1,050% VMware Price Hike? AT&T Sounds The Alarm On Broadcom's Proposal

Table of Contents

AT&T's Concerns and the Antitrust Scrutiny

AT&T's concerns regarding the Broadcom VMware acquisition are far from trivial. They represent the anxieties of many large enterprises reliant on VMware's virtualization technology.

Detail AT&T's statement:

AT&T's statement highlights the potentially crippling financial impact of a massive VMware price increase. They argue that such a hike would severely disrupt their IT budget and potentially impact their ability to deliver vital services to customers.

- Significant budget overruns: A 1,050% increase would translate to billions of dollars in additional expenditure for AT&T and similar organizations.

- Impact on vSphere and other VMware products: The price hike would affect core VMware products like vSphere, critical for their data center operations.

- Reduced competitiveness: Increased costs could hinder AT&T's ability to compete effectively in the telecommunications market.

While specific quotes from AT&T's statements may vary depending on the source, the core message remains consistent: a drastic VMware price increase is unacceptable and potentially harmful.

Antitrust implications:

The proposed acquisition has raised significant antitrust concerns. Regulatory bodies like the Federal Trade Commission (FTC) in the US and the European Commission (EC) are likely to scrutinize the deal closely. Concerns center around:

- Creation of a monopoly: Broadcom's acquisition could create a dominant player in the enterprise software market, potentially stifling competition and innovation.

- Lack of alternatives: VMware holds a significant market share, and the acquisition could limit choices for businesses, forcing them to accept higher prices.

- Potential legal challenges: Antitrust lawsuits could delay or even prevent the acquisition from proceeding, depending on the outcome of the regulatory reviews.

Impact on competition:

The acquisition's impact on competition is a key concern. Key competitors like Microsoft (with Hyper-V), Citrix, and Red Hat (with its virtualization technologies) could see reduced market share, potentially leading to:

- Reduced innovation: Less competition could hinder innovation in virtualization technology, limiting advancements and choices for businesses.

- Higher prices across the board: A lack of competitive pressure could lead to price increases not just for VMware products but potentially across the entire virtualization landscape.

Potential Impact of a VMware Price Hike on Businesses

A dramatic VMware price increase would have cascading effects throughout the business world.

Increased operational costs:

Businesses, especially those heavily reliant on VMware's virtualization solutions, face:

- Strain on IT budgets: A substantial price increase would significantly strain IT budgets, forcing difficult choices between investing in VMware and other crucial business areas.

- Impact on smaller businesses: Smaller companies may find it particularly challenging to absorb such a large cost increase, potentially forcing them to seek less robust alternatives or even exit the market.

- Reduced investment in other areas: The extra expense could divert funds from crucial areas such as research and development, marketing, or employee training.

Impact on cloud adoption:

The price hike could significantly influence cloud migration strategies. Businesses might:

- Accelerate cloud migration: To escape the high VMware costs, companies may hasten their move to cloud-based solutions from providers like AWS, Azure, or GCP.

- Explore open-source alternatives: The price increase could spur greater adoption of open-source virtualization technologies like Proxmox or OpenStack.

- Re-evaluate hybrid cloud strategies: Businesses may need to completely rethink their hybrid cloud strategies if VMware costs become prohibitive.

Long-term consequences:

The long-term economic implications could be substantial:

- Stifled innovation: High VMware prices could limit innovation in industries reliant on the platform.

- Reduced competitiveness: Companies unable to absorb the cost increase might struggle to compete effectively in the global marketplace.

- Negative impact on economic growth: The overall cost burden could negatively impact the broader economy.

Alternatives and Mitigation Strategies

Businesses are exploring various alternatives and mitigation strategies in response to the potential VMware price hike.

Open-source solutions:

Open-source options like Proxmox VE and OpenStack offer viable alternatives, often at a significantly lower cost. These solutions provide comparable functionality and can be customized to fit specific needs.

Other virtualization platforms:

Commercial alternatives such as Microsoft Hyper-V, Citrix XenServer, and Oracle VirtualBox offer different approaches to virtualization, giving businesses a range of choices to consider.

Negotiating with VMware:

Businesses should actively explore negotiating better pricing with VMware, even if the acquisition proceeds. Leveraging bulk purchasing power and exploring long-term contracts could potentially mitigate the price increase's impact.

Conclusion: The Future of VMware and the Fight Against Price Gouging

The potential 1,050% VMware price increase stemming from Broadcom's acquisition is a serious concern. AT&T's alarm highlights the far-reaching implications for businesses of all sizes. The antitrust scrutiny is crucial to prevent the creation of a virtual monopoly and ensure fair pricing in the enterprise software market. The future of VMware and the broader virtualization landscape hangs in the balance. Stay informed about the ongoing developments of the Broadcom-VMware acquisition and its impact on VMware pricing. Contact your representatives and voice your concerns to regulatory bodies. Finally, explore alternative virtualization solutions to prepare for any eventuality. The fight against potential price gouging requires vigilance and proactive action.

Featured Posts

-

Nereden Izlenir Augsburg Bayern Muenih Maci Canli Yayin

May 30, 2025

Nereden Izlenir Augsburg Bayern Muenih Maci Canli Yayin

May 30, 2025 -

Remote Lodge Break In Leads To Caribou Poaching Investigation In Northern Canada

May 30, 2025

Remote Lodge Break In Leads To Caribou Poaching Investigation In Northern Canada

May 30, 2025 -

Augsburg Bayern Muenih Maci Canli Izleme Rehberi

May 30, 2025

Augsburg Bayern Muenih Maci Canli Izleme Rehberi

May 30, 2025 -

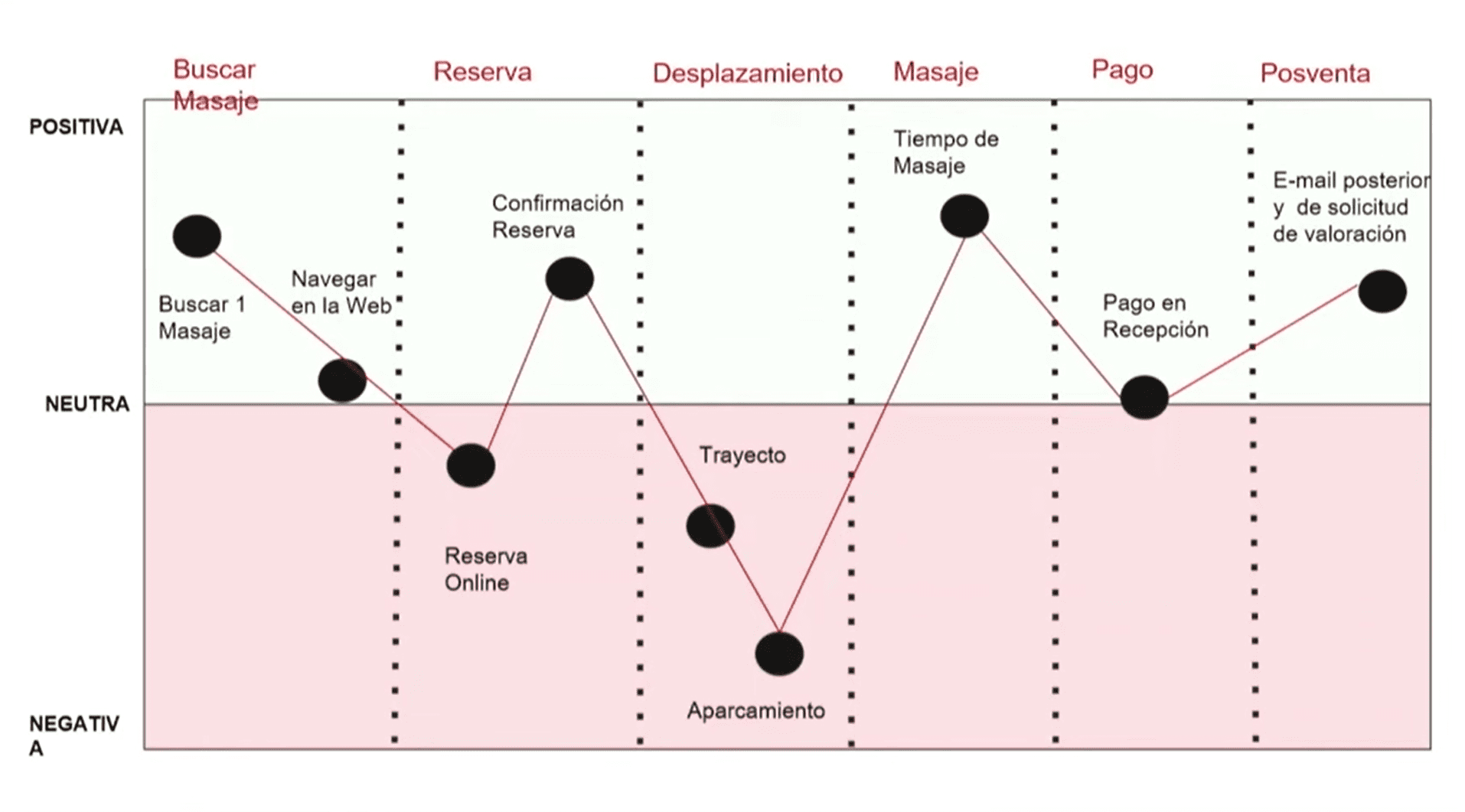

Setlist Fm Se Integra Con Ticketmaster Mejoras Para La Experiencia Del Usuario

May 30, 2025

Setlist Fm Se Integra Con Ticketmaster Mejoras Para La Experiencia Del Usuario

May 30, 2025 -

Russkaya Inzhenernaya Shkola Provodit Otkrytiy Seminar V Tolyatti

May 30, 2025

Russkaya Inzhenernaya Shkola Provodit Otkrytiy Seminar V Tolyatti

May 30, 2025