$10.5 Million Fine For Resorts World Casino In Las Vegas: Money Laundering Case

Table of Contents

Details of the Resorts World Casino Las Vegas Money Laundering Case

The Resorts World Casino Las Vegas money laundering case unfolded over several months, culminating in the substantial $10.5 million fine. The investigation, likely conducted by the Nevada Gaming Control Board (NGCB) and potentially involving the Financial Crimes Enforcement Network (FinCEN), uncovered several critical violations.

- Timeline: While the exact timeline isn't publicly available in full detail, the investigation likely spanned a period of months or even years, involving meticulous review of financial transactions and internal casino processes.

- Specific Violations: The NGCB's findings likely included failures to file Suspicious Activity Reports (SARs) in a timely manner, inadequate due diligence in verifying customer identities (KYC shortcomings), and deficient anti-money laundering (AML) compliance programs. These failures allowed potentially illicit funds to flow through the casino undetected.

- Regulatory Body & Legislation: The Nevada Gaming Control Board, responsible for regulating gaming operations within Nevada, is the primary regulatory body involved. The violations likely breached several state and potentially federal regulations pertaining to AML compliance under the Bank Secrecy Act (BSA) and related legislation.

- Investigation Process: The investigation likely involved extensive review of financial records, interviews with casino employees, and analysis of transaction patterns to identify suspicious activity. Evidence presented might have included internal audit reports, transaction data, and witness testimonies.

Keywords: Resorts World Casino violations, Nevada gaming regulations, anti-money laundering compliance, suspicious activity reports (SARs), Bank Secrecy Act (BSA), FinCEN, Nevada Gaming Control Board (NGCB).

The Impact of the $10.5 Million Fine on Resorts World Casino Las Vegas

The $10.5 million fine represents a significant financial blow to Resorts World Casino Las Vegas. The impact extends far beyond the immediate monetary penalty.

- Financial Implications: The fine will directly affect the casino's profitability and potentially impact its ability to invest in future projects or expansions. This financial strain could lead to reduced operational spending or delayed capital improvements.

- Reputational Damage: The negative publicity surrounding the money laundering case will undoubtedly damage the casino's reputation, impacting customer trust and potentially leading to a decline in visitor numbers and revenue. The Resorts World brand could face broader reputational risks.

- Legal Ramifications: Besides the fine, the casino faces the possibility of further legal repercussions, including license suspension or even revocation. This would have catastrophic consequences for the casino's business.

- Long-Term Consequences: The long-term effects could include decreased investor confidence, difficulty securing future financing, and a diminished competitive advantage in the highly competitive Las Vegas market. The parent company could also experience negative consequences.

Keywords: Financial penalties, reputational damage, casino licensing, impact on revenue, investor confidence, Resorts World brand.

Lessons Learned: Preventing Money Laundering in the Casino Industry

The Resorts World Casino Las Vegas case serves as a stark reminder of the critical need for robust AML compliance programs within the casino industry. Several key lessons emerge:

- Best Practices for AML Compliance: Casinos must implement comprehensive AML programs that go beyond simply complying with minimum regulatory requirements. This includes thorough due diligence and ongoing monitoring.

- Robust KYC Procedures: Strict Know Your Customer (KYC) procedures are essential for identifying and verifying the identities of all customers. This helps prevent the use of casinos as channels for money laundering.

- Employee Training and Internal Controls: Comprehensive training programs for casino employees are critical to ensure they can recognize and report suspicious activity. Strong internal controls and oversight mechanisms are also essential.

- Technological Solutions: Utilizing advanced technology, such as transaction monitoring software, AI-powered fraud detection systems, and blockchain technology, can greatly enhance AML compliance efforts.

Key Steps Casinos Can Take:

- Implement a comprehensive AML compliance program.

- Conduct thorough KYC checks on all customers.

- Train employees to identify and report suspicious activity.

- Utilize advanced technology to enhance AML efforts.

- Regularly review and update AML procedures.

Keywords: AML compliance, KYC procedures, casino security, fraud prevention, financial crime, transaction monitoring, AI-powered fraud detection, blockchain technology.

The Role of Technology in Combating Money Laundering in Casinos

Technology plays a vital role in strengthening AML compliance within casinos. Advanced systems can significantly improve the detection and prevention of money laundering activities.

- Transaction Monitoring Software: This software analyzes large volumes of transaction data in real-time to identify unusual patterns or suspicious activities that might indicate money laundering.

- AI-Powered Fraud Detection Systems: Artificial intelligence algorithms can analyze complex data sets to detect subtle anomalies and predict potential money laundering attempts, improving accuracy and efficiency.

- Blockchain Technology: While still in early stages of adoption, blockchain technology offers potential for enhanced transparency and traceability of transactions, making it harder to conceal illicit funds.

These technological solutions, when integrated effectively into a robust AML program, can significantly improve a casino's ability to detect and prevent money laundering.

Conclusion

The $10.5 million money laundering fine levied against Resorts World Casino Las Vegas serves as a stark reminder of the critical importance of robust anti-money laundering measures. The case highlights the severe financial and reputational consequences of non-compliance. The lessons learned underscore the need for comprehensive AML programs, including thorough KYC procedures, employee training, strong internal controls, and the utilization of advanced technology. Don't let your casino fall victim to similar penalties – explore best practices for AML compliance today. For more information on AML compliance in the gaming industry, consult resources from the Nevada Gaming Control Board and the Financial Crimes Enforcement Network (FinCEN).

Keywords: Resorts World Casino Las Vegas, money laundering prevention, casino AML compliance, financial crime prevention, KYC, AML program.

Featured Posts

-

Top Bitcoin Casinos 2025 A Comprehensive Guide To Crypto Gambling

May 18, 2025

Top Bitcoin Casinos 2025 A Comprehensive Guide To Crypto Gambling

May 18, 2025 -

Poker Stars Casino St Patricks Day Daily Spin And Bonus Offers

May 18, 2025

Poker Stars Casino St Patricks Day Daily Spin And Bonus Offers

May 18, 2025 -

Play At Top No Kyc Online Casinos No Id Needed In 2025

May 18, 2025

Play At Top No Kyc Online Casinos No Id Needed In 2025

May 18, 2025 -

Gold Trading Profits Secured As Us China Trade Relations Improve

May 18, 2025

Gold Trading Profits Secured As Us China Trade Relations Improve

May 18, 2025 -

No Deposit Casino Bonus Codes March 2025 Offers

May 18, 2025

No Deposit Casino Bonus Codes March 2025 Offers

May 18, 2025

Latest Posts

-

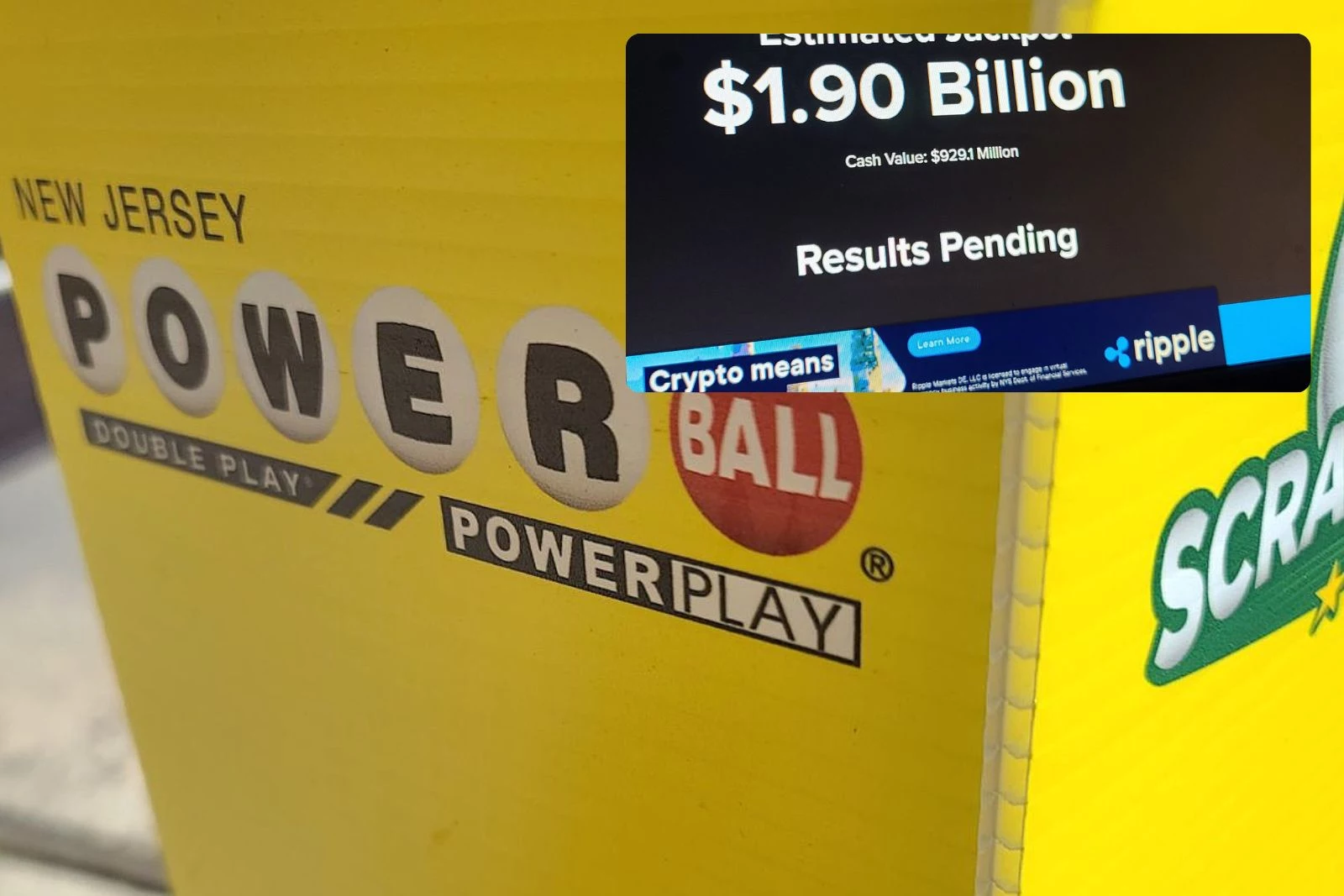

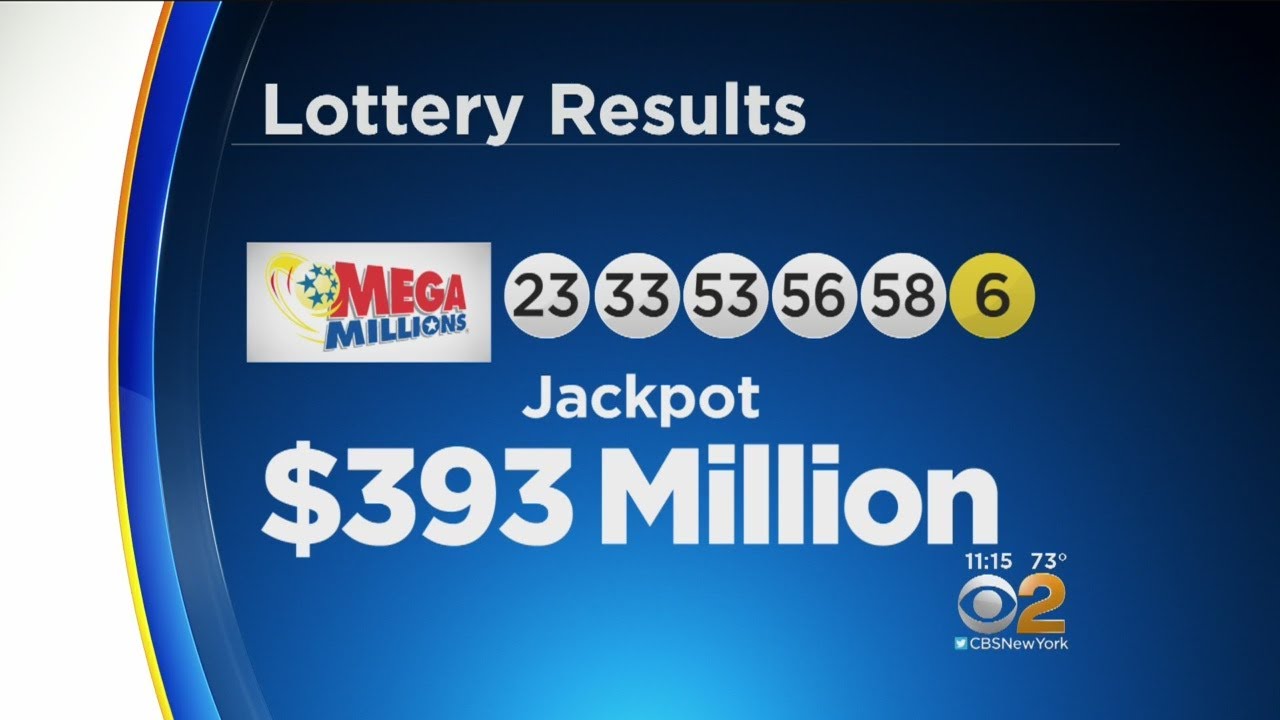

Tuesday April 15 2025 Daily Lotto Numbers

May 18, 2025

Tuesday April 15 2025 Daily Lotto Numbers

May 18, 2025 -

Wednesday April 9th Lotto Draw Winning Numbers Revealed

May 18, 2025

Wednesday April 9th Lotto Draw Winning Numbers Revealed

May 18, 2025 -

Lotto Jackpot Result Wednesday April 9th See If You Won

May 18, 2025

Lotto Jackpot Result Wednesday April 9th See If You Won

May 18, 2025 -

April 9th Lotto Draw Jackpot Numbers And Results Announced

May 18, 2025

April 9th Lotto Draw Jackpot Numbers And Results Announced

May 18, 2025 -

Spring Breakout 2025 Roster Reveal And Outlook

May 18, 2025

Spring Breakout 2025 Roster Reveal And Outlook

May 18, 2025