2025 Outlook Reiterated By Rolls-Royce: Managing Tariff Effects

Table of Contents

Rolls-Royce's Revised 2025 Projections

Rolls-Royce's 2025 forecast, and indeed their financial projections, have become intricately linked to their ability to effectively manage tariff-related risks. While specific numerical targets aren't always publicly disclosed in detail, analysts and industry experts have noted adjustments in their predictions based on the evolving global trade landscape. Understanding these adjustments is crucial to understanding the overall health and resilience of the company.

- Specific financial projections (if available): While precise figures remain confidential, Rolls-Royce's public statements have hinted at a potential slowdown in revenue growth compared to earlier projections, directly attributed to increased operational costs due to tariffs.

- Key performance indicators (KPIs) affected by tariff changes: KPIs like profit margins, return on investment (ROI), and supply chain efficiency are directly impacted by the fluctuating costs associated with tariffs. Increased costs are likely to affect margins unless offset by other operational efficiencies.

- New strategic initiatives: Rolls-Royce is likely implementing initiatives like enhanced cost optimization measures and proactive supply chain diversification strategies to counteract these effects. These strategies are likely crucial to maintaining their long-term financial targets.

Impact of Tariffs on Rolls-Royce's Supply Chain

The global supply chain of Rolls-Royce is vast and complex, making it particularly vulnerable to the effects of tariffs. The impact of import/export costs and logistics disruptions are significant concerns. Rolls-Royce sources materials and components from across the globe, leaving them exposed to a variety of tariffs levied by different countries.

- Specific examples of tariff-affected materials/components: Specific components, including rare earth minerals and specialized alloys used in their engine manufacturing, are likely subject to tariffs, driving up the cost of production.

- Increased costs due to tariffs on imported parts: The increased costs of imported parts directly translate to higher manufacturing costs for Rolls-Royce, impacting their profit margins and potentially delaying projects.

- Potential supply chain disruptions: Trade wars and unpredictable tariff changes can disrupt the flow of essential materials, potentially leading to manufacturing delays and project setbacks. Rolls-Royce is likely investing in redundancy and diversification to mitigate these risks.

Rolls-Royce's Strategies for Mitigating Tariff Effects

To offset the negative impacts of tariffs, Rolls-Royce is implementing a range of tariff mitigation strategies. This is a crucial aspect of their risk management and cost optimization efforts.

- Supplier diversification: Diversifying their supplier base to include manufacturers in regions with more favorable trade agreements or lower tariffs helps mitigate supply chain risks and reduces reliance on single sources potentially affected by tariffs.

- Manufacturing relocation: The possibility of relocating certain manufacturing operations to regions with lower tariffs or more stable trade policies is a strategic consideration to reduce import costs.

- Renegotiating contracts: Active negotiations with suppliers to share the burden of increased tariff costs is a vital strategy to minimize the financial impact.

- Investing in automation/technology: Investments in automation and advanced technologies may help reduce dependence on tariff-affected components and increase efficiency.

Long-Term Implications for Rolls-Royce and the Aerospace Industry

The long-term implications of effective tariff management are profound for Rolls-Royce and the broader aerospace industry. The future of aerospace relies on a stable and predictable global trade environment.

- Changes to long-term investment plans: Tariffs and trade uncertainties can impact long-term investment decisions and the viability of certain research and development projects.

- Impact on global competitiveness and market share: Companies that effectively manage tariff effects are likely to maintain a competitive edge in the global market, while those that don't may see their market share eroded.

- Industry collaboration: Collaboration between aerospace manufacturers and suppliers to lobby for fair trade policies and share best practices in tariff management is crucial to navigating the challenges.

Conclusion: Navigating the Future with Effective Tariff Management

Rolls-Royce's 2025 outlook is inextricably linked to their ability to effectively manage the challenges posed by tariffs. Their revised projections, supply chain adaptations, and mitigation strategies demonstrate a proactive approach to navigating this complex landscape. The key takeaway is that proactive tariff management is not just a short-term strategy; it's essential for long-term sustainability and competitiveness in the global aerospace industry. Learn more about navigating the complexities of tariff management and securing your business's future outlook by exploring resources dedicated to international trade and risk management. Understanding how Rolls-Royce's approach to managing tariff effects can inform your own strategies for 2025 and beyond is critical for success.

Featured Posts

-

Cay Fest On Film An In Depth Look At Splice

May 02, 2025

Cay Fest On Film An In Depth Look At Splice

May 02, 2025 -

Colorado Basketball Toppins 21 Points And The Upcoming Texas Tech Game

May 02, 2025

Colorado Basketball Toppins 21 Points And The Upcoming Texas Tech Game

May 02, 2025 -

The Complete Guide To This Country From City To Countryside

May 02, 2025

The Complete Guide To This Country From City To Countryside

May 02, 2025 -

Growing Concerns Over Mp Treatment Lead To Reform Uk Officer Departures

May 02, 2025

Growing Concerns Over Mp Treatment Lead To Reform Uk Officer Departures

May 02, 2025 -

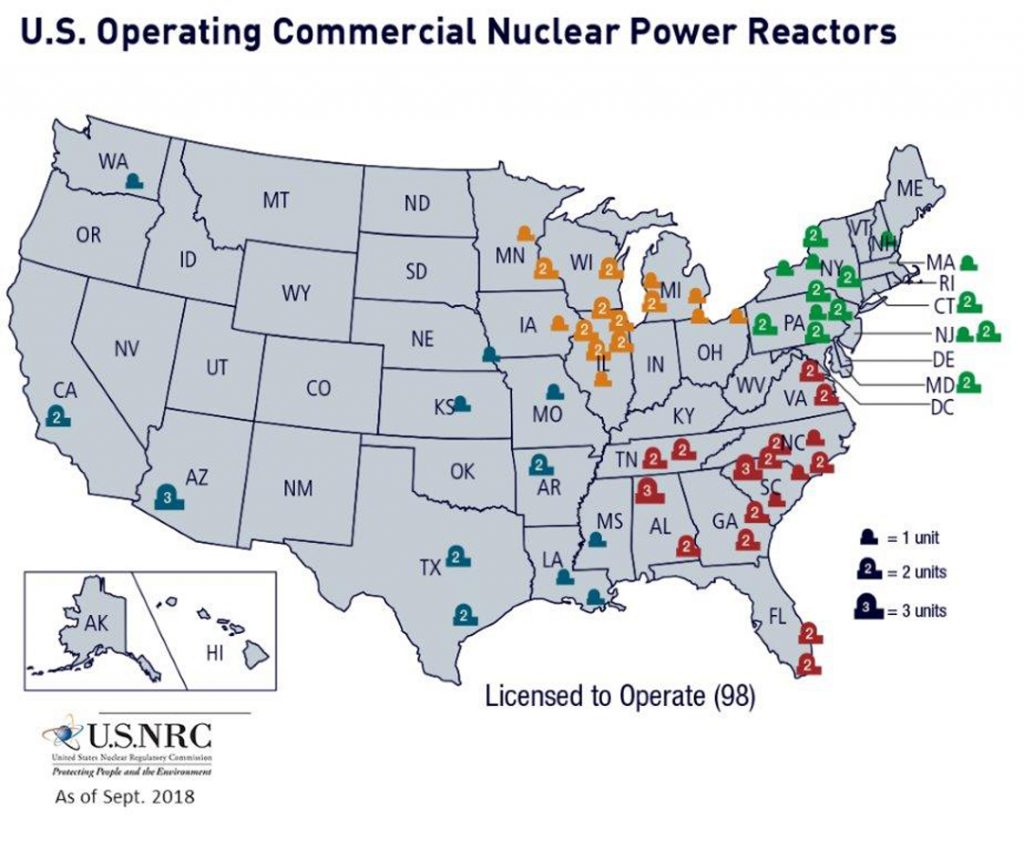

Successfully Upgrading Reactor Power Strategies For Nrc Compliance

May 02, 2025

Successfully Upgrading Reactor Power Strategies For Nrc Compliance

May 02, 2025