100,000 Job Cuts Predicted: TD Bank Warns Of Imminent Recession

Table of Contents

<meta name="description" content="TD Bank's prediction of 100,000 job cuts signals a potential recession. Learn about the economic warning signs, potential impacts, and steps you can take to prepare for economic uncertainty.">

TD Bank's stark warning of 100,000 job cuts and an imminent recession has sent shockwaves through the financial world. This prediction underscores a growing concern about the state of the global economy. Understanding the implications of this forecast and preparing for potential economic hardship is crucial for individuals and businesses alike. This article delves into the details of TD Bank's announcement, explores the potential consequences, and offers advice on navigating these uncertain times.

<h2>TD Bank's Recession Prediction: A Detailed Look</h2>

TD Bank's recent announcement regarding the potential for 100,000 job cuts is a significant economic warning. While the exact wording and specifics of their report may vary, the core message points to a concerning downturn. The prediction isn't a guarantee of a recession, but it highlights the increasing likelihood and severity of one. Let's break down the key aspects:

-

Specifics of the Prediction: While the exact wording from TD Bank's report or press release needs to be included here (insert direct quote if available), the essence is a projection of significant job losses, potentially within a specific timeframe (insert timeframe if available). This projection isn't made lightly, and indicates serious concerns within the financial institution.

-

Economic Indicators: TD Bank's prediction is likely based on a confluence of indicators, including rising inflation, slowing economic growth (GDP), changes in consumer confidence, and potential shifts in interest rates. Analyzing these indicators provides a clearer picture of the potential severity of the upcoming recession.

-

Qualifications and Caveats: It is crucial to note any qualifications or caveats that TD Bank may have included in their prediction. For instance, they might have emphasized the prediction's sensitivity to certain variables, such as government policy changes or unexpected global events. Understanding these limitations is key to interpreting the prediction accurately.

<h2>Potential Impacts of a Recession on the Economy</h2>

A recession, fueled by a potential loss of 100,000 jobs as predicted by TD Bank, will have far-reaching consequences across the economy:

-

Increased Unemployment: The most immediate impact will be a surge in unemployment rates. This will not only create personal hardship for those losing jobs but also affect consumer spending and overall economic activity.

-

Consumer Spending and Business Investment: Reduced consumer confidence and fear of job losses will likely lead to a decrease in consumer spending. Businesses, anticipating lower demand, may reduce investment, further slowing economic growth. This creates a negative feedback loop, exacerbating the recession.

-

Housing and Stock Markets: A recession typically impacts the housing market significantly, potentially leading to price drops and reduced construction activity. Similarly, the stock market will likely experience volatility and potential declines as investor confidence decreases.

-

Inflation or Deflation: The economic effects can lead to either increased inflation (due to supply chain issues and decreased supply) or deflation (due to decreased demand), each presenting its own set of challenges.

<h2>Sectors Most Vulnerable to Job Cuts</h2>

Based on TD Bank's prediction and current economic trends, several sectors are particularly vulnerable to significant job losses:

-

Technology Sector: The tech sector has already seen significant layoffs in 2023. This trend is expected to continue, with potential ripple effects across related industries.

-

Real Estate and Construction: A slowdown in the housing market will directly impact construction jobs and related industries. Reduced consumer spending and higher interest rates further exacerbate this vulnerability.

-

Retail and Hospitality: These sectors are highly sensitive to consumer spending and are usually among the first to experience job cuts during economic downturns.

-

Financial Sector: Ironically, the financial sector itself, while making the prediction, might also experience job cuts due to reduced investment banking activity, market volatility, and potentially increased loan defaults.

<h2>Preparing for Economic Uncertainty: Practical Steps</h2>

Preparing for potential economic hardship is crucial. Here are some practical steps individuals and businesses can take:

-

Personal Finance Management: Create a detailed budget, build an emergency fund (ideally 3-6 months of living expenses), and consider reducing non-essential spending.

-

Business Strategies: Businesses should focus on cost-cutting measures, diversify revenue streams, and explore strategies for improving efficiency and productivity.

-

Upskilling and Reskilling: Investing in personal and professional development can help individuals remain competitive in the job market during a recession. Adaptability and continuous learning are crucial.

-

Seeking Professional Advice: Consulting a financial advisor can provide personalized guidance on managing finances and investments during uncertain economic times.

<h2>Government Response and Policy Implications</h2>

Government response to a recession will be critical. Potential actions include:

-

Fiscal Stimulus: Government might implement fiscal stimulus packages, such as increased spending on infrastructure projects or tax cuts to boost economic activity.

-

Monetary Policy: Central banks may adjust monetary policy, potentially lowering interest rates to encourage borrowing and investment.

-

Effectiveness of Past Responses: Analyzing the effectiveness of past government responses to economic downturns can inform current policy decisions and potentially improve the outcome of future responses.

<h2>Conclusion</h2>

TD Bank's prediction of 100,000 job cuts and an imminent recession serves as a serious warning. Understanding the potential consequences—from widespread job losses to broader economic instability—is critical. By taking proactive steps to manage finances and prepare for economic uncertainty, individuals and businesses can mitigate risks and navigate challenging times more effectively.

Call to Action: Stay informed about the evolving economic situation and take steps to prepare for potential recessionary pressures. Understanding the implications of the predicted 100,000 job cuts and proactive planning can make a significant difference in navigating this challenging economic climate. Learn more about recession preparedness strategies and safeguard your financial future.

Featured Posts

-

Lotto Jackpot Winner Location Revealed Claim Your E1 Million Prize

May 28, 2025

Lotto Jackpot Winner Location Revealed Claim Your E1 Million Prize

May 28, 2025 -

Ronaldonun Cirkinlik Hakkindaki Yorumuna Adanali Ronaldodan Cevap

May 28, 2025

Ronaldonun Cirkinlik Hakkindaki Yorumuna Adanali Ronaldodan Cevap

May 28, 2025 -

Video Shows Garnacho Ignoring Young Manchester United Fan

May 28, 2025

Video Shows Garnacho Ignoring Young Manchester United Fan

May 28, 2025 -

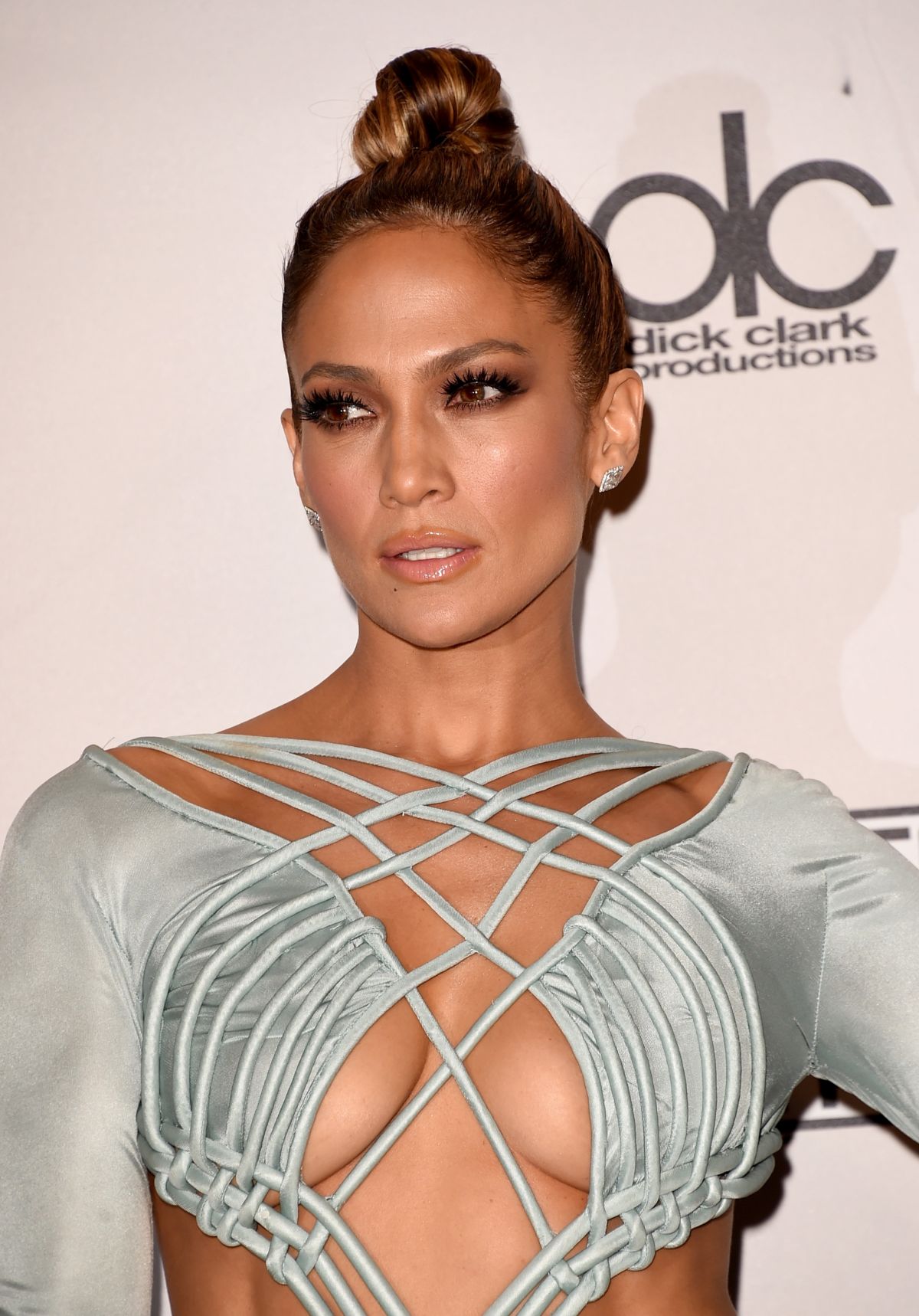

2025 American Music Awards Host Jennifer Lopez

May 28, 2025

2025 American Music Awards Host Jennifer Lopez

May 28, 2025 -

Whats Happening With Kanye West And Bianca Censori A Look At Recent Events

May 28, 2025

Whats Happening With Kanye West And Bianca Censori A Look At Recent Events

May 28, 2025