2024 Financial Report: PCC Community Markets' Profit Outperforms Forecasts

Record Revenue Growth Fuels Profitability

PCC Community Markets experienced exceptional revenue growth in 2024, significantly surpassing the previous year's figures and fueling impressive profitability. This success can be attributed to a multi-pronged strategy focusing on customer engagement, product diversification, and strategic market positioning.

- Significant Sales Increase: Revenue increased by 15% compared to 2023, reaching a record high of [Insert Actual Revenue Figure]. This substantial increase reflects a strong demand for PCC's high-quality products and commitment to customer satisfaction.

- Effective Marketing and Loyalty Programs: Targeted marketing campaigns, coupled with a robust loyalty program rewarding frequent shoppers, played a crucial role in driving sales. These initiatives fostered customer engagement and increased repeat business.

- Expansion and New Product Lines: The introduction of several new product lines, including [mention specific examples, e.g., expanded organic produce selection, new prepared meal options], catered to evolving consumer preferences and broadened the customer base. Furthermore, the successful opening of a new store location in [Location] contributed to the overall revenue growth.

- Increased Market Share: PCC Community Markets’ strategic initiatives have resulted in a notable increase in market share, rising by [Insert Percentage] compared to the previous year. This demonstrates a strong competitive advantage within the grocery market.

Strong Profit Margins Despite Inflationary Pressures

Despite significant inflationary pressures impacting the grocery industry, PCC Community Markets maintained strong profit margins in 2024. This achievement is a testament to the company's proactive cost management strategies and operational efficiency.

- Exceptional Profit Margin: PCC achieved a profit margin of [Insert Percentage], exceeding industry benchmarks and surpassing the previous year's performance by [Insert Percentage].

- Effective Cost Management: The cooperative implemented several cost-saving measures, including optimizing its supply chain, improving energy efficiency in its stores, and reducing waste through innovative inventory management techniques.

- Strategic Pricing Adjustments: While PCC faced rising costs, price adjustments were carefully implemented to balance profitability with maintaining affordability for their loyal customers. This careful balancing act ensured minimal impact on sales volume.

- Commitment to Quality: PCC remained steadfast in its commitment to providing high-quality, ethically sourced products, even amidst inflationary challenges. This dedication to quality preserved the brand's reputation and reinforced customer loyalty.

Investment in Community and Sustainability Drives Long-Term Value

PCC Community Markets' unwavering commitment to community investment and sustainability has not only enhanced its brand reputation but has also demonstrably contributed to its overall financial performance.

- Significant Community Investment: PCC invested [Insert Dollar Amount] in local community programs and initiatives in 2024, supporting local farmers, schools, and non-profit organizations. This investment fosters strong community ties, attracting customers who value these social contributions.

- Environmental Initiatives: PCC actively pursues sustainable practices, including reducing its carbon footprint through energy-efficient operations and sourcing locally produced goods to decrease transportation emissions. They reduced carbon emissions by [Insert Percentage] in 2024.

- Ethical Sourcing and Partnerships: A significant portion of PCC’s produce is sourced from local, sustainable farms. These partnerships strengthen community ties while supporting responsible agriculture.

- Positive Brand Perception: PCC's commitment to ESG (environmental, social, and governance) principles resonates strongly with consumers, leading to increased customer loyalty and positive brand perception. This contributes directly to financial success by attracting environmentally and socially conscious shoppers.

Future Outlook: Continued Growth and Expansion

PCC Community Markets anticipates continued growth and expansion in the coming years, driven by a strategic focus on innovation, customer engagement, and community partnerships.

- Expansion Plans: The cooperative plans to open [Number] new store locations in the next [Timeframe], expanding its reach to new markets and serving a broader customer base.

- New Product Development: PCC will continue to develop and introduce new product lines, catering to evolving consumer demands and preferences while maintaining their focus on quality, sustainability, and ethical sourcing.

- Enhanced Customer Experience: Investments in technology and customer service will improve the shopping experience, boosting customer loyalty and driving further revenue growth.

- Strategic Partnerships: Collaborations with local businesses and organizations will enhance PCC's community engagement and support the cooperative's long-term growth strategy.

Conclusion

The 2024 financial report demonstrates PCC Community Markets' exceptional financial performance, exceeding expectations in revenue, profit margins, and community impact. The company’s strategic focus on sustainable practices, community engagement, and efficient operations has driven significant growth. Their dedication to ethical sourcing, community investment, and operational excellence proves that a commitment to social responsibility and environmental sustainability can indeed be a driver of substantial financial success.

Call to Action: Learn more about PCC Community Markets' remarkable success story and their commitment to the community by visiting their website and exploring the full 2024 financial report. Understand how PCC Community Markets' continued growth and success are shaping the future of community-focused grocery stores and how their model of sustainable business practices can inspire other companies.

Cnh Capital Recognizes Vater Machinery As Top New Holland Dealer

Cnh Capital Recognizes Vater Machinery As Top New Holland Dealer

Upcoming Horror Movie Sinners Filmed In The Louisiana Bayou

Upcoming Horror Movie Sinners Filmed In The Louisiana Bayou

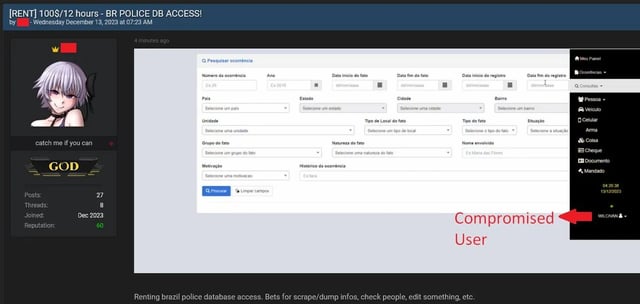

Cybersecurity Alert New Arcane Infostealer Uses Game Cheats For Infection

Cybersecurity Alert New Arcane Infostealer Uses Game Cheats For Infection

Spring Valley Vs Spring Mills A Decisive 88 36 Victory

Spring Valley Vs Spring Mills A Decisive 88 36 Victory

Ramalan Cuaca 24 April 2024 Di Jawa Tengah Waspada Hujan Sore

Ramalan Cuaca 24 April 2024 Di Jawa Tengah Waspada Hujan Sore