$2.5 Trillion Wipeout: The Crumbling Market Value Of The Magnificent Seven

Table of Contents

The Impact of Rising Interest Rates on Tech Stock Valuation

Rising interest rates have significantly impacted the valuation of tech stocks, including the Magnificent Seven. These companies, known for their high growth potential, rely heavily on future earnings to justify their current valuations. Higher interest rates increase the discount rate used in valuation models, effectively reducing the present value of those future earnings. This means that the same projected future profits are worth less today in a high-interest-rate environment.

Furthermore, increased borrowing costs make it more expensive for these companies to fund expansion and innovation. This can stifle growth and reduce profitability, further impacting their stock prices. The increased cost of capital also affects investor sentiment, causing a shift towards less risky investments with immediate returns, thus impacting the appeal of growth stocks.

- Higher interest rates increase the discount rate used in valuation models.

- Increased borrowing costs reduce profitability and hamper expansion.

- Investors shift towards less risky investments, impacting demand for growth stocks.

The Role of Inflation and Economic Slowdown

Inflation and economic slowdown have created a perfect storm for the Magnificent Seven. Inflation erodes purchasing power, impacting consumer spending and consequently reducing revenue for these tech companies. This is particularly noticeable in consumer electronics sales (affecting Apple, for example) and advertising revenue (significantly affecting Meta and Alphabet). An economic slowdown exacerbates this, as reduced consumer confidence leads to lower demand for both products and services.

The impact extends beyond reduced revenue. Increased input costs, driven by inflation, squeeze profit margins, creating further pressure on company performance and investor confidence. The uncertainty associated with an economic slowdown discourages investment, both from corporations and consumers, further compounding the negative effects.

- Reduced consumer confidence leads to lower demand for products and services.

- Increased input costs reduce profit margins and impact profitability.

- Economic uncertainty discourages investment, impacting future growth.

Geopolitical Uncertainty and Supply Chain Disruptions

Geopolitical instability, such as the war in Ukraine, has created significant supply chain disruptions, affecting the operations of many tech companies. These disruptions increase production costs and impact the availability of key components, hampering production and potentially leading to delayed product launches. The uncertainty associated with these disruptions also creates volatility in the market, influencing investor sentiment negatively.

Geopolitical risks discourage investment as they increase the uncertainty around future profitability and operational stability. The resulting volatility in the market further impacts the market capitalization of the Magnificent Seven and other tech stocks.

- Increased uncertainty creates volatility in the market, impacting stock prices.

- Supply chain disruptions increase production costs and reduce output.

- Geopolitical risks discourage investment and impact operational stability.

Overvaluation and Market Correction

The significant decline in the market value of the Magnificent Seven may also be partly attributed to previous overvaluation. Some analysts argued that certain companies were trading at excessively high price-to-earnings (P/E) ratios before the decline, indicating potential overvaluation based on future earnings expectations.

Market corrections are a natural part of a healthy market, serving to adjust prices to reflect more realistic valuations. The speculative fervor surrounding some tech stocks may have contributed to unsustainable price increases, making a correction almost inevitable. Investor sentiment plays a crucial role in these corrections; shifting sentiment towards caution can trigger a rapid decline in prices.

- High P/E ratios indicate potential overvaluation and increased risk.

- Market corrections are natural fluctuations that adjust prices to more realistic levels.

- Speculation can lead to unsustainable price increases, followed by sharp corrections.

Individual Stock Performance Analysis (within the Magnificent Seven)

Analyzing each company individually provides a more nuanced understanding of the decline.

- Apple: Supply chain issues and reduced iPhone sales contributed to its market value drop.

- Microsoft: Increased competition in cloud computing and a slowdown in enterprise spending impacted its growth.

- Alphabet: Reduced advertising revenue due to the economic slowdown and increased competition affected its performance.

- Amazon: A slowdown in e-commerce growth and increased costs impacted its profitability.

- Nvidia: While initially resilient, the slowdown in the gaming and data center markets impacted growth.

- Meta: Reduced advertising revenue and increased competition in the social media space significantly impacted its valuation.

- Tesla: Production challenges, supply chain disruptions, and decreased consumer demand contributed to the decline.

Conclusion: Navigating the Crumbling Market Value of the Magnificent Seven

The $2.5 trillion wipeout in the market value of the Magnificent Seven is a result of a confluence of factors: rising interest rates impacting valuations, inflation and economic slowdown reducing demand and profitability, geopolitical uncertainty creating supply chain disruptions, and the potential for previous overvaluation leading to a necessary market correction. While the current situation presents challenges, the long-term prospects of these tech giants remain strong, with the potential for recovery and future growth.

However, the current market conditions require caution. Before investing in tech stocks, conduct thorough research, understand the risks associated with the fluctuating market value of the Magnificent Seven, and consider consulting a financial advisor to make informed investment decisions. Remember, navigating the complexities of the market requires careful consideration and a balanced approach to risk management.

Featured Posts

-

Nyt Strands Puzzle 393 March 31 Complete Solution Guide

Apr 29, 2025

Nyt Strands Puzzle 393 March 31 Complete Solution Guide

Apr 29, 2025 -

How To Get Capital Summertime Ball 2025 Tickets Your Complete Guide

Apr 29, 2025

How To Get Capital Summertime Ball 2025 Tickets Your Complete Guide

Apr 29, 2025 -

Louisville Residents Urged To Stay Home Amidst Renewed Safety Concerns

Apr 29, 2025

Louisville Residents Urged To Stay Home Amidst Renewed Safety Concerns

Apr 29, 2025 -

Eligibility Of Convicted Cardinal To Vote In Next Papal Conclave

Apr 29, 2025

Eligibility Of Convicted Cardinal To Vote In Next Papal Conclave

Apr 29, 2025 -

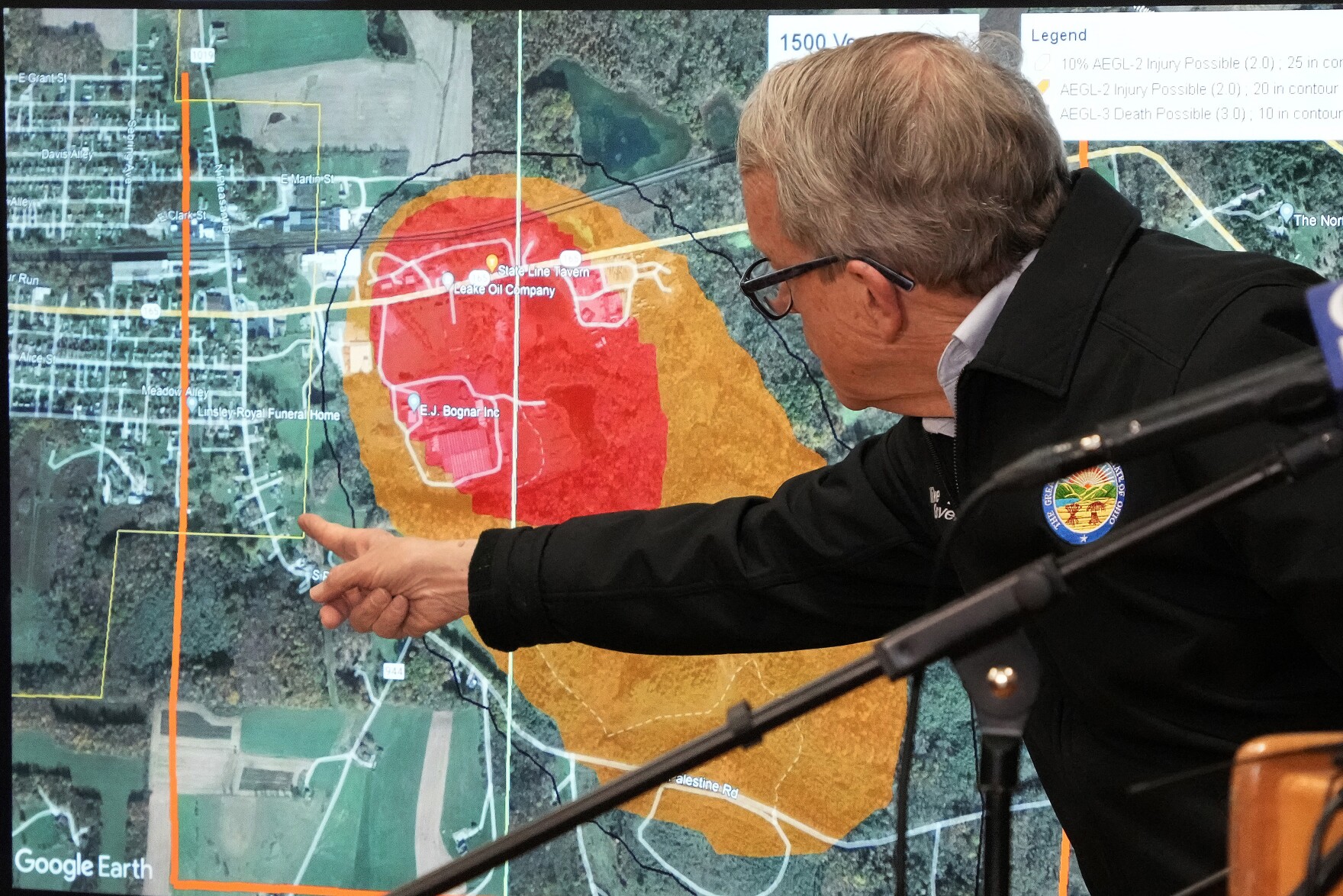

Toxic Chemicals From Ohio Train Derailment Months Long Building Contamination

Apr 29, 2025

Toxic Chemicals From Ohio Train Derailment Months Long Building Contamination

Apr 29, 2025