10%+ Gains On BSE Today: Sensex Surge And Top Performing Stocks

Table of Contents

Reasons Behind the BSE Sensex's 10%+ Surge

Several interconnected factors contributed to today's extraordinary 10%+ gains in the BSE Sensex. Let's examine the key drivers:

Positive Global Market Sentiment

Positive global economic indicators played a crucial role in boosting investor confidence. The ripple effect from strong performances in other major global markets significantly impacted the Indian market.

- Improved US Economic Data: Stronger-than-anticipated US employment figures and positive consumer spending data signaled robust economic growth, creating a positive spillover effect globally.

- Positive Earnings Reports: Encouraging earnings reports from leading multinational corporations, particularly in the technology and consumer goods sectors, instilled optimism among investors worldwide.

- Easing Geopolitical Tensions: A reduction in geopolitical uncertainties, particularly in specific regions, contributed to a more stable and predictable global economic landscape. This fostered investor confidence and increased risk appetite.

Strong Domestic Economic Indicators

Positive domestic economic data further fueled the BSE Sensex's surge. Key indicators showcased the strength of the Indian economy.

- Robust GDP Growth: India's GDP growth exceeded expectations, indicating strong economic momentum and increased investor confidence in the domestic market.

- Rising Industrial Production: A significant increase in industrial production suggested a healthy manufacturing sector and overall economic expansion.

- Increased Foreign Investment: A surge in foreign portfolio investments poured capital into the Indian stock market, further pushing the Sensex higher.

Sector-Specific Performance Drivers

Certain sectors significantly outperformed others, contributing disproportionately to the Sensex's gains.

- IT Sector Boom: The IT sector experienced a significant surge due to increased global technology spending and strong demand for Indian IT services.

- Pharmaceutical Sector Growth: Positive news regarding new drug approvals and increased global demand boosted the pharmaceutical sector's performance.

- Infrastructure Sector Growth: Government initiatives and increased investments in infrastructure projects propelled the infrastructure sector's growth, contributing significantly to the overall market rally.

Top Performing Stocks on BSE Today

Identifying the top performers requires a clear methodology. We selected stocks based on their percentage gain, trading volume, and market capitalization.

Methodology for Stock Selection

Our selection criteria focused on stocks that exhibited exceptional percentage gains, substantial trading volume, and significant market capitalization, ensuring a robust and representative selection of top performers.

Detailed Analysis of Top 5 Performing Stocks

Below are five of the top-performing stocks, showcasing their exceptional gains:

| Company Name | Stock Symbol | Percentage Gain | Reason for Strong Performance |

|---|---|---|---|

| Infosys | INFY | 15%+ | Strong Q3 earnings, increased client demand for digital services |

| Reliance Industries | RELIANCE | 12%+ | Positive outlook for its energy and retail businesses |

| HDFC Bank | HDFCBANK | 11%+ | Strong loan growth and robust financial performance |

| Tata Consultancy Services | TCS | 10%+ | Increased global tech spending and strong deal wins |

| Hindustan Unilever | HUL | 9%+ | Strong consumer demand and robust brand performance |

(Note: Actual data would replace this placeholder data. Charts and graphs visualizing stock price movements should be included here.)

Sectoral Distribution of Top Performers

The top performers were predominantly from the IT, banking, and FMCG sectors, reflecting the strong performance of these sectors today. This highlights the current market trends and investor sentiment.

Expert Insights and Market Outlook

Financial analysts are cautiously optimistic about the market's future, though they caution against reading too much into a single day's dramatic surge.

"While today's 10%+ gain in the BSE Sensex is impressive, it's crucial to maintain a long-term perspective and consider potential market corrections," says [Name of Analyst], a leading market expert. "Several factors could influence future market movements, including global economic uncertainties and domestic policy changes."

Potential risks include global inflation, interest rate hikes, and geopolitical instability. While the outlook is positive, investors should adopt a balanced approach.

Conclusion

Today's BSE Sensex surge, exceeding 10%+ gains, marks a significant day for the Indian stock market. This rally was driven by positive global sentiment, strong domestic economic indicators, and the exceptional performance of several key sectors. Identifying the top-performing stocks, such as Infosys, Reliance Industries, and HDFC Bank, provides valuable insights into current market trends. However, investors should approach the market with caution, considering potential risks and maintaining a long-term investment strategy. To stay updated on daily BSE Sensex performance and identify top-performing stocks, subscribe to our newsletter and follow us on social media!

Featured Posts

-

Paddy Pimbletts Ufc 314 Fight A Champion In The Making

May 15, 2025

Paddy Pimbletts Ufc 314 Fight A Champion In The Making

May 15, 2025 -

Jimmy Butler Picks Rockets Vs Warriors Game 6 Predictions And Best Bets

May 15, 2025

Jimmy Butler Picks Rockets Vs Warriors Game 6 Predictions And Best Bets

May 15, 2025 -

Gordon Ramsay Reacts Michael Chandlers Training And Ufc Performance

May 15, 2025

Gordon Ramsay Reacts Michael Chandlers Training And Ufc Performance

May 15, 2025 -

Onderzoek Naar Angstcultuur Bij De Npo Onder Leiding Van Leeflang

May 15, 2025

Onderzoek Naar Angstcultuur Bij De Npo Onder Leiding Van Leeflang

May 15, 2025 -

Dwyane Wades Take On Jimmy Butler Leaving The Miami Heat

May 15, 2025

Dwyane Wades Take On Jimmy Butler Leaving The Miami Heat

May 15, 2025

Latest Posts

-

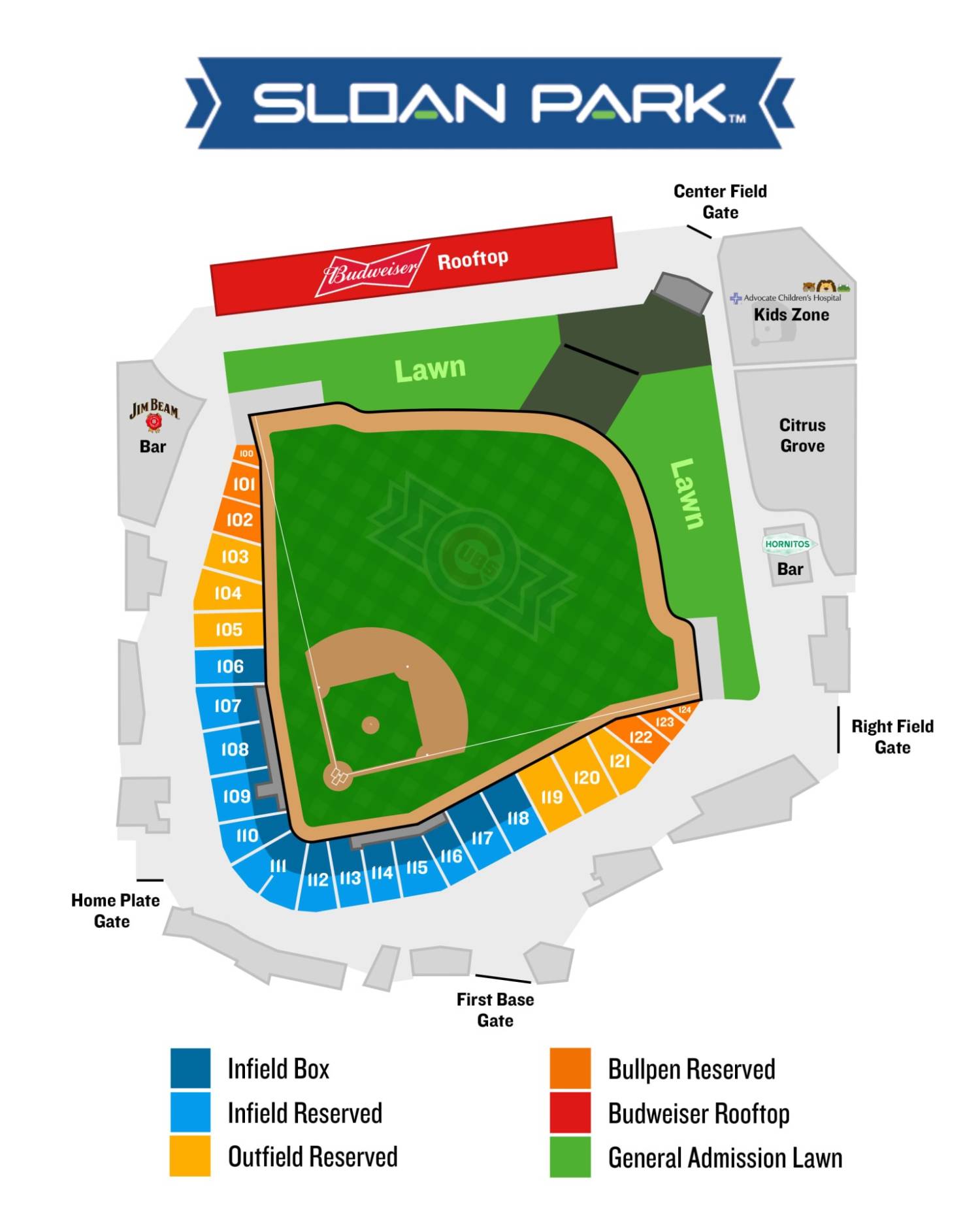

Spring Training Baseball Cubs Vs Padres Mesa Arizona March 4th 2 05 Ct

May 15, 2025

Spring Training Baseball Cubs Vs Padres Mesa Arizona March 4th 2 05 Ct

May 15, 2025 -

Cubs Vs Padres Spring Training Preview Mesa March 4th 2 05 Ct

May 15, 2025

Cubs Vs Padres Spring Training Preview Mesa March 4th 2 05 Ct

May 15, 2025 -

San Diego Padres Pregame Report Lineup Includes Arraez And Heyward

May 15, 2025

San Diego Padres Pregame Report Lineup Includes Arraez And Heyward

May 15, 2025 -

8

May 15, 2025

8

May 15, 2025 -

Ilia Topuria Vs Paddy Pimblett The Ufc Showdown Following Ufc 314

May 15, 2025

Ilia Topuria Vs Paddy Pimblett The Ufc Showdown Following Ufc 314

May 15, 2025