1,050% VMware Price Surge: AT&T Highlights Broadcom's Extreme Proposed Increase

Table of Contents

Analyzing the 1,050% VMware Price Surge: Understanding the Market Reaction

The announcement of Broadcom's acquisition sent VMware's stock price soaring, creating significant market volatility. Let's break down the key aspects of this dramatic market reaction.

The Initial Shock and Market Volatility

The immediate reaction was one of sheer surprise. The proposed price represented a massive premium over VMware's previous trading value.

- Immediate Price Changes: Within hours of the announcement, VMware's stock price experienced a dramatic increase, exceeding expectations by a significant margin.

- Expert Opinions: Market analysts expressed varied opinions, some highlighting the strategic rationale behind the acquisition, while others voiced concerns about potential regulatory hurdles and antitrust issues.

- Trading Volume Spikes: The announcement led to an unprecedented surge in trading volume, as investors rushed to buy and sell VMware shares.

AT&T's Perspective and Concerns

AT&T, a major VMware investor, publicly expressed concerns regarding the proposed acquisition and the substantial VMware price surge.

- AT&T Executive Statements: Statements from AT&T executives highlighted anxieties regarding the potential impact on their VMware investments and their overall IT infrastructure.

- AT&T's VMware Holdings: The size of AT&T's VMware holdings amplified the significance of their concerns and contributed to the overall market uncertainty.

- Impact on Services and Infrastructure: AT&T expressed concerns about potential disruptions to its services and the overall cost implications of the acquisition for its operations.

Broadcom's Justification for the Proposed Price

Broadcom justified the substantial increase in VMware's valuation by citing potential synergies and long-term strategic benefits.

- Broadcom's Official Statements: Broadcom’s official statements emphasized the combined strength of their portfolios and the potential for significant revenue growth through market consolidation.

- Potential Synergies: Broadcom highlighted the potential for cost savings and increased efficiency through the integration of VMware's technologies into their existing product offerings.

- Long-Term Strategic Goals: The acquisition was positioned as a crucial step in Broadcom's broader strategy to expand its market share and solidify its position as a leading technology provider.

The Broader Implications of the VMware Price Surge

The VMware price surge resulting from the Broadcom acquisition has far-reaching implications for the tech industry.

Impact on the Software Industry

This acquisition has created ripples across the software industry, potentially reshaping market dynamics.

- Competitor Reactions: Competitors are likely to reassess their strategies in light of this mega-deal, potentially leading to further consolidation or innovative responses.

- Potential for Consolidation: The acquisition could trigger a wave of mergers and acquisitions within the software industry, as companies seek to enhance their competitive positions.

- Future Market Trends: This deal may set a precedent for future valuations in the enterprise software sector, impacting future mergers and acquisitions.

Regulatory Scrutiny and Antitrust Concerns

The scale of the acquisition has inevitably attracted significant regulatory scrutiny and raised antitrust concerns.

- Potential Investigations: Regulatory bodies in various jurisdictions are likely to conduct thorough investigations to ensure the deal doesn't stifle competition.

- Potential Legal Challenges: There's a possibility of legal challenges from competitors or consumer groups concerned about the potential for monopolistic practices.

- Precedent Cases: Previous antitrust cases involving large technology mergers will provide a framework for assessing the legal and regulatory risks associated with this acquisition.

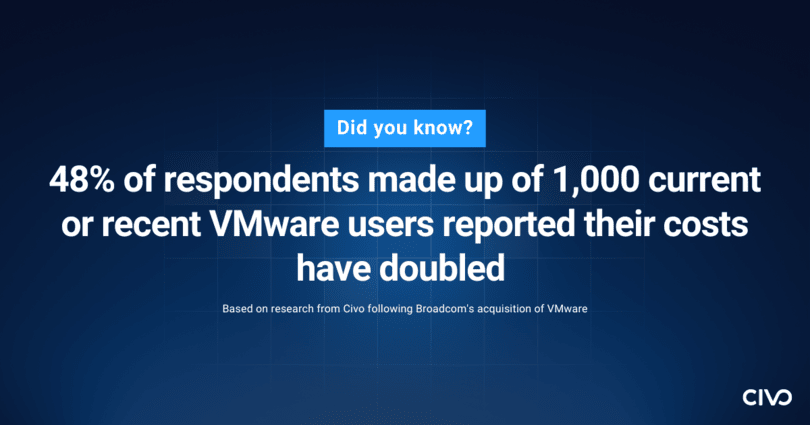

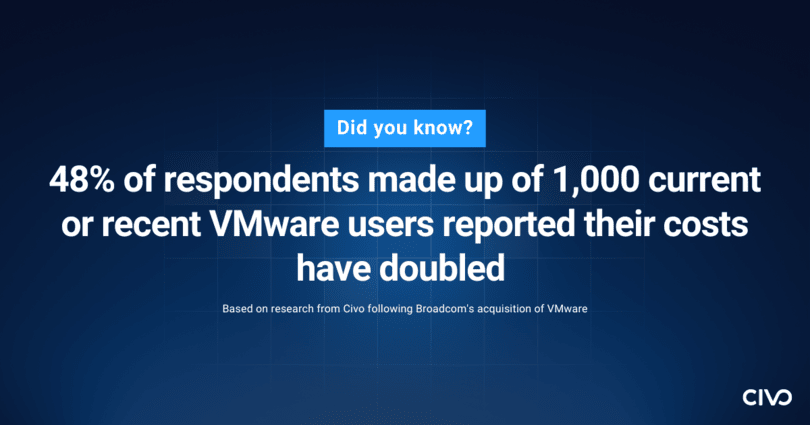

Long-Term Effects on VMware Customers

The acquisition's impact on VMware customers remains a key area of concern.

- Potential Scenarios: Potential scenarios range from seamless integration with minimal disruption to significant price increases and service changes.

- Expert Opinions on Customer Impact: Industry experts offer varying opinions on the potential customer impact, with some highlighting potential benefits and others expressing reservations.

- Future Migration Strategies: VMware customers might need to develop contingency plans and consider alternative solutions depending on the outcome of the acquisition.

Alternative Scenarios and Future Predictions for VMware

Several possible outcomes exist for the Broadcom-VMware deal, influencing future predictions.

Possible Outcomes of the Acquisition

The acquisition’s success hinges on various factors.

- Successful Completion: The deal may proceed smoothly, leading to a combined entity with significant market power.

- Regulatory Blocks: Regulatory hurdles or antitrust challenges could lead to the deal's failure or necessitate significant concessions.

- Alternative Bids: The high price might attract competing bids, potentially leading to a higher acquisition price or a different acquirer.

Impact on VMware's Innovation and Future Product Roadmap

The acquisition could significantly alter VMware's innovation and product development trajectory.

- Future Product Development: The integration of VMware's technology into Broadcom's portfolio could either accelerate or stifle innovation, depending on the integration process.

- Potential Integration Challenges: Merging two large organizations presents significant integration challenges that could affect product development timelines and quality.

- Long-Term Market Share Projections: The acquisition's outcome will significantly influence VMware's long-term market share and competitive position within the enterprise software industry.

Conclusion: Navigating the Aftermath of the VMware Price Surge

The 1,050% VMware price surge following Broadcom's acquisition proposal represents a landmark event in the tech industry, triggering significant market volatility and raising crucial questions about the future of both companies. The potential regulatory hurdles, the impact on customers, and the long-term implications for innovation remain key areas of focus. To stay updated on the VMware price surge and the unfolding of the Broadcom acquisition, follow reputable news sources and industry analysts. Stay informed about the impact of this unprecedented price increase and its potential ramifications for the future of the enterprise software market. Subscribe to our newsletter to remain updated on all future developments concerning this massive deal and its continuing impact on the VMware price.

Featured Posts

-

Core Weave Inc Crwv Analyzing The Stocks Tuesday Appreciation

May 22, 2025

Core Weave Inc Crwv Analyzing The Stocks Tuesday Appreciation

May 22, 2025 -

7 Can T Miss Netflix Shows This Week May 18th 24th

May 22, 2025

7 Can T Miss Netflix Shows This Week May 18th 24th

May 22, 2025 -

Exploring The Themes In The Love Monster

May 22, 2025

Exploring The Themes In The Love Monster

May 22, 2025 -

Sejarah Dan Statistik Juara Premier League 10 Tahun Terakhir

May 22, 2025

Sejarah Dan Statistik Juara Premier League 10 Tahun Terakhir

May 22, 2025 -

The Evolving World Of Gumball A Teaser

May 22, 2025

The Evolving World Of Gumball A Teaser

May 22, 2025

Latest Posts

-

Linsi Grem Sanktsiyi Proti Rosiyi Vidpovid Na Vidsutnist Pripinennya Vognyu

May 22, 2025

Linsi Grem Sanktsiyi Proti Rosiyi Vidpovid Na Vidsutnist Pripinennya Vognyu

May 22, 2025 -

Washington D C Terror Attack Claims Lives Of Yaron And Sara

May 22, 2025

Washington D C Terror Attack Claims Lives Of Yaron And Sara

May 22, 2025 -

Novi Sanktsiyi Proti Rosiyi Rol Lindsi Grem U Senati S Sh A

May 22, 2025

Novi Sanktsiyi Proti Rosiyi Rol Lindsi Grem U Senati S Sh A

May 22, 2025 -

Sanktsiyi Proti Rosiyi Pozitsiya Lindsi Grem Ta Senatu S Sh A

May 22, 2025

Sanktsiyi Proti Rosiyi Pozitsiya Lindsi Grem Ta Senatu S Sh A

May 22, 2025 -

New Movies And Tv Shows On Netflix May 2025

May 22, 2025

New Movies And Tv Shows On Netflix May 2025

May 22, 2025