30-Year Treasury Yield At 5%: A Deeper Look At The "Sell America" Sentiment

Table of Contents

What does the 30-year Treasury yield represent? It reflects the return investors expect on a 30-year U.S. government bond. This long-term yield acts as a benchmark for other interest rates and is a crucial indicator of investor confidence in the U.S. economy and its long-term stability. A rising 30-year Treasury yield often signifies expectations of higher inflation or increased risk aversion.

This article aims to analyze the contributing factors to the high 30-year Treasury yield and assess the validity of the prevailing "Sell America" sentiment.

The Influence of Inflation on the 30-Year Treasury Yield at 5%

Persistent Inflationary Pressures

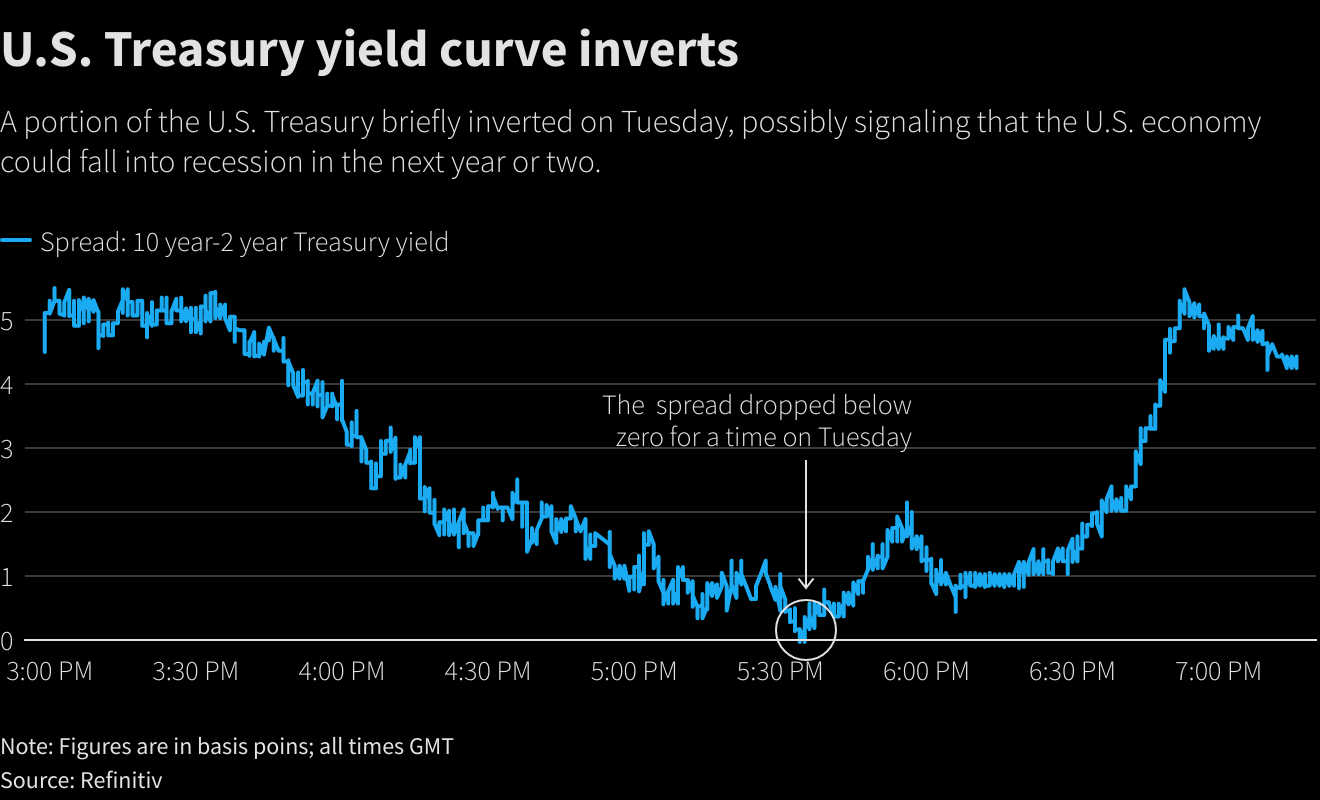

Persistent inflation is a key driver of the elevated 30-year Treasury yield at 5%. The Federal Reserve's response to combat inflation involves raising interest rates. This directly impacts bond yields because higher interest rates make newly issued bonds more attractive, increasing demand and pushing up prices. Conversely, the yields of existing bonds fall to reflect the higher returns available on new bonds. This dynamic is central to understanding why the 30-year Treasury yield has risen.

- Inflation, Interest Rates, and Bond Yields: Higher inflation leads to higher interest rates set by the Federal Reserve to cool down the economy. This, in turn, leads to higher yields on newly issued Treasury bonds.

- Inflation Expectations: Market participants' expectations about future inflation significantly influence long-term bond yields. If inflation is anticipated to remain high, investors demand higher yields to compensate for the erosion of purchasing power.

- Economic Data: Recent data showing persistent inflation, such as the Consumer Price Index (CPI) and Producer Price Index (PPI) reports, supports this analysis. These indicators have consistently exceeded expectations, reinforcing the Fed's hawkish stance and contributing to higher Treasury yields.

Impact of Inflation Expectations on Long-Term Yields

The market's perception of future inflation plays a crucial role in shaping the 30-year Treasury yield at 5%. Long-term inflation expectations are particularly important for the 30-year yield, as investors consider the potential impact of inflation over the entire life of the bond.

- Inflation Breakeven Rates: Inflation breakeven rates, which represent the difference between nominal Treasury yields and inflation-protected securities (TIPS) yields, provide insight into market expectations for future inflation. Higher breakeven rates indicate stronger inflation expectations, thus contributing to higher long-term yields.

- Long-Term Inflation Expectations and Yields: If investors anticipate persistent high inflation over the next 30 years, they will demand a higher yield on the 30-year Treasury to compensate for the expected loss in purchasing power. This increases demand for higher yields, driving up the 30-year Treasury yield.

Global Economic Uncertainty and the "Sell America" Narrative

Flight to Safety

The "Sell America" sentiment suggests a reduction in demand for US assets, potentially influencing the 30-year Treasury yield at 5%. However, the increase could also be driven by a "flight to safety," where investors seek refuge in U.S. Treasuries during times of global economic uncertainty.

- Global Economic Climate: Several factors contribute to global economic uncertainty, including the ongoing war in Ukraine, rising energy prices, and persistent supply chain disruptions. These factors create an environment where investors prioritize safety and liquidity.

- Alternative Safe Haven Assets: While U.S. Treasuries are considered a safe haven asset, investors may also allocate funds to other assets perceived as safe, such as gold or Swiss francs. This can influence the demand for U.S. Treasuries, impacting yields.

Geopolitical Risks

Geopolitical events significantly impact investor sentiment and can affect the 30-year Treasury yield at 5%. Uncertainties surrounding international relations can reduce confidence in global markets, causing investors to seek the relative safety of U.S. government bonds.

- Impact of Geopolitical Events: Recent geopolitical tensions, such as the war in Ukraine and escalating trade disputes, have increased global uncertainty. This uncertainty can push investors towards U.S. Treasuries, driving up demand and potentially increasing yields.

- Investor Confidence: Negative geopolitical developments erode investor confidence, potentially leading to capital flight and increased demand for safe-haven assets like U.S. Treasuries. This increased demand, in turn, can influence the 30-year Treasury yield.

The Role of Fiscal Policy in the 30-Year Treasury Yield at 5%

Government Debt and Borrowing

Increased government borrowing plays a role in shaping the supply of Treasury bonds and thus the 30-year Treasury yield at 5%. Larger deficits necessitate increased issuance of government debt to finance spending, potentially influencing market dynamics.

- Government Spending and Budget Deficits: High government spending and persistent budget deficits lead to increased borrowing, increasing the supply of Treasury bonds in the market. This increased supply can, under certain conditions, put downward pressure on bond prices and upward pressure on yields.

- Implications of Increasing National Debt: A continuously rising national debt can raise concerns among investors about the long-term solvency of the government, potentially impacting demand for Treasury bonds and influencing yields.

Government Debt Management

The Treasury Department's strategies for managing government debt issuance directly affect the yield curve, including the 30-year Treasury yield at 5%. The frequency and size of bond auctions can influence market supply and demand.

- Strategies for Managing Debt Issuance: The Treasury employs various strategies to manage its debt issuance, including adjusting the frequency and size of bond auctions. These strategies aim to maintain market stability and minimize disruptions to the yield curve.

- Impact on the Yield Curve: The Treasury's debt management policies can have a significant impact on the shape and level of the yield curve, influencing the yields of various Treasury securities, including the 30-year bond.

Conclusion

The recent surge in the 30-year Treasury yield at 5% is a complex phenomenon driven by an interplay of factors. Persistent inflation, fueled by supply chain disruptions and robust demand, compels the Federal Reserve to maintain higher interest rates, directly impacting bond yields. Global economic uncertainty, heightened by geopolitical risks, contributes to a flight to safety, potentially increasing demand for U.S. Treasuries. Finally, increased government borrowing to finance substantial government spending adds to the supply of bonds in the market. The "Sell America" narrative might be an oversimplification, as the increase in the 30-year Treasury yield may also reflect a global flight to safety, rather than solely a loss of confidence in the U.S. economy.

While the "Sell America" sentiment is present in some market interpretations, a nuanced understanding requires considering the multiple factors at play. Understanding the 30-year Treasury yield's complexities is crucial for navigating the current economic climate. We encourage readers to stay informed by monitoring the 30-year Treasury and conducting further research into the interplay of these macroeconomic indicators. Consulting with a financial professional can provide personalized insights into managing your investments in light of these significant shifts in the 30-year Treasury market and analyzing the broader implications for your portfolio.

Featured Posts

-

Solve The Nyt Mini Crossword March 13 Answers And Hints

May 20, 2025

Solve The Nyt Mini Crossword March 13 Answers And Hints

May 20, 2025 -

Solo Travel The Rise Of The Independent Explorer

May 20, 2025

Solo Travel The Rise Of The Independent Explorer

May 20, 2025 -

Mourinho Tadic Ve Dzeko Birlikteligin Cerrahisi

May 20, 2025

Mourinho Tadic Ve Dzeko Birlikteligin Cerrahisi

May 20, 2025 -

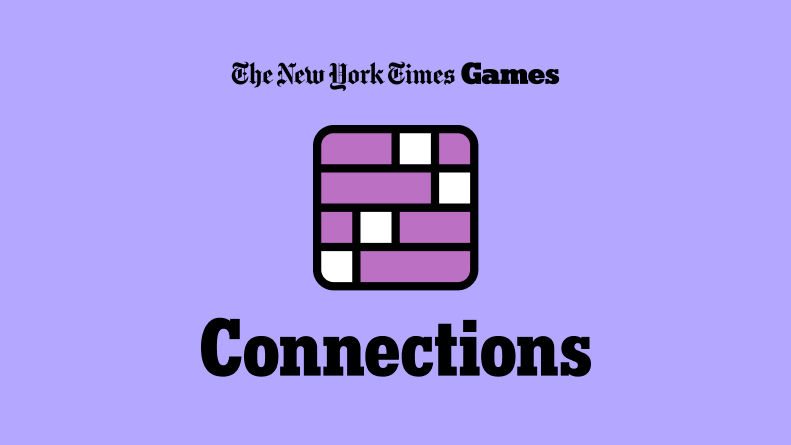

Usmc Tomahawk Missile Launch Army Explores Drone Truck Technology

May 20, 2025

Usmc Tomahawk Missile Launch Army Explores Drone Truck Technology

May 20, 2025 -

March 15 Nyt Mini Crossword Solutions

May 20, 2025

March 15 Nyt Mini Crossword Solutions

May 20, 2025

Latest Posts

-

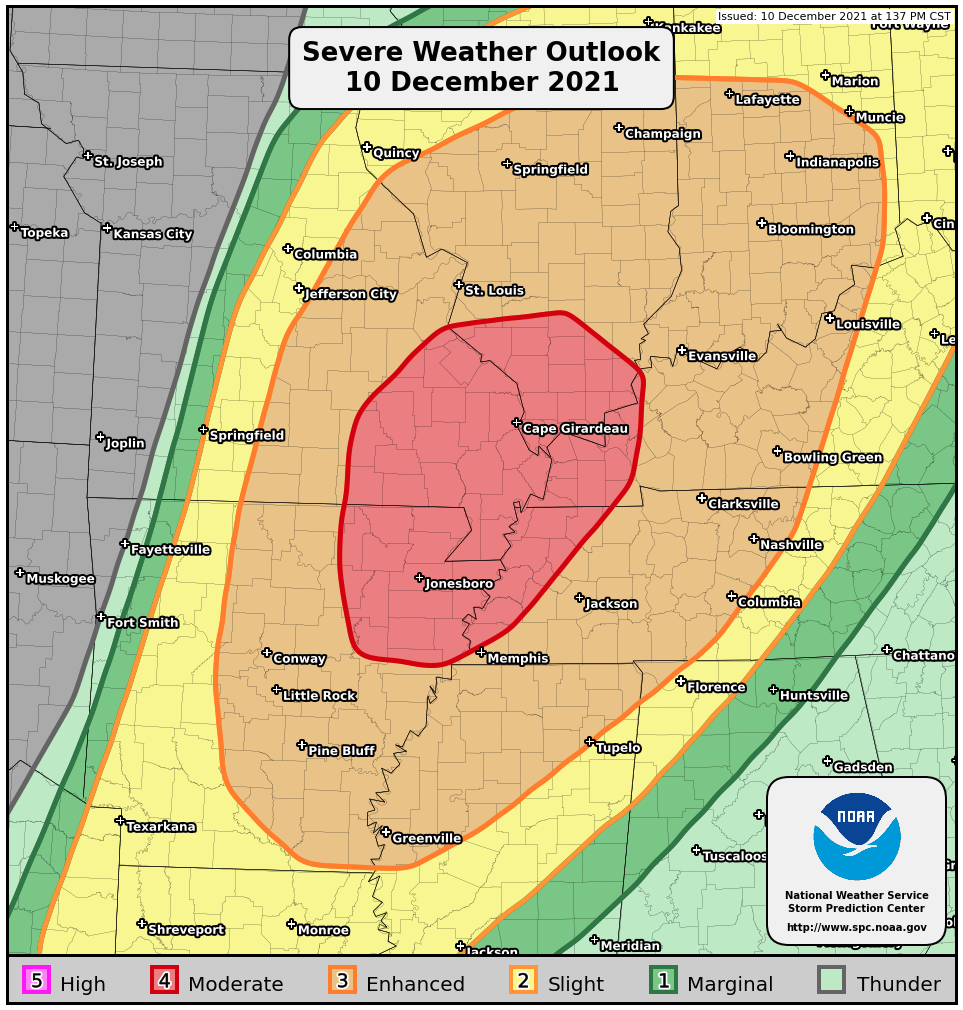

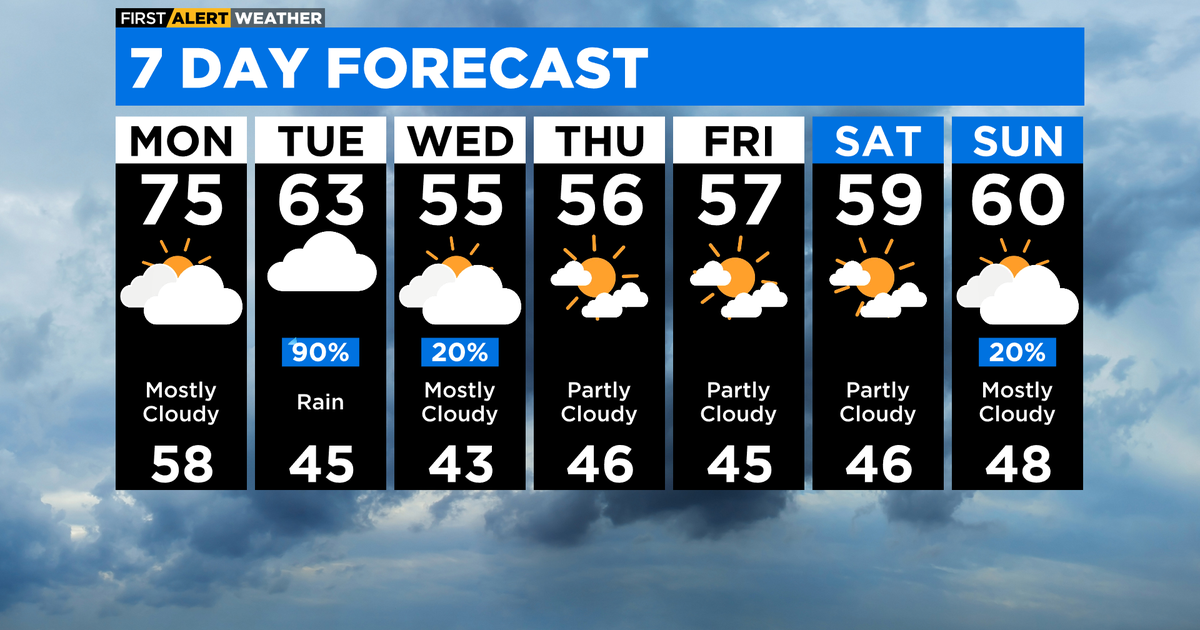

Increased Storm Chance Overnight Severe Potential Monday

May 20, 2025

Increased Storm Chance Overnight Severe Potential Monday

May 20, 2025 -

Severe Weather Outlook Storm Chance Overnight Monday Impacts

May 20, 2025

Severe Weather Outlook Storm Chance Overnight Monday Impacts

May 20, 2025 -

Large Scale Dog Seizure In Washington County 49 Animals Removed From Breeder

May 20, 2025

Large Scale Dog Seizure In Washington County 49 Animals Removed From Breeder

May 20, 2025 -

Breezy And Mild Understanding Weather Patterns And Their Impact

May 20, 2025

Breezy And Mild Understanding Weather Patterns And Their Impact

May 20, 2025 -

Overnight Storm Potential Severe Weather Risk Monday

May 20, 2025

Overnight Storm Potential Severe Weather Risk Monday

May 20, 2025