270MWh BESS Project Financing In Belgium: Challenges And Opportunities

Table of Contents

Understanding the Belgian Energy Market and its Regulatory Framework for BESS

Regulatory Landscape and Incentives

The Belgian regulatory landscape for BESS is evolving rapidly, influenced by EU directives and national policy objectives. Navigating this framework is critical for successful project financing. Key aspects include:

- Permitting Processes: Obtaining necessary permits and licenses can be time-consuming. Understanding the specific requirements at regional and federal levels is crucial. Streamlining these processes is a key area for future improvement.

- Government Incentives: The Belgian government offers various incentives to promote renewable energy and energy storage, including:

- Subsidies and grants for BESS projects meeting specific criteria.

- Tax breaks and accelerated depreciation allowances.

- Feed-in tariffs for electricity generated from renewable sources stored in BESS.

- Relevant Agencies: Key players include the Federal Public Service Economy, the CREG (Commission de Régulation de l'Électricité et du Gaz), and regional energy agencies. Engaging with these agencies early in the project development phase is crucial for efficient navigation of the regulatory landscape.

Grid Integration Challenges and Opportunities

Integrating a 270MWh BESS system presents significant technical challenges:

- Grid Capacity Constraints: The Belgian electricity grid needs upgrades to accommodate the influx of renewable energy and large-scale BESS deployments. Grid reinforcement projects are underway, but bottlenecks remain.

- Frequency Regulation and Voltage Support: BESS can provide essential grid services like frequency regulation and voltage support, enhancing grid stability. However, participation in these ancillary services requires careful planning and integration with grid operators.

- Smart Grid Technologies: Implementing smart grid technologies is vital for efficient integration and management of BESS, enabling optimal dispatch and coordination with other grid resources.

Opportunities lie in leveraging BESS to address these challenges:

- Grid Modernization: BESS investments can contribute to the modernization of the Belgian electricity grid, enhancing its resilience and efficiency.

- Improved Renewable Energy Integration: BESS enables higher penetration of intermittent renewable energy sources like solar and wind power by smoothing out their intermittency.

Market Structure and Revenue Streams

BESS projects in Belgium can generate revenue through various mechanisms:

- Frequency Regulation Services: Providing frequency regulation services to Elia (the Belgian transmission system operator) is a significant revenue stream for BESS.

- Arbitrage: Capitalizing on price differences between peak and off-peak electricity hours. This strategy requires sophisticated forecasting and trading capabilities.

- Capacity Market Participation: Participating in capacity markets offers stable, long-term revenue streams, securing a return on investment.

However, uncertainties exist:

- Market price volatility: Fluctuations in electricity prices impact the profitability of arbitrage strategies.

- Regulatory changes: Changes in grid codes and market rules can affect revenue streams.

Financing a 270MWh BESS Project: Securing Capital and Managing Risk

Sources of Financing

Securing financing for a large-scale BESS project requires a strategic approach:

- Debt Financing: Bank loans, green bonds, and other debt instruments are common sources of funding. Attractive interest rates and favorable loan terms are crucial.

- Equity Financing: Attracting equity investors requires a strong business plan, demonstrating the project's profitability and long-term viability.

- Public-Private Partnerships (PPPs): PPPs can combine public funding with private sector expertise and investment, mitigating risks for both parties.

Key financial institutions involved include specialized renewable energy banks and investment funds.

Risk Assessment and Mitigation

Significant risks are associated with BESS projects:

- Technology Risk: Technological advancements and potential equipment failures must be considered.

- Regulatory Risk: Changes in regulations and policies can impact project economics.

- Market Risk: Fluctuations in electricity prices and market demand pose risks to profitability.

Risk mitigation strategies include:

- Insurance: Comprehensive insurance coverage for equipment failure, construction delays, and other risks.

- Hedging: Using financial instruments to hedge against price volatility.

- Project Guarantees: Obtaining performance guarantees from equipment suppliers and contractors.

Comprehensive due diligence and robust risk management are essential.

Project Development and Construction Costs

Developing and constructing a 270MWh BESS project involves substantial costs:

- Land Acquisition: Securing suitable land for the project.

- Equipment Procurement: Purchasing batteries, inverters, power conversion systems, and other essential equipment.

- Installation and Commissioning: Costs associated with site preparation, installation, testing, and commissioning.

Cost optimization strategies include:

- Careful site selection to minimize land acquisition costs.

- Negotiating favorable contracts with equipment suppliers.

- Utilizing efficient construction methodologies.

Opportunities and Future Outlook for BESS in Belgium

Growth Potential and Market Trends

The Belgian BESS market is poised for significant growth driven by:

- Increasing Renewable Energy Penetration: Meeting Belgium's ambitious renewable energy targets requires substantial energy storage capacity.

- Decarbonization Targets: Reducing carbon emissions necessitates integrating more renewables, making BESS crucial.

Market projections indicate strong growth potential for BESS deployments in the coming years. Emerging technologies, such as longer-lasting battery chemistries and improved energy management systems, will further enhance the viability of BESS projects.

The Role of BESS in Enhancing Grid Stability and Reliability

BESS plays a vital role in:

- Grid Stability: Balancing supply and demand fluctuations, preventing blackouts and brownouts.

- Grid Resilience: Providing backup power during grid disturbances and enhancing grid reliability.

Successful BESS deployments in other countries demonstrate the benefits of integrated energy storage. Future challenges will include optimizing the integration of diverse BESS technologies and developing robust grid management strategies.

Conclusion: Unlocking the Potential of 270MWh BESS Project Financing in Belgium

Successfully financing and implementing a 270MWh BESS project in Belgium requires a thorough understanding of the regulatory framework, access to diverse financing options, and effective risk management strategies. While challenges exist, the significant opportunities presented by the growing renewable energy sector and the need for grid stability make BESS projects an attractive investment proposition. The potential returns and substantial contribution to a sustainable energy future are significant drivers for further exploration in this field. We encourage readers to delve deeper into the specifics of Belgian BESS project financing, considering the potential for both financial gains and positive environmental impact. The future of energy in Belgium, and indeed Europe, hinges on the successful deployment of large-scale energy storage projects such as these.

Featured Posts

-

Finding Your Dream A Place In The Sun A Practical Guide For Overseas Property Buyers

May 03, 2025

Finding Your Dream A Place In The Sun A Practical Guide For Overseas Property Buyers

May 03, 2025 -

Arsenals Havertz No Improvement Says Souness

May 03, 2025

Arsenals Havertz No Improvement Says Souness

May 03, 2025 -

Christina Aguileras Photoshopped Photos Fans React To Unrecognizable Images

May 03, 2025

Christina Aguileras Photoshopped Photos Fans React To Unrecognizable Images

May 03, 2025 -

Dac San Trai Cay Loai Qua Xua Gio Duoc Dan Thanh Pho Ua Chuong 60 000d Kg

May 03, 2025

Dac San Trai Cay Loai Qua Xua Gio Duoc Dan Thanh Pho Ua Chuong 60 000d Kg

May 03, 2025 -

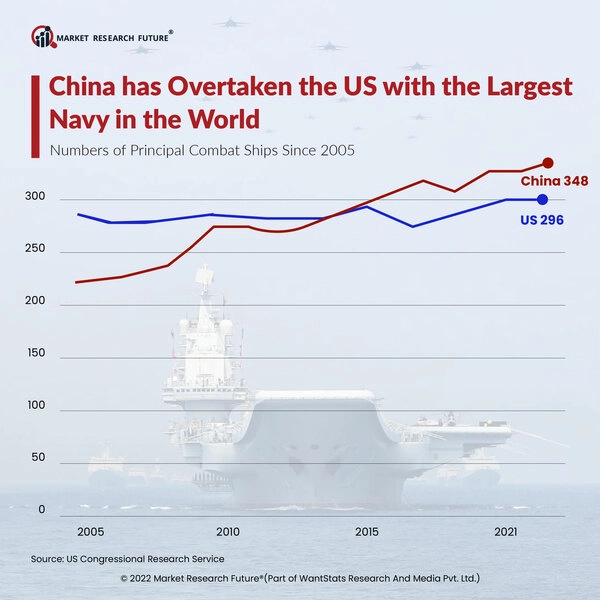

Chinese Naval Activity Near Sydney Implications For Australias Security

May 03, 2025

Chinese Naval Activity Near Sydney Implications For Australias Security

May 03, 2025