$2.1 Billion Deal: WiseTech Global Acquires E2open

Table of Contents

Strategic Rationale Behind the WiseTech Global-E2open Merger

The acquisition of E2open by WiseTech Global is a strategic masterstroke, driven by several compelling factors. For WiseTech Global, this merger offers significant benefits, bolstering their position as a leading provider of supply chain solutions.

-

Market Expansion and Enhanced Product Portfolio: E2open brings a strong presence in specific market segments and a robust suite of software solutions that complement WiseTech Global's existing offerings. This expanded portfolio allows WiseTech Global to cater to a wider range of clients and industries. The acquisition significantly broadens their geographical reach, particularly in North America and Europe, areas where E2open had a strong foothold.

-

Synergies Between Software Solutions: Both companies possess sophisticated supply chain software solutions. The integration of these systems promises improved efficiency and enhanced functionality. For instance, combining E2open's strength in collaborative planning, forecasting, and replenishment (CPFR) with WiseTech Global's CargoWise platform will create a highly integrated and comprehensive solution. This synergy creates a more powerful and versatile offering for customers.

-

Improved Efficiency and Cost Savings: Through consolidation and streamlined operations, the merger is expected to yield significant cost savings. Eliminating redundancies in infrastructure, operations, and software development will boost overall profitability. Furthermore, the combined entity can leverage economies of scale to negotiate better deals with suppliers and partners.

-

Key Benefits Summarized:

- Enhanced global reach and market share, particularly in North America and Europe.

- Integration of complementary supply chain software capabilities, creating a more comprehensive offering.

- Significant cross-selling opportunities to existing customer bases of both companies.

- Increased competitiveness in the fiercely competitive supply chain management market, potentially leading to a dominant market position.

Impact on the Supply Chain Management Industry

The WiseTech Global-E2open merger significantly reshapes the competitive landscape of the supply chain management industry.

-

Consolidation of Market Power: This acquisition represents a significant consolidation of market power, creating a behemoth in the supply chain software sector. This level of market concentration could influence pricing strategies and potentially impact smaller competitors.

-

Increased Pressure on Competitors: Other players in the supply chain software market now face increased competition from a larger, more resourceful entity. This pressure might necessitate strategic adjustments, including mergers, acquisitions, or increased investment in innovation.

-

Long-Term Effects on Pricing and Innovation: The acquisition's impact on pricing is complex. While increased market share could lead to economies of scale and potential price reductions, it also holds the potential for increased pricing due to reduced competition. The long-term effect on innovation remains to be seen, but the combined resources and expertise could lead to faster advancements in supply chain technology.

-

Industry Impacts Summarized:

- Significant consolidation of market power in the supply chain software market.

- Increased competitive pressure on rival companies, potentially leading to further industry consolidation.

- Potential for both increased pricing and accelerated innovation in supply chain technology.

- New opportunities for industry collaboration and the standardization of processes.

Financial Implications of the $2.1 Billion Deal

The $2.1 billion price tag reflects the substantial value of E2open and its strategic importance to WiseTech Global's future growth.

-

Acquisition Cost Breakdown: While the precise financial breakdown isn't publicly available in detail, the cost reflects the value attributed to E2open's technology, customer base, and future growth potential.

-

Financing Methods: WiseTech Global likely used a combination of cash reserves, debt financing, and potentially equity financing to fund the acquisition. The specifics would be detailed in their financial reports.

-

Return on Investment: The success of this acquisition hinges on successful integration and realizing projected synergies. WiseTech Global anticipates significant returns on investment from increased revenue, cost savings, and enhanced market share. This will be closely monitored by investors.

-

Financial Implications Summarized:

- A substantial investment reflecting the strategic value of E2open to WiseTech Global.

- Utilization of a diversified funding strategy, including cash reserves and potentially debt and equity financing.

- Projected synergies and cost savings expected to deliver a strong return on investment for WiseTech Global shareholders.

- Potential impact on WiseTech Global's financial performance, which will be closely monitored by analysts and investors.

Future Outlook and Integration Challenges

Successfully integrating E2open's operations and technology into WiseTech Global's existing infrastructure will be crucial for realizing the full potential of this merger.

-

Integration Process and Challenges: Integrating two large software companies presents significant technological, operational, and cultural challenges. Compatibility issues between software platforms, data migration, and the harmonization of business processes will require careful planning and execution.

-

Timeline for Full Integration: The full integration process is likely to take several years, requiring a phased approach to minimize disruption to customers and operations.

-

Potential Disruption to Existing E2open Customers: During the integration process, there's a potential for temporary service disruptions or changes to existing E2open services. WiseTech Global will need to manage customer expectations and ensure a smooth transition.

-

Long-Term Strategic Vision: The combined entity aims to become a dominant force in the supply chain software market, offering a highly integrated and comprehensive suite of solutions. This vision requires continuous investment in research and development, along with a robust customer relationship management strategy.

-

Future Outlook Summarized:

- Significant technological, operational, and cultural integration challenges require careful management.

- A phased integration approach is likely to be implemented over several years.

- Potential for temporary service disruptions during the transition period.

- Long-term strategic vision focused on market dominance and ongoing innovation in supply chain technology.

Conclusion: WiseTech Global's Acquisition of E2open: A New Era in Supply Chain Technology

The $2.1 billion acquisition of E2open by WiseTech Global marks a pivotal moment in the supply chain management industry. This merger creates a dominant player with a vastly expanded product portfolio, global reach, and significant cost-saving potential. While integration challenges exist, the potential benefits for both companies, their customers, and the industry as a whole are substantial. This WiseTech Global acquisition promises a new era of innovation and efficiency in supply chain technology.

To learn more about WiseTech Global, E2open, and the implications of this significant WiseTech Global acquisition on the future of supply chain management, we encourage you to explore their respective websites and follow industry news closely. Consider further research into supply chain software solutions and the latest advancements in logistics technology.

Featured Posts

-

New Horror Romance On Netflix A Rewatch Worthy Film

May 27, 2025

New Horror Romance On Netflix A Rewatch Worthy Film

May 27, 2025 -

A Viable Path To Affordable Housing Analyzing Gregor Robertsons Proposals

May 27, 2025

A Viable Path To Affordable Housing Analyzing Gregor Robertsons Proposals

May 27, 2025 -

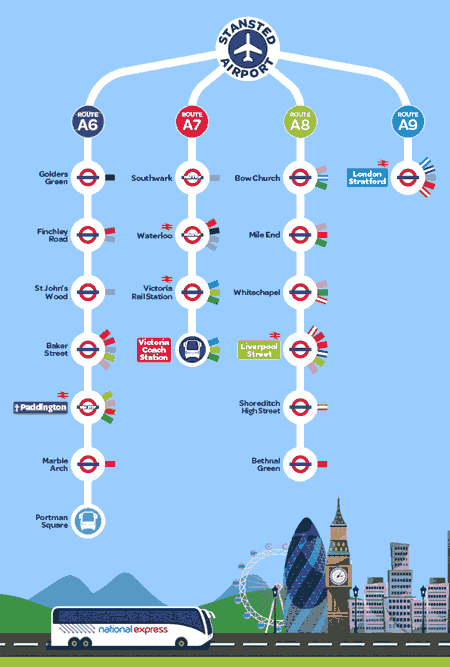

New Route Announced London Stansted Airports Network Grows

May 27, 2025

New Route Announced London Stansted Airports Network Grows

May 27, 2025 -

Yellowstones Kayce Dutton Season 5 Flashbacks And The Justification For A Spinoff

May 27, 2025

Yellowstones Kayce Dutton Season 5 Flashbacks And The Justification For A Spinoff

May 27, 2025 -

New Sesame Street Song Features Sza And Elmo A Lesson In Gratitude

May 27, 2025

New Sesame Street Song Features Sza And Elmo A Lesson In Gratitude

May 27, 2025