30% Down: Should You Invest In Palantir Now?

Table of Contents

Palantir's Current Financial Performance & Market Position

Understanding Palantir's current financial health is crucial to evaluating its investment potential. Let's analyze its recent performance and market standing.

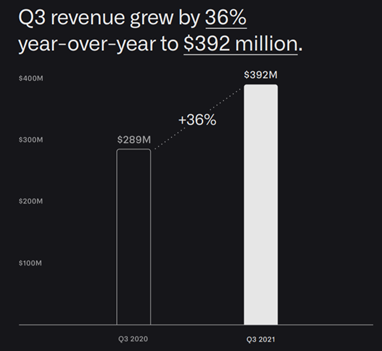

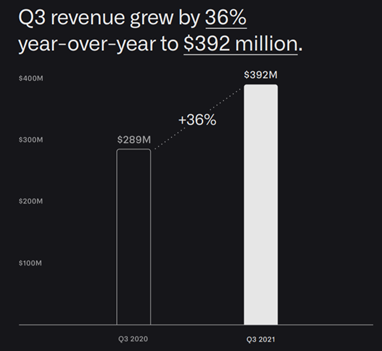

Palantir Revenue, Earnings, and Profitability

Palantir's recent financial reports reveal a mixed bag. While the company has demonstrated consistent revenue growth, profitability remains a key area of focus.

- Revenue Growth: [Insert recent revenue figures and growth percentage from Palantir's financial reports. Example: "Q[Quarter] 2024 saw a [percentage]% increase in revenue, reaching $[Amount]".] This growth is largely driven by [Mention key drivers like government contracts or commercial partnerships].

- Profitability: [Analyze Palantir's profitability metrics, including gross margin, operating margin, and net income. Are they improving or deteriorating? Example: "While revenue is up, operating margins remain under pressure, indicating challenges in achieving profitability at scale."]

- Cash Flow: [Analyze Palantir's cash flow from operations. A positive and growing cash flow is generally a positive sign. Example: "Palantir's strong cash flow from operations suggests financial stability, which is crucial for long-term growth."]

- Future Projections: [Mention any official guidance or analyst projections for future revenue and profitability. This should be treated cautiously, as projections are inherently uncertain.]

These Palantir financials paint a picture of a company with strong revenue growth but ongoing challenges in achieving consistent profitability. Further analysis is needed to fully understand the implications.

Palantir Competitors and Market Share in Big Data Analytics

Palantir operates in a highly competitive big data analytics market. Key competitors include established players like [List key competitors, e.g., Microsoft, Amazon Web Services (AWS), Google Cloud Platform (GCP), etc.] and specialized analytics firms.

- Palantir's Competitive Advantages: Palantir differentiates itself through its [Mention key competitive advantages, e.g., advanced data integration capabilities, strong relationships with government agencies, focus on complex data problems].

- Palantir's Competitive Disadvantages: However, Palantir faces challenges including [Mention key disadvantages, e.g., high pricing, dependence on large government contracts, competition from cloud giants].

- Market Share: [If available, include data on Palantir's market share in relevant segments of the big data analytics market. This data helps contextualize its competitive position.]

The competitive landscape is dynamic, and Palantir's ability to maintain and expand its market share will significantly impact its future performance.

Factors Affecting Palantir's Stock Price

The recent Palantir price drop is a result of a confluence of factors, both internal and external to the company.

Macroeconomic Factors and Investor Sentiment

Broader economic conditions play a significant role in influencing investor sentiment towards Palantir and other tech stocks.

- Interest Rates and Inflation: Rising interest rates and persistent inflation can negatively affect investor appetite for growth stocks like Palantir, particularly if profitability remains elusive. Higher rates increase the opportunity cost of investing in growth-oriented companies.

- Recessionary Fears: Concerns about a potential recession can further dampen investor enthusiasm, leading to decreased investment in riskier assets.

- Overall Market Volatility: General market volatility can impact even fundamentally strong companies like Palantir.

Geopolitical Risks and Government Contracts

Palantir's significant revenue stream from government contracts makes it susceptible to geopolitical risks.

- International Relations: Changes in international relations, particularly regarding countries where Palantir has significant operations, could impact its business.

- Government Spending: Shifts in government spending priorities could also affect Palantir's revenue from government contracts.

Recent Palantir News and Developments

Recent news and company-specific events can have a substantial impact on Palantir's stock price.

- Product Launches and Partnerships: The success (or failure) of new product launches or partnerships can significantly affect investor perception.

- Executive Changes: Any significant changes in senior management can also trigger stock price volatility.

- Regulatory Scrutiny: Regulatory actions or investigations could impact the company's valuation.

Analyzing these factors is essential to understanding the context of the recent Palantir stock price decline.

Should You Buy Palantir Stock Now? A Risk/Reward Assessment

Deciding whether to invest in Palantir at its current price requires careful consideration of the potential upside and downside.

Potential Upside of a Palantir Investment

The potential for a Palantir stock price recovery and future appreciation hinges on several factors.

- Long-Term Growth Prospects: Palantir operates in a rapidly growing market, and its innovative technology could deliver substantial long-term growth.

- Market Share Expansion: If Palantir successfully expands its market share and diversifies its revenue streams, its valuation could improve.

- Profitability Improvements: Successful cost-cutting measures and increased operating efficiencies could significantly improve profitability and enhance investor confidence.

Potential Downside Risks of a Palantir Investment

Investing in Palantir at this juncture carries significant risks.

- Further Price Declines: The stock price could continue to decline if the company fails to meet investor expectations or if macroeconomic conditions worsen.

- Competition: Intense competition from larger, more established players could erode Palantir's market share and hinder its growth.

- Dependence on Government Contracts: Over-reliance on government contracts exposes Palantir to geopolitical risks and potential shifts in government spending priorities.

Diversification and Investment Strategy

Any investment decision should be part of a well-diversified portfolio that aligns with your overall investment strategy and risk tolerance. Palantir, given its high growth potential but also inherent risks, should be considered in the context of your broader portfolio, not as a standalone investment.

Conclusion

Palantir's recent stock price decline presents a complex investment scenario. While the company exhibits strong revenue growth and operates in a lucrative market, challenges in achieving profitability, macroeconomic headwinds, and geopolitical risks pose considerable challenges. Before making any investment decisions regarding Palantir stock, it's crucial to conduct thorough due diligence, analyze Palantir's financials, and assess your own risk tolerance. Don't rely solely on this analysis; learn more about Palantir's ongoing developments, understand the competitive landscape, and consider consulting with a qualified financial advisor to make an informed decision about whether a Palantir investment aligns with your financial goals. Remember to analyze Palantir's financials and consider your risk tolerance before investing in Palantir.

Featured Posts

-

Uk Visa Restrictions New Plans For Certain Nationalities

May 09, 2025

Uk Visa Restrictions New Plans For Certain Nationalities

May 09, 2025 -

Offres D Emploi Restaurants Et Rooftop De Dauphine A Dijon

May 09, 2025

Offres D Emploi Restaurants Et Rooftop De Dauphine A Dijon

May 09, 2025 -

Anchorage Arts Scene A Standing Ovation For Local Coverage

May 09, 2025

Anchorage Arts Scene A Standing Ovation For Local Coverage

May 09, 2025 -

Photos From Arctic Comic Con 2025 Characters Connections And The Ectomobile

May 09, 2025

Photos From Arctic Comic Con 2025 Characters Connections And The Ectomobile

May 09, 2025 -

Tien Giang Phan Ung Manh Me Truoc Vu Bao Hanh Tre Em Tai Co So Giu Tre

May 09, 2025

Tien Giang Phan Ung Manh Me Truoc Vu Bao Hanh Tre Em Tai Co So Giu Tre

May 09, 2025