive yields and diversification opportunities not readily available in traditional fixed-income markets. Private debt, also known as alternative lending or direct lending, presents a compelling avenue for investors seeking higher returns. However, navigating this complex landscape requires strategic knowledge and careful execution. This article outlines five essential "do's" and "don'ts" to guide you towards success in private credit investing. Understanding these key principles will significantly enhance your chances of thriving in this dynamic market.

<h2>Do's: Mastering the Art of Private Credit Investing</h2>

<h3>Do Your Due Diligence: Thoroughly Research Potential Investments</h3>

Thorough due diligence is paramount in the private credit market. Before committing capital, meticulously investigate each potential investment. This involves several critical steps:

- Assess borrower creditworthiness: Analyze credit reports, bank statements, and other financial documents to evaluate the borrower's ability to repay the debt.

- Analyze financial statements: Scrutinize financial statements, including income statements, balance sheets, and cash flow statements, to understand the borrower's financial health and performance.

- Verify collateral value: If collateral is involved, ensure its fair market value accurately reflects its worth as security for the loan. Independent appraisals are crucial here.

- Investigate industry trends: Understand the borrower's industry landscape, including its growth prospects, competitive pressures, and regulatory environment.

- Understand legal and regulatory aspects: Ensure compliance with all relevant laws and regulations pertaining to private credit transactions.

Independent verification of information is crucial. Relying solely on the borrower's provided data is risky. Utilizing specialized software for financial statement analysis can significantly improve the efficiency and accuracy of your due diligence process. Overlooking crucial information can lead to significant financial losses.

<h3>Diversify Your Portfolio to Mitigate Risk</h3>

Diversification is a cornerstone of sound investment strategy, and this is especially true in the private credit market. Don't put all your eggs in one basket!

- Invest across various sectors: Diversify your portfolio across multiple industries to reduce exposure to sector-specific risks.

- Invest across geographies: Spreading your investments across different geographical regions mitigates risks associated with local economic downturns.

- Invest across borrower types: Consider investing in both established and emerging companies to balance risk and potential returns.

- Utilize different investment strategies: Explore diverse investment strategies such as senior secured debt, mezzanine debt, and unitranche loans to optimize your risk-return profile.

- Spread your investments across multiple deals: Avoid over-concentration in any single deal. The failure of one investment shouldn't cripple your entire portfolio.

Diversification reduces the overall risk of your private credit portfolio. The appropriate level of diversification will depend on your individual risk tolerance and investment objectives. Consult with a financial advisor to determine the best strategy for your specific circumstances.

<h3>Build Strong Relationships with Borrowers and Intermediaries</h3>

Networking is crucial in the private credit market. Building strong relationships with borrowers and intermediaries can provide access to lucrative investment opportunities.

- Network within the industry: Attend industry conferences, join relevant professional organizations, and actively engage in networking events.

- Establish trust and transparency with borrowers: Foster open communication and build a reputation for fairness and integrity.

- Maintain consistent communication: Regularly update borrowers on your investment strategy and portfolio performance.

Long-term relationships provide access to deal flow and enhance your reputation within the private credit community. A strong reputation is invaluable for attracting future investment opportunities.

<h3>Understand and Manage Legal and Regulatory Compliance</h3>

Navigating the legal and regulatory landscape is essential for avoiding potential problems.

- Adhere to all relevant laws and regulations: Stay informed about the latest regulatory changes and ensure compliance with all applicable rules and regulations.

- Consult with legal professionals: Seek legal counsel to ensure your investments and transactions are legally sound.

- Maintain accurate records: Keep meticulous records of all transactions and communications.

Non-compliance can lead to significant legal issues, penalties, and reputational damage. Staying compliant is not just a legal requirement, it's crucial for maintaining a positive reputation and building trust with your borrowers and partners.

<h3>Employ Sophisticated Risk Management Techniques</h3>

Proactive risk management is critical for success in private credit investing.

- Develop robust underwriting processes: Establish a rigorous underwriting process that includes comprehensive due diligence and risk assessment.

- Utilize stress testing and scenario analysis: Conduct stress tests to assess the resilience of your portfolio under various economic conditions.

- Monitor portfolio performance closely: Regularly monitor the performance of your investments and adjust your strategy as needed.

Effective risk management involves identifying and mitigating potential risks proactively. Using both quantitative and qualitative risk assessment tools is crucial for informed decision-making.

<h2>Don'ts: Avoiding Common Pitfalls in Private Credit</h2>

<h3>Don't Neglect Due Diligence – Cut Corners</h3>

Skipping due diligence or rushing the process is a major mistake.

- Rushing the due diligence process: Taking shortcuts can lead to overlooking critical information and increasing the risk of defaults.

- Overlooking warning signs: Ignoring red flags in financial statements or borrower behavior can have severe consequences.

- Failing to verify information independently: Relying solely on the borrower's information without independent verification is incredibly risky.

Insufficient due diligence can lead to significant financial losses and reputational damage. Always perform thorough due diligence, even if it takes time and resources.

<h3>Don't Overconcentrate Your Portfolio in a Single Sector or Borrower</h3>

Over-concentration significantly increases your portfolio's vulnerability.

- Putting all your eggs in one basket: High concentration in a single borrower or industry exposes your portfolio to significant risk. A downturn in that sector or a default by that borrower could severely impact your returns.

Avoid over-concentration by diversifying your investments across different sectors, geographies, and borrowers.

<h3>Don't Underestimate the Importance of Relationship Building</h3>

Ignoring networking and communication can limit opportunities and create difficulties.

- Failing to network: Neglecting networking opportunities means missing out on potential deals and insights.

- Neglecting communication with borrowers: Poor communication can lead to misunderstandings and strained relationships.

- Ignoring industry events: Missing out on industry events limits your access to knowledge, insights, and potential partners.

Strong relationships are crucial for securing deal flow, negotiating favorable terms, and managing potential problems.

<h3>Don't Ignore Legal and Regulatory Requirements</h3>

Non-compliance can have severe consequences.

- Operating outside the regulatory framework: Ignoring legal and regulatory requirements can lead to significant penalties, legal action, and reputational damage.

- Failing to maintain proper records: Poor record-keeping can make it difficult to demonstrate compliance and can expose you to legal risks.

- Disregarding legal advice: Ignoring legal counsel's advice can lead to significant financial and legal repercussions.

Compliance is not just a legal obligation, it’s vital for maintaining a strong reputation and avoiding significant financial and legal problems.

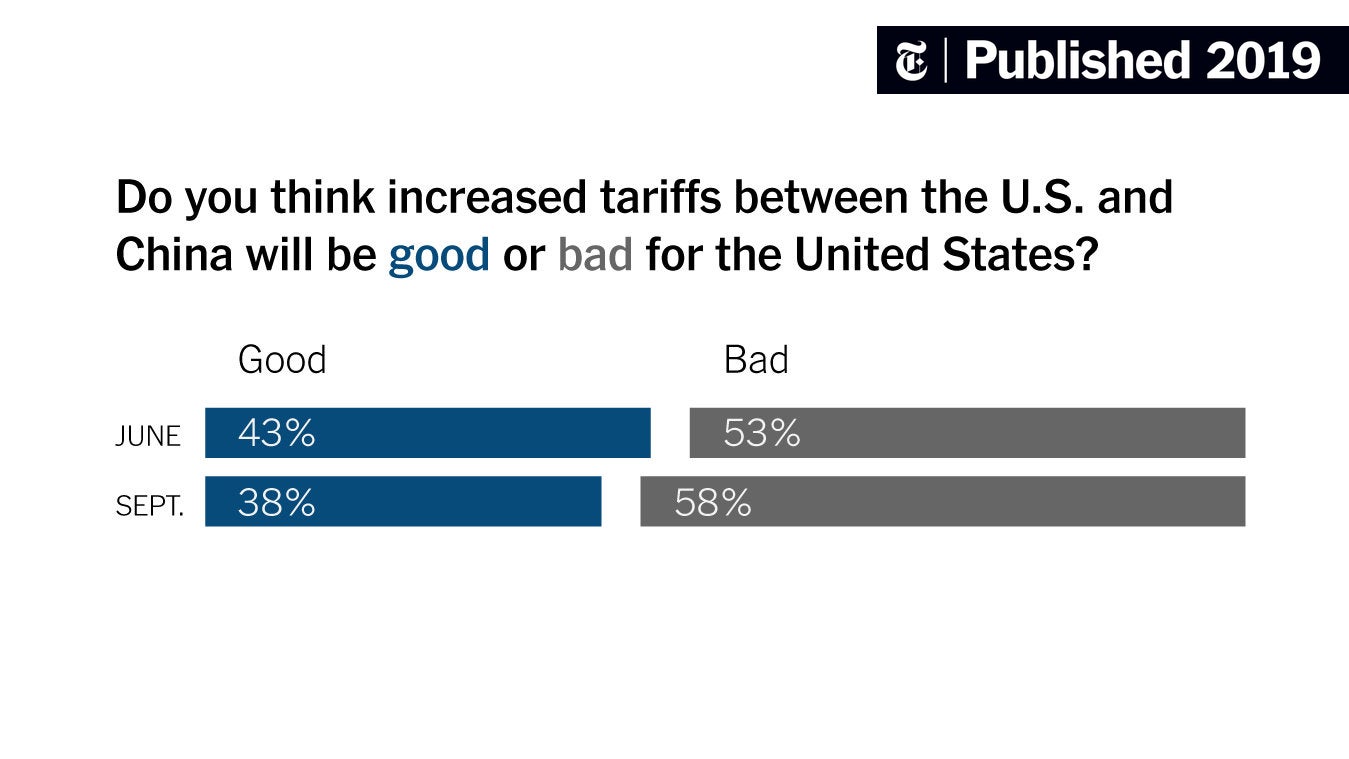

<h3>Don't Underestimate Market Cycles and Economic Conditions</h3>

Ignoring macroeconomic factors can lead to poor investment decisions.

- Ignoring macroeconomic factors: Failing to consider macroeconomic trends and economic cycles can lead to poor investment choices.

- Neglecting market analysis: Not analyzing market trends and conditions increases the risk of poor investment decisions.

- Failing to adjust investment strategies based on changing conditions: Sticking to a rigid strategy without adapting to changing market conditions can lead to significant losses.

Understanding and adapting to market cycles and economic conditions is crucial for making sound investment decisions and mitigating potential risks.

<h2>Conclusion</h2>

Succeeding in the private credit market requires a strategic approach that balances potential returns with careful risk management. By adhering to the "do's" outlined above—performing thorough due diligence, diversifying your portfolio, building strong relationships, ensuring legal and regulatory compliance, and employing sophisticated risk management techniques—you can significantly increase your chances of success. Conversely, avoiding the "don'ts"—neglecting due diligence, over-concentrating your investments, undermining relationship building, disregarding legal and regulatory requirements, and underestimating market cycles—is equally crucial. Mastering these essential do's and don'ts will significantly increase your chances of succeeding in the dynamic private credit market. Start building your successful private credit portfolio today!

Rapid Police Response Fails To Quell Student Anxiety After Fsu Security Gap

Rapid Police Response Fails To Quell Student Anxiety After Fsu Security Gap

Bmw And Porsches China Challenges A Broader Look At Auto Industry Headwinds

Bmw And Porsches China Challenges A Broader Look At Auto Industry Headwinds

Russias Aerial Assault On Ukraine Us Peace Plan Faces Steep Odds

Russias Aerial Assault On Ukraine Us Peace Plan Faces Steep Odds

Is Trumps Trade Offensive Undermining Americas Economic Powerhouse Status

Is Trumps Trade Offensive Undermining Americas Economic Powerhouse Status

Fighting In Ukraine Resumes Russias Easter Truce Ends

Fighting In Ukraine Resumes Russias Easter Truce Ends