5 Dos And Don'ts: Succeeding In The Private Credit Job Market

Table of Contents

The private credit job market offers lucrative opportunities in the world of private debt and alternative lending, but breaking into this competitive field requires a strategic approach. Demand for skilled professionals in credit investing and finance is high, but so is the competition. Landing your dream job in private credit requires more than just a strong resume; it demands a proactive and well-planned job search. This article outlines 5 crucial dos and don'ts to significantly improve your chances of success.

<h2>DO: Network Strategically in the Private Credit Industry</h2>

Networking is paramount in the close-knit world of private credit. Building relationships with professionals can open doors to unadvertised opportunities and provide invaluable insights.

-

Leverage LinkedIn Effectively: Optimize your LinkedIn profile with keywords like "private credit," "credit investing," "alternative lending," and "private debt." Join relevant groups such as "Private Equity & Venture Capital Professionals," "Alternative Lending Professionals," and engage actively in discussions using hashtags like #privatecredit, #creditinvesting, and #alternativelending. Connect with individuals working at firms you admire.

-

Attend Industry Events: Conferences and workshops are excellent networking opportunities. Consider attending events like the Private Debt Investor Forum, SuperReturn, and industry-specific conferences hosted by organizations like the American Securitization Forum. Actively engage with speakers and attendees, exchanging business cards and following up afterward.

-

Informational Interviews: Reach out to professionals in private credit for informational interviews. These conversations provide valuable insights into their career paths, the industry landscape, and potential job openings. Prepare insightful questions beforehand to demonstrate your genuine interest.

<h2>DON'T: Neglect Your Online Presence</h2>

Your online presence is often the first impression potential employers get. A neglected or poorly maintained online profile can significantly hinder your job search.

-

Outdated Resume/LinkedIn Profile: Your resume and LinkedIn profile must be meticulously crafted and regularly updated, reflecting your most recent experience and skills relevant to private credit roles. Ensure they are tailored to highlight achievements and keywords relevant to the industry.

-

Lack of Online Portfolio/Samples: If you have relevant projects or work samples (e.g., financial models, credit analysis reports), showcase them online. This demonstrates your practical skills and capabilities in areas like distressed debt analysis or direct lending.

-

Negative Online Presence: Before applying for jobs, review your social media presence. Ensure there is nothing that could reflect poorly on your professionalism or suitability for the role.

<h2>DO: Target Your Job Search Effectively</h2>

A targeted approach to your job search significantly increases your chances of success. Don't apply randomly; focus your efforts on roles and firms that align with your skills and interests.

-

Research Private Credit Firms: Thoroughly research private credit firms, understanding their investment strategies (distressed debt, mezzanine financing, direct lending), company culture, and recent transactions. This allows you to tailor your application to each firm's specific needs and demonstrate your understanding of their business.

-

Tailor Your Application Materials: Don't use a generic cover letter and resume. Customize your application materials for each job application, highlighting experiences and skills directly relevant to the specific role and firm's requirements. Demonstrate your knowledge of their investment strategy and recent activities.

-

Utilize Job Boards and Recruiters: Leverage specialized job boards focused on finance and private credit, such as those featuring alternative lending roles. Network with recruiters specializing in the placement of professionals in private debt and credit investing.

<h2>DON'T: Underestimate the Importance of Technical Skills</h2>

The private credit industry demands a strong foundation in technical skills. Lacking these crucial skills can severely limit your chances.

-

Lack of Financial Modeling Proficiency: Proficiency in Excel and financial modeling software (e.g., Argus, Bloomberg Terminal) is essential for analyzing financial statements, creating valuation models, and making informed investment decisions.

-

Insufficient Credit Analysis Knowledge: A solid understanding of credit analysis principles, debt structuring, covenant compliance, and risk assessment is crucial. Demonstrate your knowledge of credit metrics, industry benchmarks, and risk mitigation strategies.

-

Poor Communication Skills: Excellent written and verbal communication skills are essential for preparing presentations, interacting with clients, and collaborating with colleagues. Practice communicating complex financial information clearly and concisely.

<h2>DO: Prepare Thoroughly for Interviews</h2>

Interview preparation is crucial for success in the private credit job market. Thorough preparation demonstrates your professionalism and interest in the role.

-

Practice Behavioral Questions: Prepare for common behavioral interview questions, such as those focusing on teamwork, problem-solving, handling pressure, and decision-making under uncertainty. Use the STAR method (Situation, Task, Action, Result) to structure your answers.

-

Research the Interviewers: Research the interviewers on LinkedIn to understand their background and experience. This allows you to tailor your responses and ask relevant questions.

-

Prepare Intelligent Questions: Prepare insightful questions to demonstrate your interest in the firm, the role, and the investment strategy. Asking thoughtful questions shows initiative and engagement.

<h2>Conclusion</h2>

Securing a private credit job requires a strategic approach combining strong technical skills, targeted networking, and a polished online presence. By following these dos and don'ts, you can significantly increase your chances of success in this competitive yet rewarding field. Start your successful private credit job search today! Land your dream private credit job by following these tips! Master the private credit job market with these essential dos and don'ts!

Featured Posts

-

Wigan And Leigh College Students Horticultural Skills Shine At Flower Show

Apr 25, 2025

Wigan And Leigh College Students Horticultural Skills Shine At Flower Show

Apr 25, 2025 -

Bob Fickel Achieves Milestone 40th Canberra Marathon Finish

Apr 25, 2025

Bob Fickel Achieves Milestone 40th Canberra Marathon Finish

Apr 25, 2025 -

Boycott Eurovision In Israel Directors Response To Growing Pressure

Apr 25, 2025

Boycott Eurovision In Israel Directors Response To Growing Pressure

Apr 25, 2025 -

Sherwood Ridge Primary School Accommodates Students Beliefs Regarding Anzac Day

Apr 25, 2025

Sherwood Ridge Primary School Accommodates Students Beliefs Regarding Anzac Day

Apr 25, 2025 -

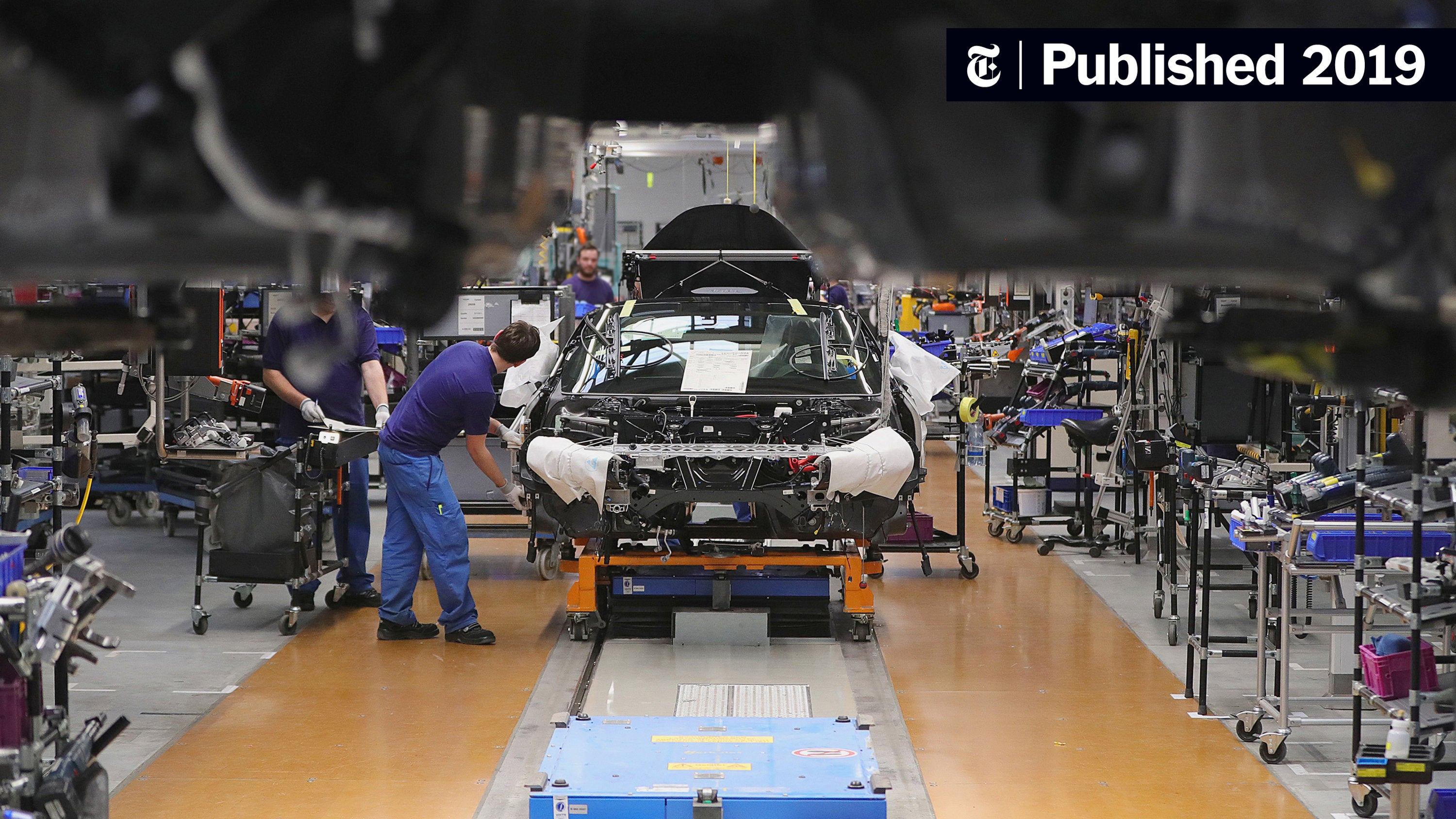

How Trumps Auto Tariffs Derailed Renaults Sports Car Plans In The Us

Apr 25, 2025

How Trumps Auto Tariffs Derailed Renaults Sports Car Plans In The Us

Apr 25, 2025

Latest Posts

-

Potential Uk Visa Restrictions Analysis Of A Recent Report

May 10, 2025

Potential Uk Visa Restrictions Analysis Of A Recent Report

May 10, 2025 -

Uk Visa Policy Changes Impact On International Applicants

May 10, 2025

Uk Visa Policy Changes Impact On International Applicants

May 10, 2025 -

New Report Uk Government Considering Visa Restrictions For Certain Nationalities

May 10, 2025

New Report Uk Government Considering Visa Restrictions For Certain Nationalities

May 10, 2025 -

Updated Uk Visa Regulations Implications For Nigerian And Pakistani Nationals

May 10, 2025

Updated Uk Visa Regulations Implications For Nigerian And Pakistani Nationals

May 10, 2025 -

New Report Potential Changes To Uk Visa Application Process For Selected Countries

May 10, 2025

New Report Potential Changes To Uk Visa Application Process For Selected Countries

May 10, 2025